Friends,

Last week I took an uncharacteristic adventure into macro which turned out to be my most popular post ever. Not to be all “Thom Yorke hates Creep” since you can only be that sickeningly self-important if you are actually in Radiohead, but come on. I give you what I got every week and all you really want to know is what happens to inflation when the moon is in Taurus.

Seriously, 400 new subs signed up for Moontower after that post which is 10x my normal weekly adds. There are over 4000 subs now which is up 1k in 6 weeks after getting 3000 in 3 years. On one hand, thank you. On the other, be aware that my commercial instincts are trash. As such I will not feed the ducks and you will still find me meandering into macro often. Annoyingly, my most 2nd most popular post ever was also frickin’ macro: Markets Will Permanently Reset Higher (My Sacrifice to the Delta Gods)

Here’s the best 5 seconds of your day.

Moving on.

Over the past few years, I’ve shared a lot of writing about careers and career transitions. Sometimes you know where you want to go and it’s just a matter of putting one foot in front of the other. For others, they sense what they are doing is not the right fit.

This doubt is especially unsettling at the start of a career. It’s easier to pivot when you are younger and opportunity costs are low. Oftentimes it’s just a matter of fighting through the initial discomfort.

I wanted to quit my trading career my first day into it.

I was 22 years old, hapless in my attempts to understand the language of bids and offers ricocheting from the smelly mouths I was standing next to on the Amex trading floor. “Everyone has to start somewhere” is true but hardly consolation when you feel useless. Fetching traders’ lunch was the only time I felt useful. Useful but stupid. I’m in Cafe World on the corner of Trinity and Rector staring at a diagram of where on the plate my boss wanted his Singapore mei fun noodles while lamenting the wisdom of taking on college debt for this privilege.

Fortunately, the initial learning curve for trading isn’t too steep if you are immersed on an exchange floor. I didn’t have to waste much time figuring out if this was a mistake, because it only took a little persistence to get to a place where I could be useful. I became proficient in Excel in less than 2 months. I stopped “offering for” and “bidding at” in less time than that. I could see that my development was in line with my cohort. These clues were helpful because I’ve always felt some suspicion about grit.

I thought grit was overrated.

It wasn’t a buzzword back then, but I always had a feeling that Venkat Rao put into words when he said “hard equals wrong” in Calculus of Grit.

There’s a bit I want to highlight:

School’s failure to reveal most people’s strengths sets their lives on a needlessly masochistic journey.

Venkat explains:

Why? Think of it this way. The disciplinary world very coarsely measured your aptitudes and strengths once in your lifetime, pointed you in a roughly right direction and said “Go!” The external environment had been turned into a giant obstacle course designed around a coarse global mapping of everybody’s strengths.

So there was no distinction between the map of the external world you were navigating and the map of your internal strengths. The two had been arranged to synchronize. If you navigated through a map of external achievement, landmarks, and honors, you’d automatically be navigating safely through the landscape of your internal strengths.

But when you cannot trust that you’ve been pointed in the right direction in a landscape designed around your strengths, you cannot afford to navigate based on a one-time coarse mapping of your own strengths at age 18.

If you run into an obstacle, it is far more likely that it represents a weakness rather than a meaningful real-world challenge to be overcome, as a learning experience.

Don’t try to go over or through. It makes far more sense to go around. Hack and work around. Don’t persevere out of a foolhardy superhuman sense of valor.

It can be difficult to tell when you should persevere vs cut your losses. I offer some thought and links in On Grit. To be clear, I think grit is important. But if anything it’s probably more overrated than ever since an airport book was published on it.

In the years since I read that post, I came across an essay that I think is a perfect companion to the grit discussion. The subtext, at least in how I read it, is to orient your heading so it’s downhill. No matter how you read it, it’s a terrific essay. Since it’s commencement season, send it to a recent grad.

✍️How Will You Measure Your Life? (16 min read)

by Clayton M. Christensen

Here are excerpts I like to return to.

