Friends,

Some recent convos had sex with lingering thoughts from a podcast on a bed of a blank page this morning and today’s Moontower is the weird baby that popped out.

I recently listened to my first episode of Dan Carlin’s Hardcore History — a tour of the transatlantic slave trade entitled: Human Resources. Dan’s story-telling and research shine in this nearly 6-hour episode. He deserves all the accolades he gets. The style, quality and nuance of his work are well-advertised, I’m just late to the party. He immediately jumped into my ring of favorite creators.

I’m also a fan of the Founder’s podcast. Because I found an interview with its host David Senra to be as compelling if not more than the books he highlights (a high bar), I decided to hunt down interviews with Carlin. The first one I clicked on with Lex Friedman did not disappoint.

3+ hour interview (Lex Friedman on YouTube)

Here are 4 excerpts that stood out to me, but the whole interview is good.

https://moontowermeta.com/a-few-excerpts-from-dan-carlin-on-lex-friedman/

I’ll post one of the excerpts here because I like Carlin’s approach — he answers the question probabilistically (and his gambling mindset in general to handicapping answers is prevalent in the way he reasons) but explains the framework he is adopting to approach the question.

[Meta observation: Answers to questions often fall out trivially from the model you choose to approach it, so it’s a reminder that your choice of model in the first place is critical — any ensuing logic will unconsciously inherit its assumptions. The work of overriding assumptions to adjust for differences between the reference model and the question at hand is where devilish details lie. But when encountering an argument, it’s a good idea to question the choice of model before quibbling over details.]

On to the excerpt:

Lex asks how we will “destroy ourselves”. Carlin gives a framework for handicapping what calamity will undo us.

Lex: If you were to wager on the method in which human civilization collapses, rendering the result unrecognizable as progress, what would be your prediction? Nuclear weapons? A societal breakdown through traditional war? Engineered pandemics, nanotechnology, artificial intelligence, or something we haven’t anticipated? Do you perceive a way humans might self-destruct or might we endure indefinitely?

Dan’s response (emphasis mine):

My perspective is primarily influenced by our ability to unite and focus collectively. This informs my estimates of the likelihood of one outcome versus another.

Consider the ’62 Cuban missile crisis. We faced the potential of nuclear war head-on. That, in my view, is a hopeful moment. It was one of the few instances in our history where nuclear war seemed almost certain. Now, I’m no ardent Kennedy admirer, despite growing up during a time when he was almost revered, especially among Democrats. However, I believe John F. Kennedy, acting alone, likely made decisions that spared the lives of over a hundred million people, countering those around him who preferred the path leading to disaster.

Reviewing that now, a betting person would have predicted otherwise. This rarity underpins our discussions about the world’s end. The power to prevent catastrophe was in the hands of a single individual, rather than a collective.

I trust people at an individual level, but when we unite, we often resemble a herd, degrading to the lowest common denominator. This situation allowed the high ethical principles of one human to dictate the course of events.

When we must act collectively, I become more pessimistic. Consider our treatment of the planet. Our discussions predominantly center around climate change, which I believe is too narrow a focus. I become frustrated when we debate whether it’s occurring and if humans are responsible. Just consider the trash. Disregard climate for a moment; we’re harming the planet simply through neglect. Making the necessary changes to rectify this would necessitate collective sacrifice, requiring a significant consensus. If we need around eighty-five percent agreement worldwide, the task becomes daunting. It’s no longer about one person like John F. Kennedy making a single decisive move. Therefore, from a betting perspective, this seems the most likely scenario for our downfall as it demands a massive collective action.

Current systems may not even be in place to manage this. We would need the cooperation of intergovernmental bodies, now largely discredited, and the national interests of individual countries would need to be overridden. The myriad elements that need to align in a short span of time, where we don’t have centuries to devise solutions, make this scenario the most probable simply because the measures we would need to undertake to avoid it appear the least likely.”

[a later thread that rounds out his thinking on this]

“Returning to our primitive instincts, we are conditioned to address immediate and overwhelming threats. I hold a considerable amount of faith in humanity’s response to imminent danger. If we were facing a cataclysmic event such as a planet-threatening explosion, I believe humanity could muster the necessary strength, empower the right individuals, and make the required sacrifices. However, it’s environmental pollution and climate change that pose a different challenge.

What makes these threats particularly insidious is their slow development. They defy our innate fight or flight mechanisms and contradict our ability to confront immediate dangers. Addressing these problems requires a level of foresight. While some individuals can handle this, the majority are more concerned, understandably so, about immediate threats rather than those looming for the next generation.

