Friends,

Let’s review December’s Moontower reader survey. For context, this letter went out to ~ 9k recipients and has an open rate of 50%. 180 readers responded, or about 4% of the typical number of readers who open the letter.

[The actual views of the letter are 2x that number routinely and for a popular issue I’ve seen as high as 5x that number as it gets passed around by men who stare at computer screens all day. More on that ahead.]

My guess, based on how the responses rolled in, is that it mostly represents subscribers as opposed to people who clicked on the Twitter link. 180 responses was about 2/3 of what I was hoping for, but based on Zoho’s survey math it’s not a terrible sample — 95% confidence, 7% margin of error — which feels like a decent enough resolution. The bigger question, as is the case with any survey, is whether the sample was representative. My gut says yes because I wasn’t too surprised by the results.

We’ll start with numbers before getting to the provocative part — the answers to the open-ended questions. The anonymity brought out honest, vulnerable answers.

Demographics

2/3 in US

20% non-white (Indian and Asian most common minority)

70% b/t 25 and 45 yrs old

45% have children (90% of parents have kids college-aged or younger)

95% male (Male heavy, not surprising but 19 to 1?! Can’t say this didn’t rattle me)

Politics and Education

85% moderate to progressive political leaning

More than 1/3 have a graduate degree

1/3 of the grad degrees are a terminal degree (MD, PhD, JD)

Industry

>50% in finance

50% of these are in asset management front offices (risk/trading)

14% of these are advisors or allocators

25% software

Title

40% director/founder/c-suite

12% entry level

Income

50% > $250k annual household income

11% > $750k annual household income (concentrated in asset management/front office/securities brokerage)

50% of this cohort >$2mm annual household income

Investing/Giving

50% self-report as “accredited investors”

Only 15% have more than 40% of wealth in home equity

50% could estimate the annual volatility of their portfolio (this percentage is also true for the people with > $750k income)

50% of respondents give more than 1% of income to charity;

Of the people who give more than 1%, 30% give more than 5%

Open Ended Questions

Some preamble:

Thanks for the honesty

I took liberties in the name of summarization by assigning most of the responses into general categories but I’m no doctor.

Percentages won’t add to 100% b/c some responses included multiple answers and some responses went uncategorized

What personal shortcoming/insecurity comes to mind? (116 responses)

Half of the reported shortcomings revolve around some version of low confidence or fear.

A quarter of the responses are matters of self-control whether it’s ADD, listlessness, a lack of discipline, or indecisiveness. An answer I didn’t see that could fit either next to or envelop many of these —”lack of meaning”. It can be hard to motivate unless the reason seems urgent or at least worthwhile. Kind of like the dizziness of freedom I mentioned last week.

The remaining balance of insecurities are directly framed as difficulties in handling our own perceptions of others or being competitive (ie vanity/status games). The low confidence categories also have an interpersonal aspect but they are not framed directly in that way. They seem to have more of a component of self-esteem. It’s all interrelated but I tried to find a distinction. Basically “Am I frustrated with others or myself?”

Imposter syndrome is one of those fears that we hear a lot about. Like many fears, it’s adaptive to a point. One of my heroes (we are going to get to that word later), Sal Khan, has a brilliant framing of it you can borrow:

[That blurb is from my notes from one of the best interviews I listened to recently: Sal Khan On The Finding Mastery Podcast]

The idea of healthy imposter syndrome is best captured in Bardo during the hallucinogenic bathroom scene when the protagonist's father advises: “Take a swig of success, swish it around and spit it out, otherwise it will poison you.”

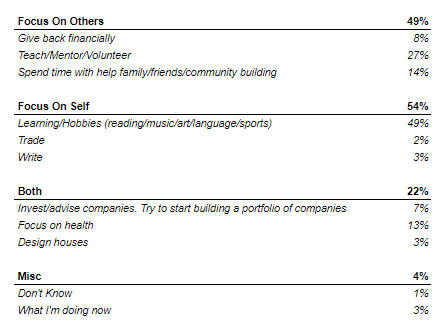

If you had no money concerns and purchased all the things you wanted and checked off every place on your travel bucket list (like imagine you won the lotto and several years have elapsed since), what would you do with your time?

(150 responses)Other than the 5 people who want to specifically design houses, this was not shocking. Sadly, but also not shocking, only 3% answered, “what I’m doing now”.

