Warrant

Moontower #186

Friends,

There's this thing called “content brain” that you get when you write online.

Thomas Bevan explains:

You develop content-brain as each day you spend you peak creative energy feeding the algorithm the bite sized chunks of easily digestible nonsense that it craves.

You degenerate from essays and paragraphs down to fortune cookies and quotations.

[Kris: the mechanism conjures the still-fresh-on-my-mind reading of Amusing Ourselves To Death]

Rather than actually writing you merely write about writing. You become a commentator rather than a practitioner.

I’m as guilty as anyone. And if you want to give me lashes, I’ll even provide the whip — see my old post The Literary Version Of A Chart Crime.

Despite the justifiable negative characterization, “content brain” is also a filter. Its most refined expression in financial writing is story-mining history to explain some evergreen concept in a memorable way. At the same time there's a dangling sense that you can see the string suspending the magician's levitation act. The more skillful the writer the less visible the string.

While I was in Vietnam I had to suppress many urges to intellectualize the experience for the purpose of talking about it here. And then several people told me they look forward to me writing about it.

Well, I'm going to disappoint them.

Why?

I actively didn't want to be in my head. I told myself I didn't want to “find the insights” in the experience. I just x’d out the FindInsight.exe window that auto-boots when I do something novel. Partly in the name of being present but mostly because I don't have the chops to give Vietnam and its people the words they deserve.

I read Viet Thanh Nguyen's The Sympathizer (Khe texted me to recommend it when he noticed I was in Saigon). You are better off reading 1 sentence from Nguyen than a blog article from me.

So to that end:

Deeper themes

Other topics of note

Impression of Americans (this is full of banger observations!)

For the theatrically inclined:

Here's the trailer for the 2024 release of a series of the show on HBO MAX. Robert Downey is one of the stars. I'll take the liberty of making one connection here — in The Sympathizer there's a theme of “representation” and the book's protagonist is cast in a dilemma of how to influence a film made about the Vietnam War, an unsubtle reference to Apocalypse Now, and its choice of actors for Vietnamese roles.

In the tongue-in-cheek film Tropic Thunder, Downey's character does the blackface thing in the name of method-acting but the movie is in on the self-skewering joke. In the series adaptation of The Sympathizer, Downey does the Eddie-Murphy-plays-lots-of-chacters-thing.

I willfully decided this is not an accident. I'm giving Downey massive props for commitment to a highly meta display of satire that breaks the container from a single film and lands an impressively drawn-out professional wink.

A Little Help

I could use some help for someone dear.

Do you know of any FP&A recruiters or jobs? I know a fantastic person looking. She has 20+ years experience.

(Bay Area based or remote preferred)

Money Angle

I managed to read 4 books during my trip — the Postman book, The Sympathizer, How To Lie With Statistics — and one finance book.

And it’s f’n awesome:

Financial Hacking by Philip Maymin.

I wish I wrote this book. The approach is deeply familiar and resonant — build intuition by tinkering. Since my formal math education pretty much stopped in 12th grade, I had to build intuition for derivatives instead of relying on formulas and proofs.

The book is a fun read. The tone is conversational — Maymin is talking directly to you. The book is casual. Loaded with quotes from pop culture (esp the Simpsons) on nearly every page.

The question-and-answer tempo is engaging and highly reminiscent of workflow on a trading desk. A recurring trope is “your boss just said X, how do you respond assuming you don’t have time to come up with a formal presentation”

While the references to Mathematica might feel dated, the logic is easily transported to Python or your tools of choice.

I would make this book mandatory reading for someone who has completed a basic finance rotation and has a few months of live trading under their belt. It’s also a great refresher for seasoned traders — especially if you are preparing for an interview.

You’ll get the most out of this book if you engage with the questions actively. In fact, I’d use this book as a source of interview questions for mid-career traders.

A practical argument for the “financial hacking” approach:

build intuition so that we can quickly gain deep understanding of even brand new products, faster than the competition. To that end, we don't look to find delicate new pricing formulas, but rather rigorous and useful ways of looking at the problem… If you think of the timeline involved in new products, those who implement well-established pricing formulas are several years late to the party. Those who completely derive what will eventually become well-established pricing formulas are probably about a year late. The purpose of this book is to make you ready to be the first one to trade, when the new product just comes out, and its mispricing is likely at a maximum, or at the very least at its most volatile. It is in times like those that a prepared, flexible financial hacker and trader can pick attractive spots.