On how Clayton responds to advice-seekers…

When people ask what I think they should do, I rarely answer their question directly. Instead, I run the question aloud through one of my models. I’ll describe how the process in the model worked its way through an industry quite different from their own. And then, more often than not, they’ll say, “OK, I get it.” And they’ll answer their own question more insightfully than I could have.

On remembering why you do something at all…

Over the years I’ve watched the fates of my HBS classmates from 1979 unfold; I’ve seen more and more of them come to reunions unhappy, divorced, and alienated from their children. I can guarantee you that not a single one of them graduated with the deliberate strategy of getting divorced and raising children who would become estranged from them. And yet a shocking number of them implemented that strategy. The reason? They didn’t keep the purpose of their lives front and center as they decided how to spend their time, talents, and energy.

Had I instead spent that hour each day learning the latest techniques for mastering the problems of autocorrelation in regression analysis, I would have badly misspent my life. I apply the tools of econometrics a few times a year, but I apply my knowledge of the purpose of my life every day. It’s the single most useful thing I’ve ever learned. I promise my students that if they take the time to figure out their life purpose, they’ll look back on it as the most important thing they discovered at HBS. If they don’t figure it out, they will just sail off without a rudder and get buffeted in the very rough seas of life.

Not everything that matters is good at giving you prompt feedback. If you fail to appreciate this, you chase what’s easily legible at the cost of things that are hard to measure.

Allocation choices can make your life turn out to be very different from what you intended. Sometimes that’s good: Opportunities that you never planned for emerge. But if you misinvest your resources, the outcome can be bad. As I think about my former classmates who inadvertently invested for lives of hollow unhappiness, I can’t help believing that their troubles relate right back to a short-term perspective.

When people who have a high need for achievement—and that includes all Harvard Business School graduates—have an extra half hour of time or an extra ounce of energy, they’ll unconsciously allocate it to activities that yield the most tangible accomplishments. And our careers provide the most concrete evidence that we’re moving forward. You ship a product, finish a design, complete a presentation, close a sale, teach a class, publish a paper, get paid, get promoted. In contrast, investing time and energy in your relationship with your spouse and children typically doesn’t offer that same immediate sense of achievement.

Kids misbehave every day. It’s really not until 20 years down the road that you can put your hands on your hips and say, “I raised a good son or a good daughter.” You can neglect your relationship with your spouse, and on a day-to-day basis, it doesn’t seem as if things are deteriorating. People who are driven to excel have this unconscious propensity to underinvest in their families and overinvest in their careers—even though intimate and loving relationships with their families are the most powerful and enduring source of happiness.

If you want your kids to have strong self-esteem and confidence that they can solve hard problems, those qualities won’t magically materialize in high school. You have to design them into your family’s culture—and you have to think about this very early on. Like employees, children build self-esteem by doing things that are hard and learning what works.

Give me an example…

The lesson I learned from this is that it’s easier to hold to your principles 100% of the time than it is to hold to them 98% of the time. If you give in to “just this once,” based on a marginal cost analysis, as some of my former classmates have done, you’ll regret where you end up. You’ve got to define for yourself what you stand for and draw the line in a safe place.

Be careful how you strive…

Once you’ve finished at Harvard Business School or any other top academic institution, the vast majority of people you’ll interact with on a day-to-day basis may not be smarter than you. And if your attitude is that only smarter people have something to teach you, your learning opportunities will be very limited. But if you have a humble eagerness to learn something from everybody, your learning opportunities will be unlimited. [Me: This is a powerful prescription to make yourself more teachable]: Generally, you can be humble only if you feel really good about yourself—and you want to help those around you feel really good about themselves, too.

His final recommendation…

Don’t worry about the level of individual prominence you have achieved; worry about the individuals you have helped become better people. This is my final recommendation: Think about the metric by which your life will be judged, and make a resolution to live every day so that in the end, your life will be judged a success.