Could we engage in a nuclear war? Absolutely. However, there’s sufficient inertia against this due to people’s instinctive understanding. If I, as India, decide to launch an attack against China, it’s clear that we will have 50 million casualties tomorrow. If we suggest that the entire planet’s population could be extinguished in three generations if we don’t act now, the evolutionary trajectory of our species might hinder our response.”

The remaining excerpts cover:

An example of how propaganda can scramble your beliefs in a way that creates collective distortions that are hard to see

The problem with dictators or strongmen even if they are wise and benevolent

Will the US tear itself apart in a second civil war?

[Note: I used GPT-4 to clean up sections of this transcript: https://www.happyscribe.com/public/lex-fridman-podcast-artificial-intelligence-ai/136-dan-carlin-hardcore-history]

Money Angle

Here’s a stream of consciousness reflecting on a few recent private convos jambalayed with some of Dan Carlin’s thoughts.

I was hanging out with a good buddy (and former biz partner) and talking shop a bit about the options biz. I’ve heard about how implied correlation is “trading in the 0th percentile” but that selling it continues to be profitable in 2023 because it’s “realizing” even less than implied (to be clear he runs a big strategy and we don’t discuss what he does so there is no suggestion that he is also doing this. He merely confirmed that implied corr was historically low). This reminded me of the misery that was 2017, where the best trade would have been to just lay into single-digit SPX vol because realized vol was so low you’d wonder if the stock market even opened anymore. The opening bell rings and you immediately ask “What’s for lunch?”.

While we were walking around Ghirardelli Square, my boy made a throwaway comment that my mind hasn’t emptied from the trash.

The hard leg is always where the money is.

I thought about how, in 2021, the dumbest possible idea — buying a dog coin — was the best trade at one point and shorting it was too at a different point. But both were hard at the ripest times to do it and easiest when they were riskiest.

I thought about the double lot property I looked at this week with a realtor friend (the same one who sold both my house and my biz partner’s — if you are in the East Bay I’d be happy to intro. Good realtors are like good mechanics — gold amongst pyrite). There’s no math that makes the price of the homes make sense. Property in a specific location has little substitute and just trades like art. As my realtor properly diagnoses — “Kris, you’re like my lawyer father, you see the risk. But the people who win these auctions only see their family on a Christmas card”. This was not a knock on those people. As my friend Jared likes to say, their bank accounts have a phone number in them — I’ve seen enough behavior here to know that while folks aren’t Miami-flashy, a Ferrari is a rounding error sum of money in a home negotiation, not a decision. If you move from the Bay Area or NYC your bid would be obnoxious to the locals too.

It feels to me that everything is a momentum trade — selling dispersion at low levels, buying homes at 0 after-expense cap rates, having no top on what you’d pay for Harvard, hell, it’s an imperfect measure but even stock market earnings yield is less than t-bills.

It’s all momentum until some grand event makes it abundantly clear that the world has changed. Then you get the situation currently embodied in the no-bid CRE markets of say SF and Chicago.

Liquidity is utterly discontinuous in such a world. Value will become increasingly resistant to traditional measurement because there is so much wealth in search of a return you can reason that any opportunity where the math makes in a textbook spreadsheet, the value is sitting on a landmine, already passed on by the infinitely patient family offices of moguls who are not forced to chase LP-friendly payoff diagrams.

I chatted this week with another good friend who finds and stacks strategies at a well-known pod shop. He talked about a trend he had seen in motion much earlier — the accelerating difficulty in finding talent/alpha. He’s impressed at the speed at which the market for alpha is getting efficient but this is what you’d expect when pods are eating the investment world. Millenium manages $50B that is laser-focused on uncorrelated skill (grapevine tells me they increased how many pods that trade dispersion in recent years — cue the “markets are biology not physics” analogy — which means the marginal bid for single stock vol has increased. This actually means the environment for covered call selling might be unusually nice. This doesn’t contradict my broad admonitions about call-selling. It actually makes my point — that you should be discerning about the practice and not think of it as passive income or free money but understand what circumstances make the strategy more or less ripe.)

All of this makes me wonder about the distribution of investment outcomes in aggregate. Suppose the underlying economy is steady. Does the median return increase at the expense of the left tail (keeping the expectancy the same)? In a world where capital is more easily deployed and more concentrated, what happens to the shape of returns?

Look at the deal the Saudis have offered Mbappé or their pot-splashing with LIV golf. It all feels related. Financialization, private-equityization, Softbankization. Increasing rewards for capturing attention (see athletes or Cathie Wood). The internalization of rage bait as a social media strategy. Twitter X is rapidly being consumed by engagement tactics (dystopian thought: this trains people to be numb as they will eventually adopt defenses against engagement until we lose the ability to know what we should pay attention to). The harder profit is to find the greater the temptation to cut another forest down. We are great at identifying growth. Less great at understanding its costs. Wouldn’t be a bad tagline for America if taglines were honest.