Once you have read the book, you may agree with my contention that this is the single most important statement in the treatise:

These kinds of practical issues are ignored in standard textbook discussions of riskless profit opportunities but they are precisely the issues that financial hackers worry about most. And you will almost surely never experience anything with this level of certainty at any time in your career [referencing a trade where you are given the outcome]. There will always be doubts about your model, your inputs, and your forecast. According to standard theoretical concepts of arbitrage, none of those questions matters. According to real-world practical experience, you can't even begin to trade until you have answered all of them.

Money Angle For Masochists

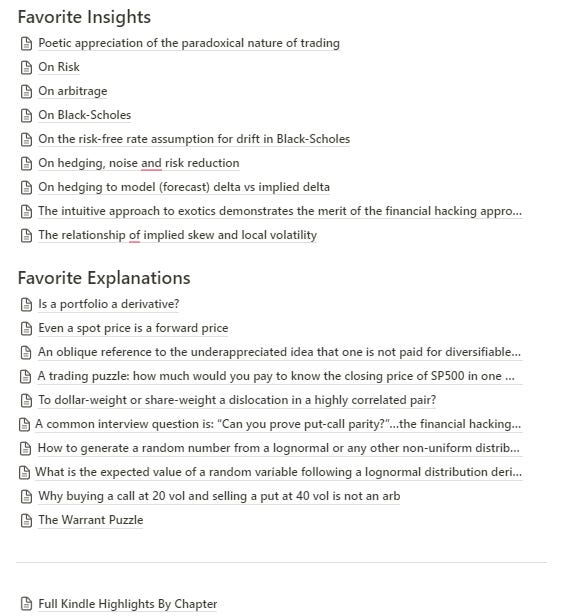

Ok nerds, I made it easy to drill down into the topics. Obviously, buy the book if this is useful.

It’s hard to pick one of these to explore here, but I’m going to go with the warrant one for 3 reasons:

If you are unfamiliar with warrants (I never traded them myself) you’ll acquire basic background knowledge.

The “devious” part of the puzzle is a great test of your arbitrage-goggles.

(Totally self-serving comment but I did get the right answer to this puzzle as well as most of the questions in the book — when you don’t spend your days in the mines anymore you worry about how rusty you are getting so the check-up is nice.)I weaponized the logic of the puzzle’s solution — it’s implicitly a proof that “selling calls is not income”!

I’ll get you started here.

The setup:

Warrants are just call options issued by the company itself (as opposed to a call option written in a listed market by an arbitrary counterparty).

Imagine 2 identical stocks. One with a call option outstanding and the other with a warrant outstanding. These respective derivative contracts have the same exact terms (expiration date, expiration style, etc) and the stocks themselves have the same attributes but are distinct entities. This is not a trick — you can accept the assumptions — the terms of the contracts and the behavior of the 2 different stocks is identical.

Question 1: What is worth more — the call option on Stock A or the warrant on Stock B?

Then the more “devious” version”

Question 2: What if a single company has both a warrant and call option (again identical terms) outstanding…which is worth more?

You can find the answers to the questions as well as my case for how this proves that “selling calls for income” is a nonsense statement. [In that explanation, you will also have more mental foundations shaken when you start to consider the ramifications of “implied delta”]

🔗 https://notion.moontowermeta.com/the-warrant-puzzle

I’ll mention one more thing that doesn’t have to do with the book. Again, this concept of “selling calls for income”. If you overwrite calls each month on a stock you own you are doing something very similar to just selling a portion of your position every month. If you own 100 shares of X, and you sell a .20 delta call, you theoretically liquidate 20% of your position. It may not feel like that because usually the calls expire worthless but look at 2 approaches:

Strategy #1: You sell 20% of your holdings a month instead of selling calls

Your position shrinks by 20% each month. In 10 months your position is .80¹⁰ or 10% of what you started with. Zeno’s paradox aside, in about a year you are out of your position.

