when quitting is ambitious

Moontower #290

Friends,

Let’s hop right into a recommendation.

This essay is packed with useful decision frames. If you’ve been with me for awhile I think you’ll understand why I’d appreciate it.

In praise of quitting (Cate Hall)

From the opening:

the danger is in devoting our days to something that fundamentally doesn’t matter to us, because we’re too afraid to cut our losses.

Tournament poker is basically about finding the highest-value uses of a scarce resource, your chips. The fact that losing those chips means getting completely locked out of a shot to win major money means that their opportunity cost is high. This means it can be a big mistake to commit yourself to hands that are somewhat positive-value in expectation, if you have good reason to believe there will be better, higher-value opportunities…Life is, of course, just like this: You get only one shot, and it’s up to you to make the most of it by rejecting okay or even pretty good ways to allocate your time or other resources — to hunt down the opportunities to make really great bets on yourself. Do not make barely positive-value bets with your life!

A description of almost anyone can relate to by middle-age, if not earlier:

The interesting thing about steady jobs is that they’re actually not so steady. They are static in a conceptual sense — in the sense that if you say you’re a “lawyer” when you’re 30, and say you’re a “lawyer” when you’re 50, there is the same label for what you do. And that can feel like steadiness, like a reassuring kind of coherence to your life story.

But the truth is that everything is in constant flux. Beneath the labels, life continues evolving all the time. Your interests change, companies change, and industries change. Given that your “steady job” is constantly evolving, even if you picked the highest-leverage option initially, there is a low chance that it will remain your highest-leverage option over time.

The same goes for places to live, relationships, opinions, and hobbies. Over time, these things can degrade in value or resonance — and yet still retain the emotional pull of their initial promise. And when this happens, people often stay too long.

Cate offers some exercises or what I think of as useful frames:

By default, we tend to think of “choices” as the kinds of things that take us off the path we’re already on. From this stance, it doesn’t feel like we are “choosing” to go to our job every day, or choosing to remain where we live. The scary thing is that this means we can actually be making the biggest mistake of our lives on a daily basis, despite it feeling like nothing is happening at all. If we want to evaluate whether our current set of choices is really best or whether it’s just inertia keeping us where we are, it can be powerful to upend that frame.

Try it. Go around your day, narrating all of your choices to yourself. With everything you do, consciously say, in your head: “I am choosing to do this, because it’s the best course of action according to all the information I have available.” See if it feels true. It might — perhaps this exercise will reinforce your conviction. But you might also find that entire regions of your life suddenly look strange. The declaration that you’re doing the best thing will sound like hollow propaganda, an attempt to convince yourself of something you know just isn’t so.

More:

Another powerful exercise, of a similar kind: Imagine that you were instantly unsubscribed from everything in your life. All of your choices undone — where you live, who you’re with, what you do with your time. All of a sudden, you’re a completely empty canvas. And then, imagine that you have the power to bring back each element just by hitting a “resubscribe” button, like it’s an email newsletter. Being honest with yourself, which elements would you hit “resubscribe” on?

Once you realize you’re choosing something, you regain the ability to un-choose it.

Note that un-choosing doesn’t always mean quitting in the complete, traditional sense. It might just mean an alteration — working hard to establish a new phase in your relationship, or changing roles at your job, or moving to a different neighborhood rather than a different country. This, too, is strategic quitting: declaring that a given battle is over so that you can win the war.

She closes with a bright side.

Leaving can still break your heart even though it’s the right thing to do…But something to remember is that there is always some unknown part of the future that you will be equally fond of.

When people think about quitting, it’s hard because they’re comparing the rich web of attachments they have now to some mostly blank slate, or, worse, the possibility of disaster. However, what’s more realistic to imagine, if you’re leaving something you’re no longer aligned with, is a future with more to love than you have now.

My 2 cents since we’re here.

Quitting the familiar always feels risky. And to be clear, it often is. But it’s also risky to stay and even though we can feel that in our hearts, we don’t seem to warn people about that risk with the same urgency we do about when they plan to change.

The asymmetry is an expensive risk reversal. Paying up for the put, and hittin’ bids on calls. Playing for upside, I don’t mean financially, although that can be included, demands courage. Not heroism. Small courageous steps. Folding a comfortable hand never feels heroic, but it does take courage. It risks looking like a fool.

We are surrounded by grand examples of ambition. Bottomless appetites for wealth and power. But figuring out how to live on your terms, around people you are happy to be around, working on things that light you up, and staying true to your values is an ambitious goal. Pulling that off is hard because unless you got lucky and ended up on YOUR path from the start, at some point you will need to know when to quit.

