Friends,

A few links before finance stuff today:

📖RTFM

I never heard this acronynm before — “read the f’ing manual”. I came across it in a link embedded in

letter referencing engineering video game Shenzen I/O.Wikipedia says:

RTFM is an initialism and internet slang for the expression "read the fucking manual", typically used to reply to a basic question where the answer is easily found in the documentation, user guide, owner's manual, man page, online help, internet forum, software documentation or FAQ.

In the not-distant AI-interface-everywhere future, asking anything but really good questions will make you appear lazy.

the control surface and its crinkliness (1 min read)

Dan Davies gives a nice explanation and visual of unpredictable discontinuity in functions that have regions of smoothness:

Whenever I hear someone talking about “tradeoffs” in policy, this is the picture that flashes into my mind - you can see that at every point in this diagram, there are tradeoffs, but that doesn’t mean that every point is easily accessible by changing a parameter and it doesn’t mean that the outcome of nudging the big dial a little is going to be predictable.

Money Angle

Notable short seller Andrew Left’s firm Citron Research gave his “all roads lead to $40” pronouncement on X this week regarding PLTR 0.00%↑ :

Give Palantir the same $100 billion valuation that Databricks just earned. Where does that put the stock? $40. The exact same math we saw when comparing Palantir to OpenAI.

Tyler pinged me before the stock dove on 8/18 before the stock dove:

walk through of put spread LEAP payoffs on PLTR pls

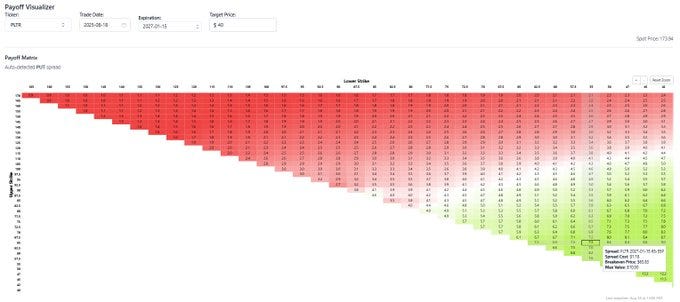

I pulled up moontower.ai to see what odds you can find to bet on $40:

Jan'27

67.5/50 put pays 8-1 if the stock hits 50 or lower ~11% chance of stock dropping 2/3

Tyler’s was drawn to a similar one before asking me:

my gut brought me to 65/55

I looked it up. That one is similar, pays 7.5-1

Put spreads, like any vertical spreads, are straightforward, risk-budgeted, ways to bet on an outcome by a specified expiration. Tyler followed a proper instinct — “Hey someone made a prediction, what odds are being offered by market prices?”

Since stocks obviously only go up in America, those odds don’t sound too exciting for something that is obviously impossible. But putting aside the laws of patriotic stock market anti-gravity, the mathematics of variance drag are the true reason why the odds feel underwhelming — PLTR is a high vol stock so a high likelihood of a negative return is baked into the surface:

In risk-neutral pricing world with RFR of 4% the median one-year outcome for a 50% vol name is RFR minus half the variance.

See Vol drag is misunderstood...until now

You can use my simulator to mess with this idea.

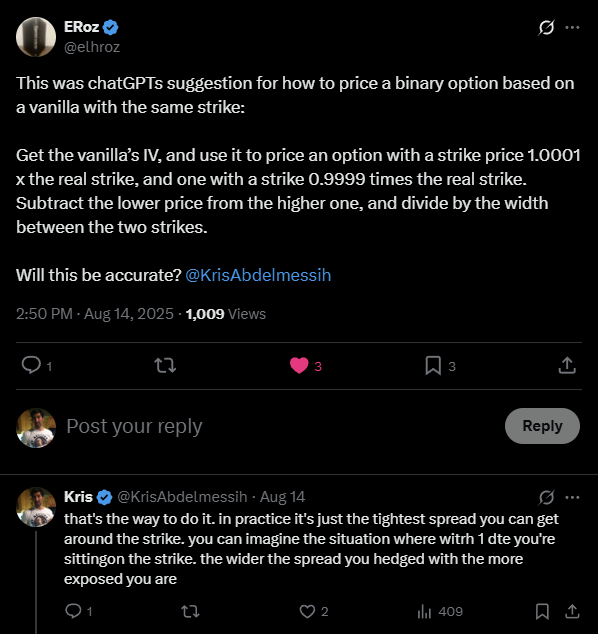

Another application of vertical spread: hedge binaries

Between ERoz and Tyler I feel like I’ve been the options candyman this week. Say my name and I appear. Except you don’t even have to do it 5x.

I gotta change that, I ain’t THAT thirsty.

Money Angle For Masochists

I was asked if I had written anything on the impact of events on skew percentile measures in the Discord. Sharing widely:

I haven’t, but most events are just one-day pricing problems. The effect of skew from 1-day pricing is heavily diluted if you are looking at 1-month skew and beyond. If you are looking at percent skew in like 1 week options, well all kinds of measurement issues anyway:

IV on 1-week options alone is a hairy topic since assumptions about how much vol time remains become impactful. Which is why if I’m trading near-dated, I really just think in terms of straddles and the price of vertical spreads. For the latter if a stock is trading 102.50 with 3 days to expiry you simply ballpark that the 100/105 call spread should be about $2.50 which is about the same saying the 105 call and the 105 put are equal (HW: prove this with put-parity). All the weird lognormal Black-Scholes math really melts away in the short term and you are in the realm of common sense handicapper.

