Friends,

This summer we started a family tradition — Friday night pizza and movies. Each week we rotate who picks the movie and the pizza place. A few weeks ago, we did a Matthew Broderick double feature.

We started with Ferris Bueller’s Day Off. Turns out I don’t remember seeing this movie before. I just thought I did because of how common the references to it have been throughout my life. Coincidentally, I read a good thread about it this past weekend. I had the same sense as the author — Cameron is the main character and Ferris is a device. He’s the powder form of boredom and rebellion. Even when he appears human, like when he says he’ll marry Sloane, I think he does so for contrarian value. Like she’d be a life-long partner in crime — but only for a few years. One thing the thread didn’t comment on, but I thought was relevant, was Jennifer Grey’s character having a similar arc to Cameron, with Charlie Sheen playing the role of Ferris as “trickster.” They just have to pull it off with the cheap misunderstood-leather-jacket-delinquent-dude-uses-syrupy-socratism-to-get-sheltered-girl-to-hook-up trope.

The second movie was WarGames, which came out in 1983, three years before Ferris. Notably, a year before The Terminator, WarGames did an admirable job dramatizing mistrust of AI and machines. The plot involves a supercomputer that simulates games to discover game-theory-optimal (GTO) behavior via trial and error. Familiar stuff now, but novel 40 years ago. We’re well past the statute of limitations on spoilers, but I won’t ruin anything. I’ll just say there’s a point in the story where Broderick — playing the role of a smart, bored underachiever enthralled with computers and early networking — learns from some hacker kid (whose voice sounds exactly like that annoying nerd on the Polar Express train) that programmers always build a backdoor into a system that only they know. Broderick researches the professor who created this simulation, which goes rogue and takes over real weapons systems, to try to guess the backdoor. Drama ensues. The whole fam enjoyed the movie. Go for it.

But this “backdoor” idea lingers for me. (Oh, stop it)

I feel like this post-modern, financialized, attention-as-capital landscape (btw,

has been on fire in 2025 writing on this theme) is capitalism’s backdoor. It’s a system of prosperity with a hack that threatens to undo it. But unlike the WarGames computer, nobody invented the system.Adam Smith is known as the “father of capitalism” for theorizing an “invisible hand” mobilized by individuals’ decisions signaling how society should allocate resources. A swarm intelligence that maximizes benefit under the curve for the plurality of its members, as opposed to the narrow interests of a corruptible centralized authority.

Just as miners, without coordination, vying for the next block of BTC, exhaust a salutary byproduct — a secure network — entrepreneurial pursuits leave behind surplus in the form of intelligence and lower costs. We acknowledge that every system has costs and benefits. Like BTC mining, there are also negative externalities like pollution that might not be properly charged back to its spewer. In America, we believe capitalism is the creatine of economic systems — the performance upgrade obliterates the side effects.