The only thing I’ll say here is if you say you want to garden when you retire, and you don’t garden now, you are fooling yourself. Your actions reflect priority. Sure there are some things which money is a prerequisite for, but I’m just a seller of the idea that your current self arrives at some mental projection of your future self where you will do the things you think you like. Look at the first question — half of the responses are fear. Look at the demographics. Most of you are less than 45 years old and by the standards of geography and history — rich. (I get that nobody ever feels rich — hedonic treadmill, the banana republic parody we seem to live in, egg prices. But the material reality is, as Jack Raines points out, that you have already won.)

If this is the wrong language to speak to you, consider the outside view. What do half of the rich boomers you see do as they travel around the world on cruise ships or finally get the value out of those timeshares they’ve been roosting on? They complain about money and inflation instead of all these amazing aspirations they had about what they’d do when they had money or time.

Or they spend their time in doctors’ offices. I’m not saying this to be mean. (I have aging parents and these are not personally easy times…but they do cultivate perspective). I’m saying this to merge this question and the one before it with a blunt solution at least a few of you might need — start living right now. Every week I hear of a friend of a friend dropping dead. That’s something that you hear more of in your 40s. It’s counterintuitive…but I hope that it kills your fear.

3. What's stopping you from being more like your hero? (83 responses)I will start by admitting that this question is poorly posed. The word “hero” conjures worship, cults, Aquaman. There were only 83 real responses because “I’m an adult — I don’t have heros”. Fair enough. Yinh had the same reaction and I projected my own connotation of that word on everyone else.

We have all heard the expression “don't meet your heros”…those on a pedestal can only fall down. But I’m not talking about a person I want to wholesale exchange my life with or even be handed their superpower.

A hero is someone who embodies a personal aspiration. It’s someone who I keep in mind as a model for behavior. A teacher with a loving but firm demeanor. A parent that stays calm when the children turn the living room into a winter wonderland out of tiny cut-up styrofoam (this happened in December. I wish I kept a picture but I was too busy overreacting with the giant a-hole daddy voice).

Visualizing heroes is how I hack our preloaded “mimic others" bloatware for good use. Where did your own aspirations come from? You're not Buffalo Bill trying to wear their skin. You're trying to channel inspiration. “How might X approach this? How would X react to this situation?” You can have a stable of heroes for different situations. They can be celebrities, people you know, or even fictional.

Ultimately, I blame myself for the poor wording. I could have used “role model” or just “someone you admire”. Semantics aside, I hope the visualization hack, should you try it, is useful.

And one last thing…look at those responses — from “welp” to “selfish” to “low priority”, those of you who responded did so with deep self-awareness. Y’all are clearly familiar with the Kipling quote:

If you don't get what you want, you either didn't really want it, or you tried to negotiate over the price[In our house there’s no such thing as “I didn’t have enough time”…it’s always “I didn’t prioritize it”. Be responsible or get help. There are definitely victims in the world — but we are not them]

Amusing Bits

2/3 of you can drive stick (I actually never tried)

40% played a sport in college (nearly 20% of the NCAA athletes were basketball players)

Book recs that showed up more than once:

And to wrap this up, you should know that 45% of you have seen Dazed & Confused and the rest of you buried a dagger in my heart.

It’s paywalled, but Freddie deBoer did an awesome ranking of Linklater films. D&C is #2. Its spiritual sequel, Everybody Wants Some!!, was #3.

Money Angle

Byrne Hobart is one of these alien finance writers like Matt Levine who I just marvel at. Geniuses that dazzle with both quality and quantity. One of the differences is Byrne presumes a bit more financial knowledge from his audience. I was stoked to see he launched a second letter, Capital Gains, that breaks down one financial concept a week. It’s more basic than his regular writing making it a great resource to forward to learners as a reference or simply see a new way of communicating something you already know. Even for you, Byrne will make you see in a fresh way.

For example, this bit at the end of his recent Capital Gains post:

Money Manager Fees: Who Gets Paid How? (6 min read)

Understanding why different types of funds charge different fees

The thing for investors to watch out for is not the total fee load, but to look at what they're paying for compared to what they're getting. A multi-strategy fund can plausibly be undercharging if the pass-through fees and performance fees eat half the gross return, if what's left is an uncorrelated return that beats other alternatives. And a mutual fund can be overcharging when it asks for 50 basis points a year if it claims to be offering stock-selection alpha but is really delivering market-tracking beta at a high markup.