(In Dan Carlin’s slavery pod I felt that the moral concerns didn’t gain steam until the cost of enslaving Africans became more apparent. You know that expression “narrative follows price”? Maybe we don’t moralize until a loathsome but profitable practice reaches its blood-from-a-stone phase and the cost of moralizing is lower. If you try on that perceptive for a day you’ll either want to claw your eyes out or you’ve already sold humanity to zero.]

All of this echoes Dan Carlin’s suspicion that our undoing will be collective action problems. If you believe that the logic of efficient markets (a collective action coordination mechanism that differs from democracy) is playing itself out in a rules landscape that has significant divergences from the political question of “what is good for broad-based flourishing”? You could imagine capitalism resting on many different types of rule frameworks. But you’d also expect the ruling framework, the one called a “free market”, to be shaped by its victors (corporations are people too, right?).

To Carlin again — propaganda can scramble your beliefs in a way that creates collective distortions that are hard to see

[Carlin is a war historian and while he admits to his bias towards individualistic ideals “I’m famously one of those people who buys into the ideas of traditional Americanism”, his characteristic nuance is well-displayed in his deep skepticism of the “military-industrial complex” and how its inclination towards self-preservation as an institution often exerts undue influence in when America looks at its menu of choices]

“Many people living today seem to think that patriotism requires a belief in a strong military and all the features we have in the present. However, this is a departure from traditional Americanism, which viewed such elements with suspicion during the first hundred years of the republic. They saw them as foes to the very values that Americans celebrated. The question arises, how could freedom, liberty, and individualistic expression thrive with an overarching military always engaged in warfare?

The founders of this country examined examples such as Europe and concluded that standing militaries or armies were the enemy of liberty. Today, we have a standing army deeply woven into our society. If one could go back in time and converse with John Quincy Adams, an early president of the United States, and reveal our current situation, he would likely find it terrible and dreadful.

Somewhere in our history, Americans seemed to have strayed from their path and forgotten their founding principles. We have successfully combined the modern military-industrial complex with the traditional benefits of the American system and ideology, so much so that they have become entangled in our thought process. Just one hundred and fifty years ago, they were seen as polar opposites and a threat to each other. When discussions arise about the love of the nation, I harbor suspicion towards such sentiments.

I am wary of government and strive hard not to fall prey to manipulation. I perceive a substantial part of what they do as manipulation and propaganda. Therefore, I believe a healthy skepticism of the nation-state aligns perfectly with traditional Americanism.”

I’ll leave you with a thought — let’s do an analogy substitution.

What if the version of capitalism we endure today is the military-industrial complex and Georgism is actually more aligned with the meritocratic principles this country is supposedly based on?

Money Angle For Masochists

My biz partner friend is way more of a math guy than me. If you want to be a trader you’ll get more mileage studying gambling than investing. Although I’ve done some study of gambling, it’s nothing compared to my friend’s info diet. He’s been a giant sports analytics nerd for the past 20 years (one day I might share a story of his meeting with an NFL team owner. I get stressed thinking about it, so can’t imagine how my buddy feels).

I asked him for some book recs in the vein of Scorecasting written by AQR quant Tobias Moskowitz (you may remember me recommending his children’s novel Rookie Bookie).

The list:

Baseball Between the Numbers: Why Everything You Know About the Game Is Wrong

The Book: Playing the Percentages in Baseball

Seminal: Bill James

Win Shares

Basketball on Paper: Rules and Tools for Performance Analysis

The Expected Goals Philosophy: A Game-Changing Way of Analysing Football

The Hidden Game of Football: A Revolutionary Approach to the Game and Its Statistics

Finally, my internet friend Andrew is an independent trader who came out of the sports gambling world. I’ve spoken to him several times. Very smart, you should follow him and check out the sports modeling books he’s written:

From My Actual Life

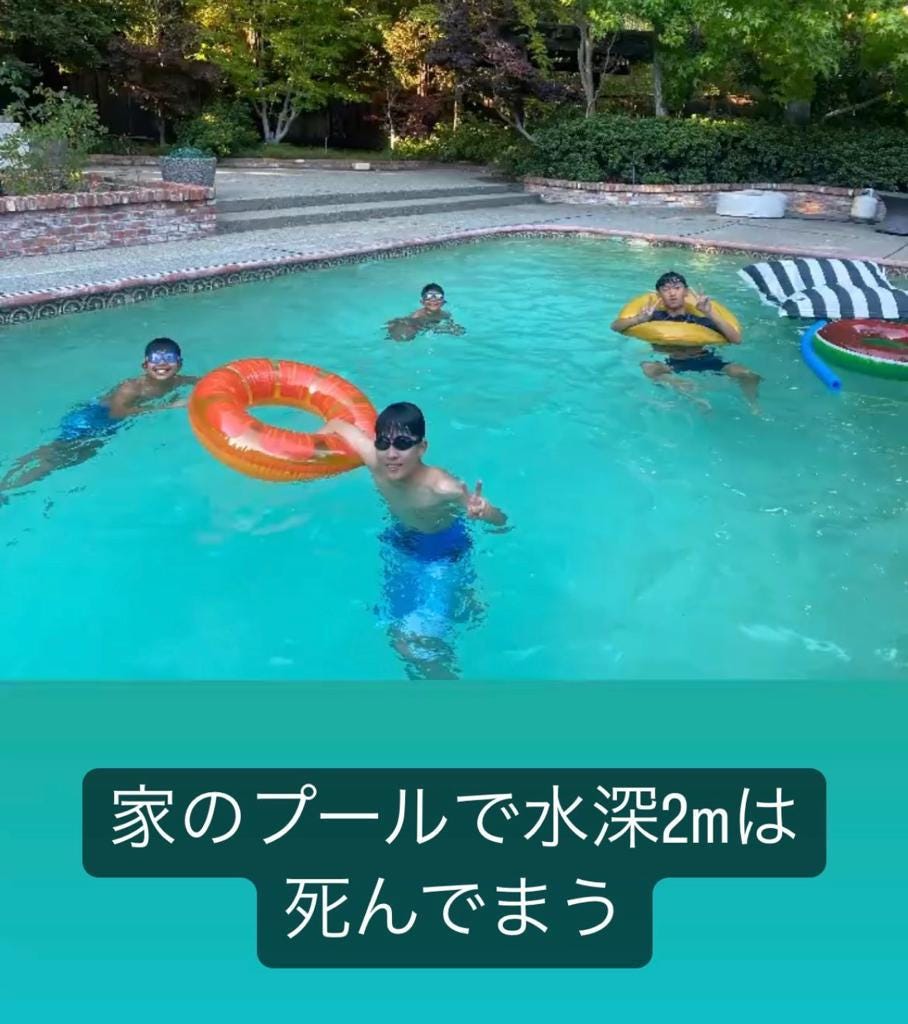

We had a pair of 15-year-old Japanese exchange students stay with us this past week. Our kids have new older brothers — this crew loved each other. Play is a universal language.

Stay groovy ☮️

Substack Meetings

I was invited to be a part of the Substack Meetings beta. You can book a time to chat. I’m more expensive than a 900 number from 1988 and have a less sexy voice.

Book a meeting with Kris Abdelmessih

Moontower On The Web

📡All Moontower Meta Blog Posts

Specific Moontower Projects

🧀MoontowerMoney

👽MoontowerQuant

🌟Affirmations and North Stars

🧠Moontower Brain-Plug In

Curations

✒️Moontower’s Favorite Posts By Others

🔖Guides To Reading I Enjoyed

🛋️Investment Blogs I Read

📚Book Ideas for Kids

Fun

🎙️Moontower Music

🍸Moontower Cocktails

Becoming a patron

The Moontower letter is and will always be free. My writing is a search “for the others”. The “others” are people like you who are unlearning the mental frames that artificially narrow our choices.

If you are here you already understand that inspiration is a tradable good. It’s not as tangible as a cup of coffee, but it packs 10x the adrenaline with an infinitely longer half-life than caffeine.

If you feel inspired, you can upgrade to becoming a patron.

"Value will become increasingly resistant to traditional measurement because there is so much wealth in search of a return you can reason that any opportunity where the math makes in a textbook spreadsheet, the value is sitting on a landmine, already passed on by the infinitely patient family offices of moguls who are not forced to chase LP-friendly payoff diagrams."

The whole article is a mine. This long quote is a gem. It's both descriptive of the current situation, both in general and in specific pockets of the economy. But it's also predictive, as it describes the likely (inevitable ?) spread of this change in valuation measure across society. I'm going to be referring back to this for many years.

Thanks also for the reading links.

Hard to "like" this. Seems like it deserves a more nuanced reaction. That's just me.

What I do like though is the idea of a GAME to EDUCATE people with. In this case Monopoly to educate re: Geogism.