Strategy #2: You overwrite .20 delta calls every month

Most months you keep the call premium, approximately 1 in 5 months, your entire position gets called away.

The relative performance of the 2 strategies is going to depend on the volatility and path of the stock!

[This is a significant insight to noodle on by the way]

It’s tempting to think “well if I get assigned on those .20d calls less than 1-in-5 times then I’m selling the calls for more than they are worth”.

Sorry. That’s not the full test.

Just think of the scenario where you sell 20% of the holding instead of selling the call option — then the stock drops to zero. You will never have been assigned on your call but that call-overwriting strategy will have much worse results than the “sell a portion of your holdings” strategy. And what did the performance disparity depend on? The volatility.

I know it’s hard to believe — but calls are puts and puts are calls and this demonstration didn’t rely on the put-call parity formula to make the point. Mayim gives an intuitive proof of p-c parity as well.

Generalizing

Stocks that pay dividends are the equivalent of strategy #1 (although on a much smaller scale since dividends are closer to 2% than 20%). If the stock didn’t pay a dividend you can create your own by just selling a portion of your holdings. The same logic holds for selling calls.

That there is a whole asset management sales-machine that revolves around call-selling and dividend-paying stocks obscures the reality that the economics are pretty similar (taxes are a central difference). That a company making $10 in earnings might retain/reinvest it instead of paying it is an overrated distinction.1

[After all, once a company pays a dividend, the stocks drops by the amount of the dividend since its assets fall by the cash amount. This is literally why you exercise in-the-money call options early — the stock is going to drop and you need to own the shares to receive the dividend that compensates the call holder for share decline.

Mayim even uses this point in a separate context — to show that even spot prices are forwards! This is a more important point for arbitrage traders than investors — a handful of readers might recall a nefarious strategy of picking off stock specialists by requesting a different settlement date than the standard T+3 ahead of a special dividend. This strategy ended up in court. I’ve always thought those extreme couponers who read fine print as a form of offense would enjoy high-finance shenanigans. I see such cleverness as Moloch embodied — when you actively hunt for the limit of where the spirit of a law gives way to the letter you take the free-rider problem and make it a feature for personal gain. Congratulations on your yacht, I guess.]

From My Actual Life

I initialized a social media escape pod: I’m moontower.bsky.social on Bluesky. I don’t have invite codes sorry. I’m not active there (yet).

Twitter might be frustrating but there’s plenty of community there. In fact, without me asking, just by conveying a story, I received over $500 in donations which Yinh and I matched for a neighborly cause.

The aftermath:

https://twitter.com/KrisAbdelmessih/status/1646898185254871040?s=20

(Twitter disabled embeds in Substack. “Take my ball and go home energy” is always a sign of strength. Right?]

Stay groovy ☮️

Substack Meetings

I was invited to be a part of the Substack Meetings beta. You can book a time to chat. I’m more expensive than a 900 number from 1988 and have a less sexy voice.

Book a meeting with Kris Abdelmessih

Moontower On The Web

📡All Moontower Meta Blog Posts

Specific Moontower Projects

🧀MoontowerMoney

👽MoontowerQuant

🌟Affirmations and North Stars

🧠Moontower Brain-Plug In

Curations

✒️Moontower’s Favorite Posts By Others

🔖Guides To Reading I Loved

📚Book Ideas for Kids

Fun

🎙️Moontower Music

🍸Moontower Cocktails

Becoming a patron

The Moontower letter is and will always be free. My writing is a search “for the others”. The “others” are people like you who are unlearning the mental frames that artificially narrow our choices.

If you are here you already understand that inspiration is a tradable good. It’s not as tangible as a cup of coffee, but it packs 10x the adrenaline with an infinitely longer half-life than caffeine.

If you feel inspired, you can upgrade to becoming a patron.

It might even pose an anomaly that can be traded against depending on how overrated it is —which depends on effective the marketers are at convincing large pools of money and the amount of risk capital that may find fading the anomaly worthwhile. I’m not saying there is an anomaly, I haven’t and normally don’t do the kind of work that would reveal that, but framings like this can be the type of place to hunt for an anomaly.