I don’t know where I heard it, but someone said the reason some finance people stay in finance (unhappily) long past satisfying their financial goals is that they can’t do anything else. Not in a “they lack the ability” but in a learned helplessness kind of way. They cannot stomach the hit to their identity, status, or sense of usefulness, even if all of it is in vain. For appearance. For others. For lack of creativity. Soul last seen on the back of milk carton at age 17.

On a personal note, even having went through a substantial quit, I’m still not here to glorify it. I effectively run a craft consumer-facing small business between the writing, consults and option analytics. Bruh, I’m teetering on the edge of self-doubt and self-belief from day to day.

Making money and creating surplus go together. That I make less than I used to hurts because it feels like a statement about the surplus I create.

[I obviously understand that it’s not that simple. Leverage and ability to capture a share of surplus are giant inputs into what you actually get paid. That there’s no-name closet indexers richer than your favorite drummer is capitalism’s bunion but I’m not suggesting we amputate the foot even if I’d get some perverse joy from clawbacks against people who suck.]

Still, I wrestle with this quite a bit. I don’t really see myself as a businessman. As someone who would spin something up just because they see an opportunity. I’ve always been impressed by those kinds of people because I wish I could be like that. But it’s hard for me to care about something unless I love it. I don’t care about solving a problem just because it exists. There are infinite problems and I have one attention span. To a businessman, profit helps them filter. But more money than I actually need* is not motivating enough to do work I don’t care about. How would I even be excellent at something I didn’t care about?

But this perspective is a constraint of my own making. I don’t get to eschew opportunism and then complain that’s how the world and economy work. As it goes, I’m trying to figure out how to make more money doing these things that intersect my interest and ability. There’s a better product-market fit at the end of this rainbow, but finding it is harder than trading, and there’s no guarantee it will pay as well. But I’m immersed in the process of going there. And for that feeling, quitting was right for me.

*Adulting means you gotta do whatever you gotta do to make what you need OR lower what you need. But I’m talking about the same decisions we all make on the scale that is personally relevant. For some, it’s the choice of doing X for the 100k they need or Y for the extra 50k, and for others it might be the choice of $500k working remote or $1mm being on the road 60% of the time. Cate’s point in this essay is that everything is a choice and when you forget that become an entitled victim. Or to use one of my favorite lines…you’ve exchanged a walk-on part in the war for the lead role in a cage.

Money Angle

I want to clarify a statement from my chat with John from Risk of Ruin.

I said “vol trading is easier than directional trading”.

This is something I’ve felt from experience. I long attributed it to derivatives pricing being, well, derivative of an underlying. Trading an ETF or index future, both derivatives, is “easier” in the sense that there is a fair value with respect to some assumptions like cost of carry but the variation in the assumptions is vanishingly small compared to the error bars on the assumptions one makes when formulating an opinion about a stock price.

For options, most of the inputs except volatility also have error bars that are far smaller than anything you’ll assume about a stock.

Which brings me to volatility.

Volatility is more stable than returns.* This is why quants target risk in their sizing, not returns.

🔗See Know-Nothing Sizing for a fuller discussion. It’s an idea that underpins my approach to investing and risk management.

So if handicapping volatility is easier than handicapping returns, shouldn’t everyone just trade options for that sweet, easy cash?

The fact that it’s easier, also means the competition is fierce. It’s a zero-sum, capacity-constrained game. Predicting vol is easier than predicting returns, but…so what? You care about “how easy is it to make money?” and that is not easier.

The distinction reminds of this Daryl Morey bit on sport analytics:

Our underlying data is more predictive, quite a bit predictive. I talk to a lot of quants on Wall Street, and I tell them our signal to noise ratio using whatever measure you want….And they go like —whoa, you guys are — that’s incredible. And I’m like, yes, but you remember, we have to be best of 30. You guys just have to beat the S&P by 2% and you are geniuses. So each industry has its own challenges.

