vega's finishing move

Friends,

“Vega wounds, gamma kills” is an esoteric expression that’s still common enough that you can google it and return a bunch of hits. It’s a reasonable acknowledgement of realized vol p/l being quadratic with respect to how large a stock move is.

I’ve recently been cross-posting my writing on how this works on X since they’ve been pushing their Articles functionality.*

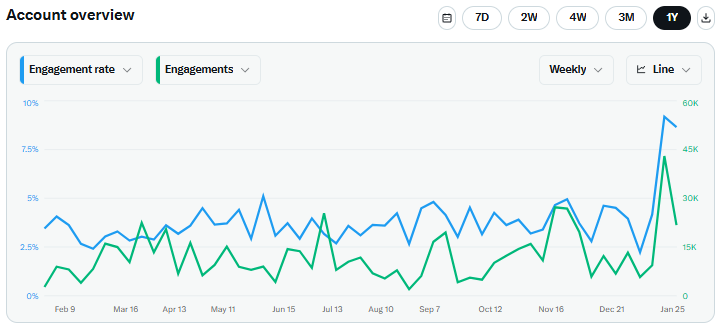

* A lot of people (and bots) are boosting these. I am treating these releases as a spaced repetition exercise for long-time readers. Analytics show very high engagement so X must be signal-boosting them. This is a 1-year chart. The recent spike is Articles:A lot of people cry about the growth of Articles longform on X but twitter is a long way from the community it used to be anyway, so don’t really care as much if I’m burning the house for warmth in the eyes of diehards. Although I don’t think I am since the reason I came to twitter in the first place was to find stuff to read and learn not hot takes. It's different things to different people and when they suppressed Substack it shifted the appeal for me. This is some re-alignment, albeit on their terms. Fine. It's a reasonable negotiation. The Articles I’ve posted on the theme of non-linearity in options

This last one is about the “gamma” of vega. For OTM options, the vega of the option, its sensitivity to changes in IV, itself changes. We call that second-order sensitivity volga. Volga is to vega as gamma is to delta.

I don’t have a dedicated post on vanna I’ll cover it briefly right now.

Vanna

The definition of vanna you are most familiar with is change in delta due to change vol. You have heard of this because of dealer flow discourse. For example, if dealers are long calls and hedged with short shares, as vol declines on a rally, their long option deltas shrink. If this happens faster than their long gamma increases their net delta, then they will have stock to buy to rebalance to neutral.

But vanna has an alternate definition. One that dominates our understanding of trading skew:

the change in vega for a change in underlying

If you are short puts on a risk reversal as the stock falls, you get shorter vol and vice versa. Your vega changes as the spot moves.

I suspect the “gamma kills” idea is popular because it’s a common experience. Option volume is dominated by near-dated expiries where gamma and theta dominate the p/l. Most people will simply never feel what it’s like to be wrecked or celebrated by volga or by a delta-hedged skew position. They might know what it’s like to get crushed to vega directly, but even that will be less familiar than realized vol-driven performance, given typical trade duration.

But I can tell you that my most memorable p/ls have all had vanna and volga at the scene. 2020 was especially dramatic in this regard as an explosion in vols led to position sizes exploding and finding myself sitting on a growing pile of vega that varied from “increasing in demand” to “panic bid”.

Qualitatively, the repricing of vega is significant because vega is illiquid. You can delta-hedge your way to a replication of a relatively short-dated option. In a sense, the volume in the underlying itself is a form of liquidity for options even if the options themselves are illiquid. But this idea extending to a long-dated option is only theoretical. In practice, if you are short a long-dated straddle that doubles in value, the mark and its accompanying hit to your capital may leave you in a forced position. You don’t have the luxury of manufacturing that vol via delta-hedges for a year.

This will be exacerbated if you were short, say 100k 1-year vega, but because of vol exploding you find that you are now short 200k vega. Maybe you can stomach the p/l hit due to vega, but you might not be able to hold the new position size. If Street Fighter’s Vega had Mortal Kombat finishing moves, they would be called vanna and volga.

The recent silver move has been so crazy that vega p/l has dominated realized p/l (realized p/l is the tug of war between gamma p/l from the equation at the opening of the post and theta). It’s an outstanding case study in how higher-order effects are fundamental to understanding options.

We’ll begin with a classic “trap” trade.