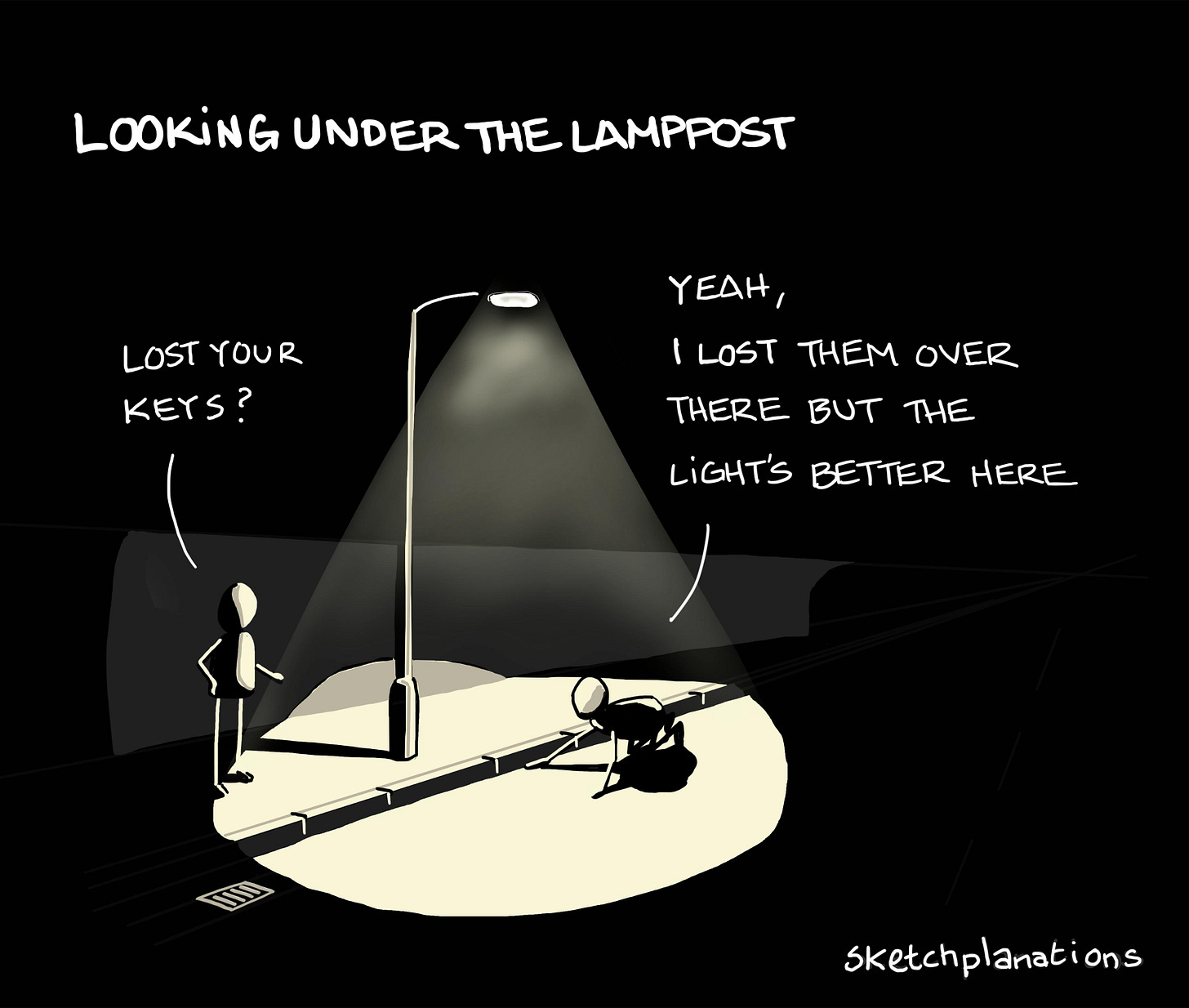

Since nobody, including Adam, devised capitalism, there’s no hidden kill switch that one person pushes. Instead, the backdoor will look like a decentralized hack on a structural vulnerability — that prosperity is too nebulous for GDP to summarize, yet we maintain Robert McNamara-esque susceptibility to “streetlight effects”.

When the going gets tough, we lean even harder into “make number go up.” Bullishness as a prayer.

All the Haidt and Galloway stuff about mental health, youth suicide, rejection from college, rejection from homeownership, rejection from finding a mate. The country voted for a hard right turn, not because half the nation loves Trump, but because of a simple, desperate perception:

that your children will not be better off than you

I don’t know what number represents optimism/pessimism on THAT criteria, but that’s the number you want to measure.

For understandable reasons, we don’t know how to make the polycrisis better. But we know you can’t let the market slide. The whole TACO thing shows even Mr. Art of the Deal has a master. Our allegiance to “number go up” is an incurable Stockholm syndrome. We have internalized “what’s good for the market is good for us” to such a degree that we are captured. We are captured because there’s enough truth in it to let us overplay it. There’s enough truth to it that any movement that slows near-term growth, regardless of its wider merit, can be parried with “commie.”