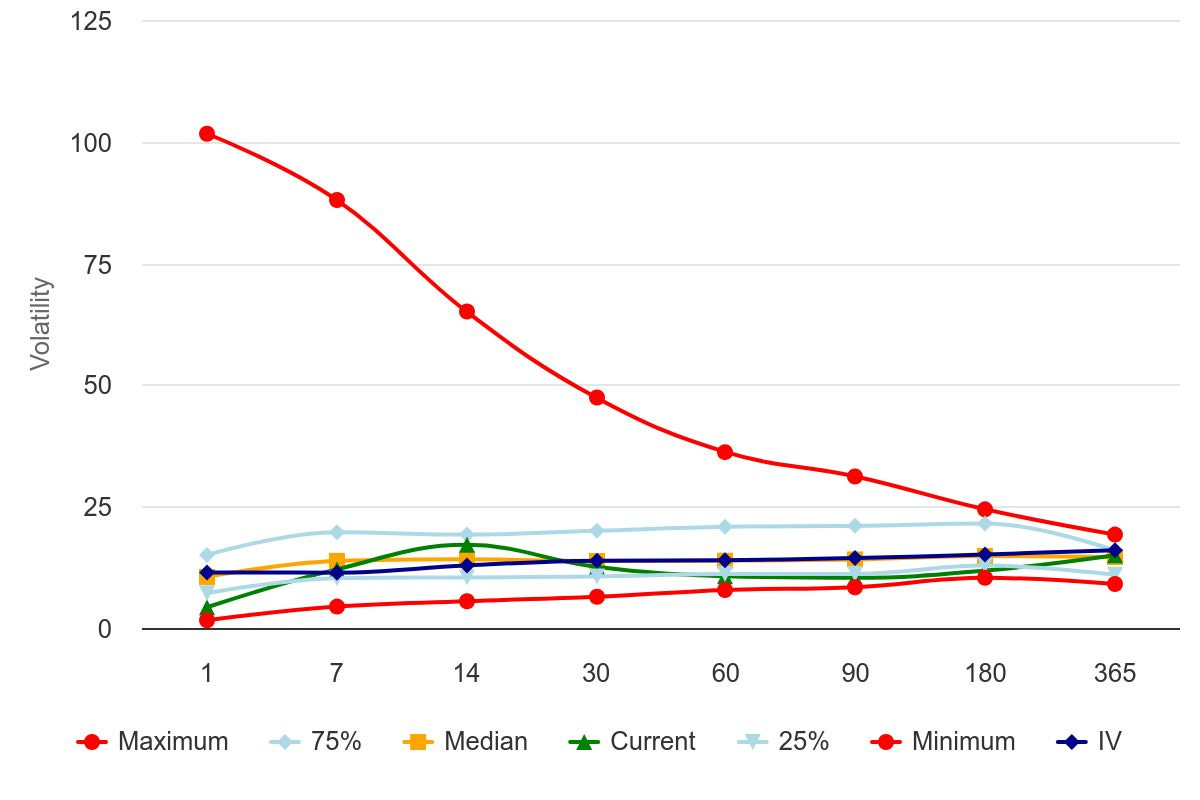

*For the option enjoyyyyers who are thinking “Bruh, VVIX is way higher than VIX, how can you say vol is less volatile than the vol of returns?”, here’s my rebuttal: What’s your 90% confidence interval on SP500 returns next year vs SP500 1-year realized vol?

An investor doesn’t care about vol of vol as if they are trying to price an option on VIX. If SPY realizes 14% give or take 5 points for a year (this is about the high/low range of 365 day vol using overlapping data for the past 4 years), this is not as destabilizing as the outright returns being say -5% vs +15% which is probably an even narrower relative range than 9% to 19% for a 1-year realized vol.

Money Angle For Masochists

Speaking of VIX…

Here’s an FYI that reinforces a lot of moontower 2025 writing on option synthetic futures.

