what's the difference between a free market and the Easter Bunny?

Moontower #301

Friends,

Trading firms are Rand-pilled cloisters of libertarianism.

Is it a self-serving post-hoc rationalization of meitrocracy that allows rich traders to not only enjoy wealth but virtue? Ha ha, sorry folks, not today. I’m ain’t gonna bait myself into this discussion.

I’m just going to leave you with a couple thoughts to turn over at your own pace.

When I was a trainee I remember an argument by a senior colleague who, as was typical, a market-maximilist who argued that teachers are probably overpaid, not underpaid as a fixed price will weed out everyone who knows they are worth more and therefore you structurally select for those worth less on average because your best case scenario is the price and talent are exactly matched. It’s basically the same argument for why buffet restaurants are bad business. It only selects for eaters who see the price as a good value.

To be honest, I think I’m giving the colleagues’ argument some grace. I don’t remember it being as cosmetically coherent as mine. His argument gestured in the general direction of “markets are right”. That the price of teachers is not set by a free market doesn’t seem to have found its way into the discussion. Details, details. This person is very rich today and extremely sharp on topics like trading and business, so you know, just another reminder that high aptitude in one area doesn’t easily transfer (whether it reflects natural cognitive silo-ing or motivated reasoning is yet another question.)

I’ve heard that a stereotypical view of wealth in many parts of the world is that if you’re rich you must have been corrupt or left a trail of bodies in your wake to amass wealth. In the US, wealth is virtue. Capitalism victory points. Evidence that you gave people something they wanted. A ledger of value creation.

My view is directionally American with wide error bars. There are a lot of rich people whose profit has been nothing but an unaccounted for externality. They got the benefit without bearing the cost. Tobacco is giving people what they want. But pardon me if I think gains from trying to get teenagers to become early addicts should not become wealth. I think even the oncologists who treat those “customers” would be willing to sacrifice the 5th bedroom in their house to not have this “value created.”

Markets are downstream of politics. Markets and law are inseparable constructs and US law is the product of either pure mob democracy (the proposition system in CA) or representative government, whereby a centralized agent, like a senatr is entrusted to, umm... do what they want, subject to the constraint of “get re-elected.”

If law is not a free market, the so-called neither are the markets that it rests on, notwithstanding the platonic inventions of libertarian fever dreams. My favorite example of this today is college athletes. They were always creating tremendous value. But one day they weren’t allowed to extract their share and the next they were swimming in NIL money. With the stroke of a pen, their bargaining position changed.

Wealth is not just a function of value creation. Its value creation times some bargaining position factor. And that factor is often political. From FCC spectrum to land to labor laws to unions to IP laws, from subsidy to censure, from Spotify to artists, from accredited investor laws to bank charters, from casino to prediction markets…it’s all infused with law which creates centralized nodes of outsize power to influence or corrupt.

This has always been my concern with wealth inequality. It’s not a normative or moral concern so much as an acknowledgement of social physics. Wealth is power and nobody believes anyone’s power should be unlimited. We watch as individuals’ wealth continues to climb to those of city-states distracted by talk of “greed” or “fair share”. That discourse travels well because it’s smoke. The fire is deeper in the walls.

The future is going to require more transparency than ever. Which should be available in the age of broadband, compute, and video. And yet we don’t trust our eyes and when we do, we disagree about what we see. The line between info and info hazard is blurring every day. It’s ironic that so much wealth has been created by liberating information, but that same wealth will be used to selectively control it.

Switching gears to wrap up…

As a practical matter, when you think about the work you do and how it improves people’s lives, recognize that it’s within a path-dependent, arbitrary system-level backdrop. You may create lots of value, but the rules have limited your bargaining position.

You can choose to make peace with it, fight to change the rules, find a way to express your talents in a more advantageous industry/company. But crying over it or arguing with the smug who say the invisible hand is giving you what you deserve will rot your heart. Face reality to deal with it.

I had a chance to join legends Jeff Ma and Rufus Peabody thanks to John Reeder! If you don’t already listen to Bet The Process, you might remember Jeff as the protagonist of Ben Mezrich’s Bringing Down The House (later adapted to the film 21). I Having the ringleader of the famous MIT blackjack team ask me a question about Catan strategy is not something I had on my podcast bingo card!

Money Angle

On Thursday was the first session of the Investment Beginnings Class I spun up locally.

These are the materials I used.

Materials from class 1:

Homework

Identify 5-10 companies in 3 industries and report on what their margins are and the average margins in the industry based on your research. The open-endedness of this question is a feature not a bug. Let’s see what they come up with.

⭐I strongly recommend playing with the spreadsheet to explore the lender and equity investor results if we had rolled “bankruptcy”. Stepping through the formulas is a valuable exercise!