The vega of options gets small in near-dated options so...maintaining a sense of proportion if important. If the ATM vol is 20% and the skew is 10% (ie 22 vol) vs 15% (23 vol) and the vega is 0.005 you haven’t even changed the value of the vertical spread by a cent even though the skew is 50% larger. I have written about this “sense of proportion” stuff. People get caught up in metrics that when you translate back into price space matter on the order of “it’s like paying an extra commission charge to IB on the trade”. In other words, if the difference changed your decision to trade, then the rest of your infra better be medical grade accuracy bc you're trading for slivers.

From My Actual Life

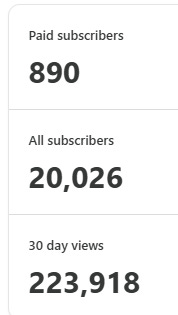

Appreciation thread I wrote late Thursday nite when I noticed sub count crossed 20k:

You people are sick. And I appreciate you for it.

Some history on this letter and joining Twitter…

I started lurking on Twitter in mid 2010s bc I was trying to learn about investing. Despite being a trader investing was foreign to me. Frankly I didn't care about investing or business broadly. Trading was always just some kinda boardgame to me that you could make a living from.

But I had savings and figured I should think about money a bit more so I came to Twitter where there was lots of links to articles and podcasts (consuming everything from @awealthofcs @dollarsanddata @patrick_oshag @ShaneAParrish) learning about Munger or smart beta etc.

Maybe some of that sounds quaint today. It was fresh to me. I was pretty offline, but just knew I didn't know much. So I came to learn.

I start sharing links with my friends in Whatsapp chats often with own opinion.

Wife tells me stop spamming the friend and family chats. She suggests, “Why don't you ask your friends if they'd want one weekly email with your thoughts and links so they can opt in?” She's smart, but more so she's kind & aware. She'll save you if you're trapped in a convo at a party. She was saving my friends and family.

So I email 100 people or so and 40 opt in. I'm obviously huge D&C fan and the Moontower is a symbol of togetherness and dorm room kinda convo so I pick that for a title.

I send the email on Sundays.

In hindsight, I realize I was just arbing offline and online. Online people find mental model shit trite and offline people think it's catnip because it's interesting if you're like you're just living your damn life and not reading your phone all day.

Eventually, I started finding analogies to trading or just explaining things from my own lens. Often quite personally, for better or worse. In any cas,e that's when it started to grow. Every now and then you get a RT from a big account. I was a reply guy once I was publishing because I was also now tweeting links to the letter into the void. @EconomPic was the first large account to boost me (I remember I was on vacation in Palm Springs when I crossed 100 followers because of him).

And so you get a little boost and some confidence and you keep going.

I met him pretty early, and he told me, “If you can publish 20 weeks in a row you will be 95th percentile.”

That seemed like a super low bar. And tbh it was, other than the time I take off a few weeks in summer and Xmas, I basically never stopped.

I've had many convos with people who said they were going to do it and started and got nowhere near 20, so it really is a great mile marker bc if you start out eager it's really not intimidating, but if you hit it you did achieve a milestone. Just fyi if you wanna write.

It took me about 7-12 hours a week to publish those early letters (takes about 3-8 now). In 2020, I started writing long-form on the blog. The first big one was the "sacrifice to the delta gods" post which took about 40 hours to write over the course of a month. I hit send the day before the market felt its first tremor of 2020 (I can remember the trading environment from that pre-COVID period well. Things felt quite alive on the desk).

After that post I started, I started writing the educational option posts. So many hours over the years on those education posts. No plan. Just writing because I thought "I could explain this my way" and hopefully someone else who needs or wants to know it but is mathematically undereducated could get it with less trouble than it took me.

Anyway, it's turned into a lot of words on the internet. It's quite crazy to hear almost every day how those words helped someone get a job or see something in a way they never could before. I hear from pros all the time how they tell their juniors to read MT and that's always been the most validating feedback.

The writing thing was a happy accident and I really feel like it never would have happened if I didn't poke around on Twitter and if Yinh didn’t nudge me. The writer/reader relationship is win-win in ways that trading isn't.

(Trading is a win-win too, but that aspect of it isn't the primary feeling, whereas in writing that feeling is stronger because it's personal… it scratches a different itch.)

Thanks for following along. So much more to do.

Stay groovy

☮️

Moontower Weekly Recap

Posts:

Need help analyzing a business, investment or career decision?

Book a call with me.

It's $500 for 60 minutes. Let's work through your problem together. If you're not satisfied, you get a refund.

Let me know what you want to discuss and I’ll give you a straight answer on whether I can be helpful before we chat.

I started doing these in early 2022 by accident via inbound inquiries from readers. So I hung out a shingle through the Substack Meetings beta. You can see how I’ve helped others:

Moontower On The Web

📡All Moontower Meta Blog Posts

👤About Me

Specific Moontower Projects

🧀MoontowerMoney

👽MoontowerQuant

🌟Affirmations and North Stars

🧠Moontower Brain-Plug In

Curations

✒️Moontower’s Favorite Posts By Others

🔖Guides To Reading I Enjoyed

🛋️Investment Blogs I Read

📚Book Ideas for Kids

Fun

🎙️Moontower Music

🍸Moontower Cocktails

🎲Moontower Boardgaming

As one of the 20,000+ regular subscribers, I appreciate the content (even if I don't trade options). Your way of thinking is interesting and often I find useful bits. Keep up the great work!

Kris, funny you bring up “RTFM”. I remember it being all over IT circles in the early 2000s, especially on forums and IRC chatrooms. It may have existed earlier. If you lived through that culture, you know it was usually meant as a jab, pushing people to ask smarter questions instead of getting spoon fed answers, especially if they weren’t being kind or asking nicely. I remember being told that plenty of times myself, and also throwing it back at others when I got annoyed.

Huge milestone too! Congrats!