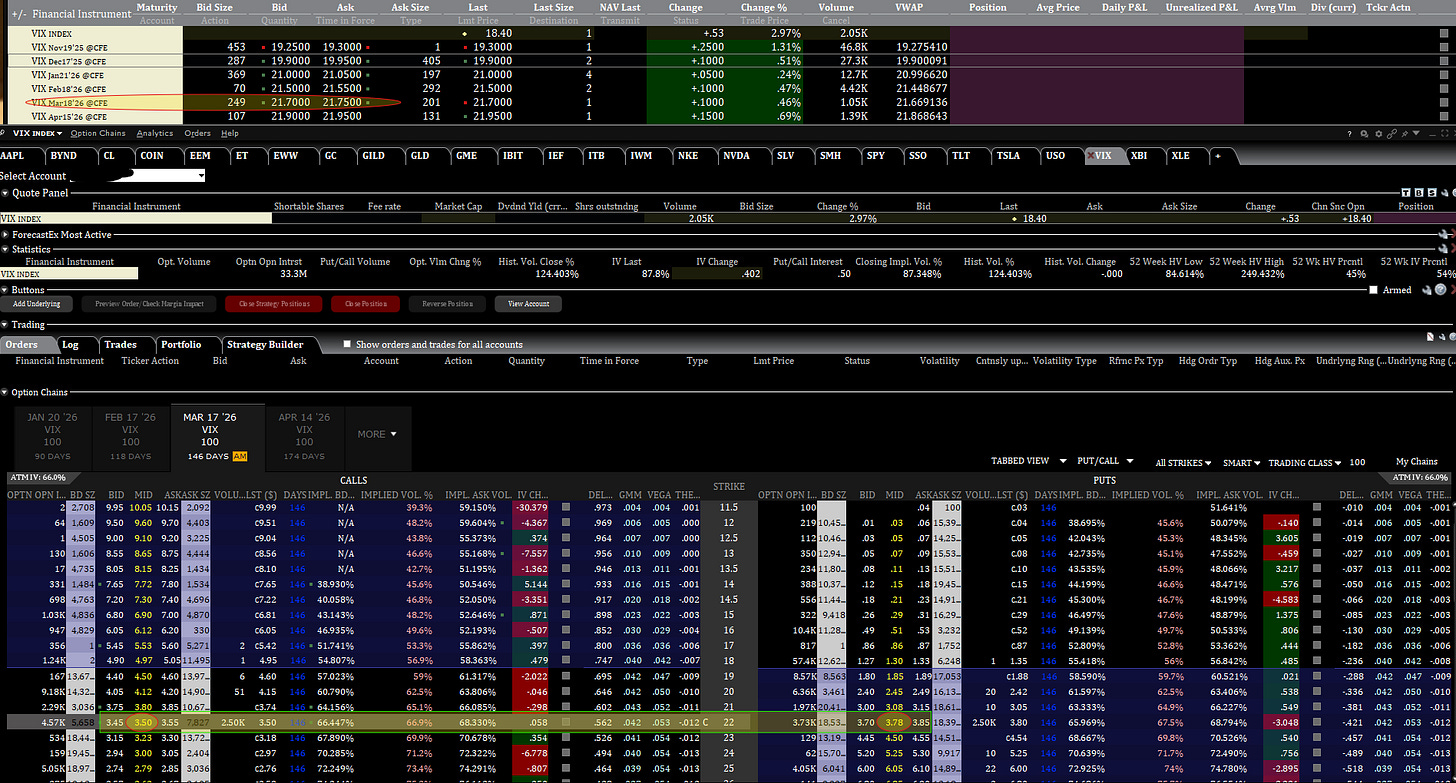

This is from my IBKR screens from 10/22:

Spot VIX was 18.4

I highlighted the March VIX future. It had a mid-market of 21.725

The ATM strike for options on VIX expiring in March is 22.

The combo or price of the 22 synthetic =

call price - put price = 3.50 - 3.78 = -.28

Synthetic future = Strike + Combo = 22 -.28 = 21.72

No arbitrage available folks (as expected).

The synthetic future on VIX and the actual VIX futures trade in line.

💡The VIX options and futures typically expire on the Wednesday morning preceding monthly option expiry cycles. The options cannot be traded between the prior night’s close and the Wednesday settlment but the futures can.

Stay groovy

☮️

Moontower Weekly Recap

Posts:

Need help analyzing a business, investment or career decision?

Book a call with me.

It's $500 for 60 minutes. Let's work through your problem together. If you're not satisfied, you get a refund.

Let me know what you want to discuss and I’ll give you a straight answer on whether I can be helpful before we chat.

I started doing these in early 2022 by accident via inbound inquiries from readers. So I hung out a shingle through the Substack Meetings beta. You can see how I’ve helped others:

Moontower On The Web

📡All Moontower Meta Blog Posts

👤About Me

Specific Moontower Projects

🧀MoontowerMoney

👽MoontowerQuant

🌟Affirmations and North Stars

🧠Moontower Brain-Plug In

Curations

✒️Moontower’s Favorite Posts By Others

🔖Guides To Reading I Enjoyed

🛋️Investment Blogs I Read

📚Book Ideas for Kids

Fun

🎙️Moontower Music

🍸Moontower Cocktails

🎲Moontower Boardgaming

VIX options and VIX futures actually settle on the same Wednesday using the same Special Opening Quotation (SOQ), which has the ticker VRO.

https://www.cboe.com/tradable-products/vix/faqs/#product-and-settlement-information

Perhaps you are referring to the discrepancy in final trading day, since the options stop trading on the close Tuesday, whereas the futures continue to trade the premarket on Wednesday. (This would not have forward vol implications for the synthetics, however, since any time the options are tradable, they remain arbitrage-bound with the futures.)

Such an expiration timing offset would be interesting, though, if it were real! (I assume, a little *too* interesting for the VIX options market makers to stomach.)