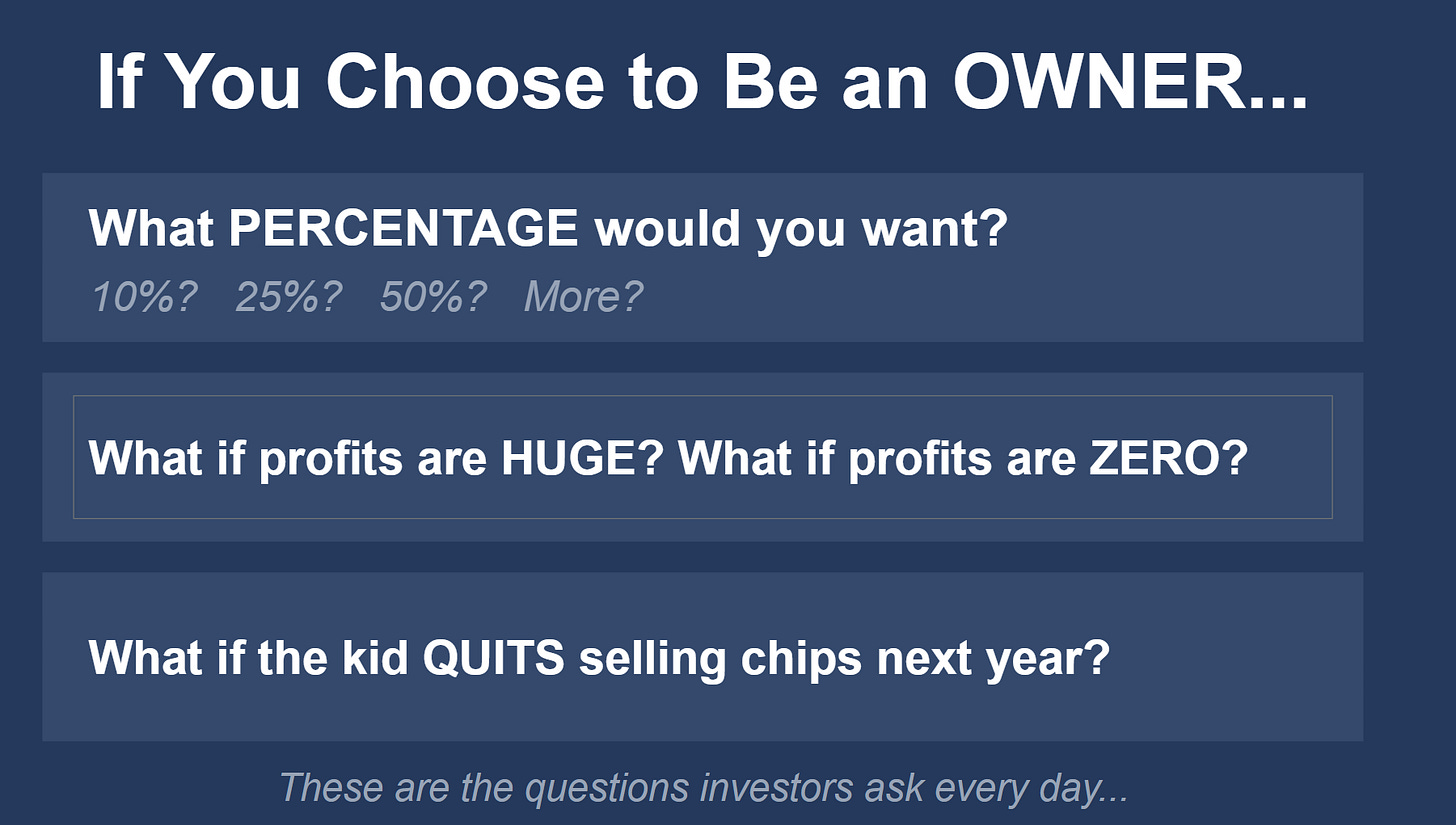

This introductory lesson opens with a question:

What can you do? What can go wrong? What’s your best-case scenario?

Then pose a new question…

From there, the lesson begins…

There were 18 youths, mostly 12-17 years old, and a bunch of interested parents as well.

The next session will be in a few weeks, I’ll share the materials as we go along and consolidate it all on this page:

https://notion.moontowermeta.com/investment-beginnings-course

Money Angle For Masochists

In the spirit of spaced repetition, I published The Gamma of Levered ETFs as an article on X. Seemed relevant given silver’s 30% selloff on Friday.

Here’s the short version of the math of levered ETFs. To maintain the mandated exposure the amount of $$ worth of reference asset they need to trade at the close of the business day is

x(x - 1) * percent change in the reference asset * prior day AUM

where x = leverage factor

examples of x:

x=2 double long

x=-1 inverse ETF

x= 3 triple long

x= -2 double inverse

Applying this to silver:

AGQ, the ProShares Ultra Silver ETF, is 2x long. It had ~$4.5B in assets at the close on Thursday.

For the underlying swap to maintain the mandated exposure, at the close of Friday (assuming no redemptions) the swap provider must trade silver. How much of it?

2(2-1) * -30% * $4.5B

or -60% of $4.5B.

-$2.7B worth of silver in forced flows. Negative = sell.

There’s an UltraShort 2x ETF, ZSL, that had about $300mm of AUM going into Friday.