And this applies to individuals, too: you can decompose your own compensation into the beta-like returns from what line of work you're in, what your educational background is, and your location. But it's hard to get upside trading one kind of beta for another; for example, if you move somewhere for a high-paying job, you’ll make more, but a lot of that extra income compensates for a higher cost of living.

Alpha is whatever value you add on top of what's expected based on superficial and commoditized traits. Selling beta at a markup can be a very good living, but delivering alpha is more lucrative and ultimately more satisfying.

Money Angle For Masochists

On August 5th 2022, this tweet appeared on my timeline:

The tweet asserts that the LEAPs are expensive or “priced for perfection”. The next part of the sentence is shaky if you take it literally — “if you can hedge the upside blowout risk”. You “can” sell the straddle for about $50 whether or not you can hedge the upside, but the author is prudently demonstrating where the risk resides. I give a total hall pass to the writing as my own tweets are often thrown together while standing in line at Trader Joe’s.

Allow me to re-word the tweet without worrying about character limits and without feeling rushed.

“Optically, the CVNA LEAP straddle is expensive because it’s trading for the same premium as the strike price. I can’t get burned on the downside so my only concern is the unbounded upside of the call option I’m short, so if I can truncate the potential loss there, this straddle is a good candidate to sell”

The original poster exhibits a solid understanding of options. But…markets are hard. They don’t leave free or near-free money laying around. It turns out, with 5 months of hindsight, this is a good case study in the limits of optically attractive trades1.

By dissecting what has happened we can learn about how to think of options “dynamically”.

I’m going to try a rhetorical approach to this lesson to make it more interactive. If you want to continue strap in:

A Socratic Dissection Of An Option Trade

Last Call

This is the last “Last Call”. Your feedback indicated the main body, Money Angle, and my personal life were your favorite parts.

I suspect curated links are still useful because I appreciate them in letters I sub to but I decided to just send a 2nd email every week. Here’s the description from my re-written About page:

Moontower Munchies (Wednesdays)

This is a lightweight email.

It could be a few links I found interesting. I focus on productivity, self-hacking, modernity, finance, learning tools, and sometimes philosophy or culture.

Or

It could be one link to a piece of content with my notes. I’m a compulsive note-taker and often scribble my own comments into them connecting ideas to something else in my grey(ing) matter.

Happy Lunar New Year rabbits…stay groovy!

Substack Meetings

I was invited to be a part of the Substack Meetings beta. You can book a time to chat. I’m more expensive than a 900 number from 1988 and have a less sexy voice.

Book a meeting with Kris Abdelmessih

Moontower On The Web

📡All Moontower Meta Blog Posts

🧀MoontowerMoney

👽MoontowerQuant

🌟Affirmations and North Stars

✒️Moontower’s Favorite Posts By Others

🔖Guides To Reading I Loved

📚Book Ideas for Kids

🎙️Moontower Music

🍸Moontower Cocktails

Becoming a patron

The Moontower letter is and will always be free. My writing is a search “for the others”. The “others” are people like you who are unlearning the mental frames that artificially narrow our choices.

If you are here you already understand that inspiration is a tradable good. It’s not as tangible as a cup of coffee, but it packs 10x the adrenaline with an infinitely longer half-life than caffeine.

If you feel inspired, you can upgrade to becoming a patron.

In What The Widowmaker Can Teach Us About Trade Prospecting And Fool’s Gold I dissect another optically attractive trade that is really just fool's gold

So I use HERo at the start of my programme (and in fact in a post today. And in fact it’s the tag line for Be Braver).

Be your own hero.

With the idea being we look at those we admire, role models, dead or alive. Friend or foe. Known to us or we’ve never met.

And we model what is so inspiring and aspirational about them.

By the end of the programme we have a version of that for each person, that enable them to effectively be their own muse. Inspired to test the limits of their own potential and becoming.

So I totally get you and understand the choice of word. I too have been berated and applauded for its use.

The stats done surprise me much. Imposter syndrome isn’t the great undesirable we think it is. Unless it’s debilitating. It stops us from being reckless, means we are thoughtful, considered, prepared and self aware.

You can’t confident your way to competence. But you can competent your way to confidence?