This echoes the wisdom of another late visionary, Michael Crichton:

“If you want to be happy, forget yourself. Forget all of it—how you look, how you feel, how your career is going. Just drop the whole subject of you. People dedicated to something other than themselves are the happiest people in the world.”

It’s a lot of brilliance in a couple of paragraphs:

✍️Happiness (3 min read)

by Michael Crichton

Money Angle

Greeks Are Everywhere

The option greeks everyone starts with are delta and gamma. Delta is the sensitivity of the option price with respect to changes in the underlying. Gamma is the change in that delta with respect to changes in the underlying.

If you have a call option that is 25% out-of-the-money (OTM) and the stock doubles in value, you would observe the option graduating from a low delta (when the option is 25% OTM a 1% change in the stock isn’t going to affect the option much) to having a delta near 100%. Then it moves dollar for dollar with the stock.

If the option’s delta changed from approximately 0 to 100% then gamma is self-evident. The option delta (not just the option price) changed as the stock rallied. Sometimes we can even compute a delta without the help of an option model by reasoning about it from the definition of “delta”. Consider this example from Lessons From The .50 Delta Option where we establish that delta is best thought of as a hedge ratio1 :

Stock is trading for $1. It’s a biotech and tomorrow there is a ruling:

90% of the time the stock goes to zero

10% of the time the stock goes to $10

First take note, the stock is correctly priced at $1 based on expected value (.90 x $0 + .10 x $10). So here are my questions.

What is the $5 call worth?

Back to expected value:

90% of the time the call expires worthless.10% of the time the call is worth $5

.9 x $0 + .10 x $5 = $.50

The call is worth $.50

Now, what is the delta of the $5 call?

$5 strike call =$.50

Delta = (change in option price) / (change in stock price)

In the down case, the call goes from $.50 to zero as the stock goes from $1 to zero.

Delta = $.50 / $1.00 = .50

In the up case, the call goes from $.50 to $5 while the stock goes from $1 to $10

Delta = $4.50 / $9.00 = .50

The call has a .50 delta

Using The Delta As a Hedge Ratio

Let’s suppose you sell the $5 call to a punter for $.50 and to hedge you buy 50 shares of stock. Each option contract corresponds to a 100 share deliverable.

Down scenario P/L:

Short Call P/L = $.50 x 100 = $50

Long Stock P/L = -$1.00 x 50 = -$50

Total P/L = $0

Up scenario P/L:

Short Call P/L = -$4.50 x 100 = -$450

Long Stock P/L = $9.00 x 50 = $450

Total P/L = $0

Eureka, it works! If you hedge your option position on a .50 delta your p/l in both cases is zero.

But if you recall, the probability of the $5 call finishing in the money was just 10%. It’s worth restating. In this binary example, the 400% OTM call has a 50% delta despite only having a 10% chance of finishing in the money.

The Concept of Delta Is Not Limited To Options

Futures

Futures have deltas too. If the SPX cash index increases by 1%, the SP500 futures go up 1%. They have a delta of 100%.

But let’s look closer.

The fair value of a future is given by:

Future = Seʳᵗ

where:

S = stock price

r = interest rate

t = time to expiry in years

This formula comes straight from arbitrage pricing theory. If the cash index is trading for $100 and 1-year interest rates are 5% then the future must trade for $105.13

100e^(5% * 1) = $105.13

What if it traded for $103?

Then you buy the future, short the cash index at $100

Earn $5.13 interest on the $100 you collect when you short the stocks in the index.

For simplicity imagine the index doesn’t move all year. It doesn’t matter if it did move since your market risk is hedged — you are short the index in the cash market and long the index via futures.

At expiration, your short stock position washes with the expiring future which will have decayed to par with the index or $100.

[Warning: don’t trade this at home. I’m handwaving details. Operationally, the pricing is more intricate but conceptually it works just like this.]

P/L computation:

You lost $3 on your futures position (bought for $103 and sold at $100).

You broke even on the cash index (shorted and bought for $100)

You earned $5.13 in interest

Net P/L: $2.13 of riskless profit!