Our reliance on the market is the backdoor. An ironic one at that.

Why?

Because the backdoor welcomes the real commie while the monied interests cry wolf at sensible critics.

Remember, capitalism is supposed to be a swarm intelligence that maximizes benefit under the curve for the plurality of its members.

But as the middle hollows — a trend that certainly risks accelerating if intelligence and creation become matters of electricity, aka capital, capitalism will have eaten its host while its greatest benefactors distract us, placate us with stories of “freedom”, and stall until the clone army shows up to bring their physical numbers in proportion with their ownership of the wealth pie.

The counterstory will grow. Like the capitalism story, it will contain a pit of truth within a fleshy fruit of hyperbole. Hell, I’ll write it for you:

Financialization, absentee ownership, and P/E rollup-industrial complex sever the stakeholder-client relationship that once carried an implicit warranty of personal reputation. Instead of an owner standing behind their service, you only find agents. The role is two-way, representing the customer back to the owner and the owner back to the customer. Yet it’s a link with little intrinsic motivation, disinterested at best and corruptible at worst. What Doctorow coined “enshittification” in both the physical and digital worlds. Not by an Orwellian oppressor but by a seductive Huxleyan whose vision we bought and voluntarily moved into.

AI won’t fully automate this structure. Too obvious. It needs cover. It will push humans into the role of “shit umbrella”, assigned to absorb responsibility while true decision-makers cloister themselves behind high hedges and high-minded abstractions. Don’t worry shit umbrella, you’ll be well-paid, your parents proud of your fancy job. Alienated from the self? Mismatched between the risk you carry and the puppetry that sustains you? The irony of living in a Pink Floyd concept album while listening to their straight one…”did you exchange a walk-on part in the war for a lead role in a cage?"

The prediction isn’t bold. The signs are there. But the anti-capitalism story will gain steam the more people get shut out. The real commies are going to walk right through the backdoor as invited guests once enough servants realize their job isn’t a stepping stone but the destination. When they realize their master believes in “capitalism for me, but not for thee.”

I’m going to pause there. We’ll pick up the thread next week. There is a technology woven into the very fabric of capitalism that, on a long enough timeline, inevitably exposes the backdoor.

A special for nerds

This Sunday, QuantInsider is hosting a webinar entitled:

"Unified Real-Time Derivatives Modelling: Making Every Model as Fast as the Fastest"

Join us for an exclusive webinar with Dr. Robert Navin – Founder & CEO of Real Time Risk Systems – where he reveals - How a Unified Overnight Grid Architecture Delivers Microsecond Derivatives Pricing speed

Moontower readers can sign up with a discount.

Stay groovy

☮️

Need help analyzing a business, investment or career decision?

Book a call with me.

It's $500 for 60 minutes. Let's work through your problem together. If you're not satisfied, you get a refund.

Let me know what you want to discuss and I’ll give you a straight answer on whether I can be helpful before we chat.

I started doing these in early 2022 by accident via inbound inquiries from readers. So I hung out a shingle through the Substack Meetings beta. You can see how I’ve helped others:

Moontower On The Web

📡All Moontower Meta Blog Posts

👤About Me

Specific Moontower Projects

🧀MoontowerMoney

👽MoontowerQuant

🌟Affirmations and North Stars

🧠Moontower Brain-Plug In

Curations

✒️Moontower’s Favorite Posts By Others

🔖Guides To Reading I Enjoyed

🛋️Investment Blogs I Read

📚Book Ideas for Kids

Fun

🎙️Moontower Music

🍸Moontower Cocktails

🎲Moontower Boardgaming

Good read... The McNamara fallacy is only all too common in investing/trading circles. First time I hear of the actual word/concept

Have thought this for years and now it’s starting to become a lot more apparent. US government becoming the largest shareholder of INTC has “government seizing the means of production) written all over it. Exciting and also terrifying time to be alive