Rebalance trade:

-2(-2-1) * -30% * $300mm = -$540mm

Assuming no redemptions, these levered ETFs needed to sell ~$3.25B worth of silver into the close.

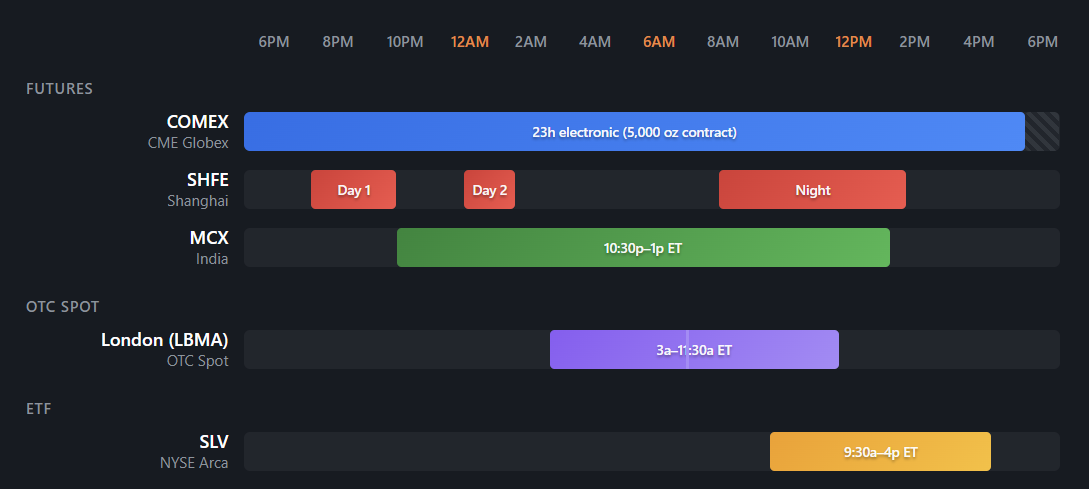

In a typical environment, silver volumes are mostly split between London’s spot market (LBMA) and COMEX futures (NY deliverable) with Shanghai (SHFE), India (MCX) and SLV (London deliverable, US traded ETF) combining for less than 10% of total volumes.

At the NY close, SLV and COMEX represent all the liquidity that’s open.

COMEX futures traded nearly $150B of volume Friday and SLV traded ~$50B which is on the order of 10x the dollar volumes silver used to trade a year ago at lower prices. Still, those forced sales, if they are happening in the few hours of trading may represent something like 5-10% of the liquidity.

I’m guessing readers who are actually on metals desks have a better guess.

Silver futures margins, after being raised again this week, are about 15% of the contract value (although your broker may ask for more. IB asks for twice that, which was prescient!)

If Shanghai futures, which were closed, have a similar requirement, that means the exchange doesn’t have enough collateral to cover the 30% move if Shanghai futures match the COMEX move.

I don’t know how that exchange works (many exchanges have an insurance pool where some of the losses are socialized across clearing members), but one thing that would be interesting is if Shanghai exchange officials have the authority, balance sheet, and ability to have sold COMEX futures as a hedge. I doubt that, it’s just a speculative musing, but if such a thing did happen, their Sunday evening unwind trade would be to buy back COMEX futures as they liquidated Shanghai holders. Again, this is just a ridiculous musing, but I look forward to seeing how it all shakes out.

In any case, I think a useful takeaway from all this could be to add expected levered rebalancing flows to your dashboards (of course, this is a recursive problem because the price at any point in time reflects some people’s knowledge of these flows. Pre-positioning always opens the door to backfiring if enough arbs think the same way).

Stay groovy

☮️

Moontower Weekly Recap

Posts:

Need help analyzing a business, investment or career decision?

Book a call with me.

It's $500 for 60 minutes. Let's work through your problem together. If you're not satisfied, you get a refund.

Let me know what you want to discuss and I’ll give you a straight answer on whether I can be helpful before we chat.

I started doing these in early 2022 by accident via inbound inquiries from readers. So I hung out a shingle through the Substack Meetings beta. You can see how I’ve helped others:

Moontower On The Web

📡All Moontower Meta Blog Posts

👤About Me

Specific Moontower Projects

🧀MoontowerMoney

👽MoontowerQuant

🌟Affirmations and North Stars

🧠Moontower Brain-Plug In

Curations

✒️Moontower’s Favorite Posts By Others

🔖Guides To Reading I Enjoyed

🤖Resources to Get More Out of AI

🛋️Investment Blogs I Read

📚Book Ideas for Kids

Fun

🎙️Moontower Music

🍸Moontower Cocktails

🎲Moontower Boardgaming

Morning Kris. If I could add.. I think the one thing people miss with finance is how well it scales. So while it may seem like everyone is an investment banker or portfolio manager if you live in a handful of affluent, urban areas, there's many less in the country compared to doctors, dentists, teachers, etc. If a school looked like a trading firm, a very few teachers would be selected to teach classes many multiples bigger than they currently do.