You can walk through the example of selling an overpriced future and buying the cash index. The point is to recognize that the future must be priced as Seʳᵗ to ensure no arbitrage. That’s the definition of fair value.

You may have noticed that a future must have several greeks. Let’s list them:

Theta: the future decays as time passes. If it was a 1-day future it would only incorporate a single day’s interest in its fair value. In our example, the future was $103 and decayed to $100 over the course of the year as the index was unchanged. The daily theta is exactly worth 1 day’s interest.

Rho: The future’s fair value changes with interest rates. If the rate was 6% the future would be worth $106.18. So the future has $1.05 of sensitivity per 100 bps change in rates.

Delta: Yes the future even has a delta with respect to the underlying! Imagine the index doubled from $100 to $200. The new future fair value assuming 5% interest rates would be $210.25.

Invoking “rise over run” from middle school:

delta = change in future / change in index

delta = (210.25 - 105.13)/ (200 - 100)

delta = 105%

That holds for small moves too. If the index increases by 1%, the future increases by 1.05%Gamma: 0. There is no gamma. The delta doesn’t change as the stock moves.

Levered ETFs

Levered and inverse ETFs have both delta and gamma! My latest post dives into how we compute them.

✍️The Gamma Of Levered ETFs (8 min read)

This is an evergreen reference that includes:

the mechanics of levered ETFs

a simple and elegant expression for their gamma

an explanation of the asymmetry between long and short ETFs

insight into why shorting is especially difficult

the application of gamma to real-world trading strategies

a warning about levered ETFs

an appendix that shows how to use deltas to combine related instruments

And here’s some extra fun since I mentioned the challenge of short positions:

Bonds

Bonds have delta and gamma. They are called “duration” and “convexity”. The duration is the sensitivity to the bond price with respect to interest rates. Borrowing from my older post Where Does Convexity Come From?:

Consider the present value of a note with the following terms:

Face value: $1000

Coupon: 5%

Schedule: Semi-Annual

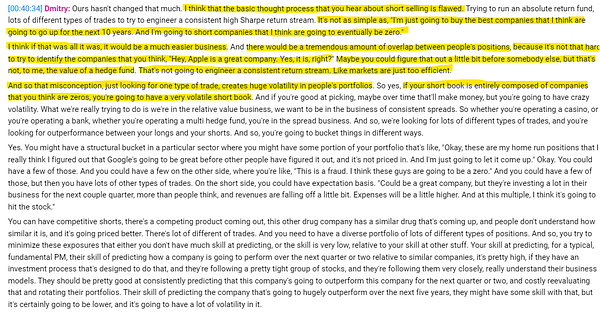

Maturity: 10 yearsSuppose you buy the bond when prevailing interest rates are 5%. If interest rates go to 0, you will make a 68% return. If interest rates blow out to 10% you will only lose 32%.

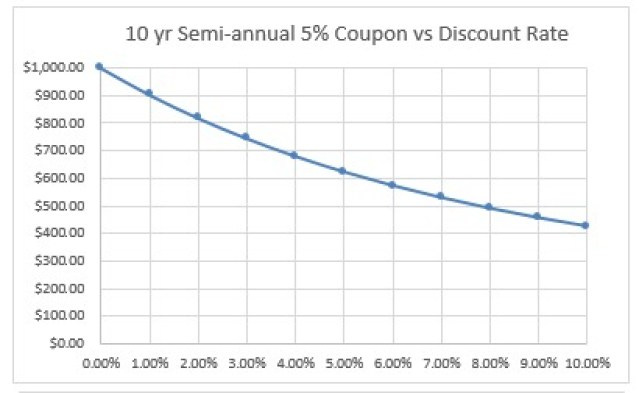

It turns out then as interest rates fall, you actually make money at an increasing rate. As rates rise, you lose money at a decreasing rate. So again, your delta with respect to interest rate changes. In bond world, the equivalent of delta is duration. It’s the answer to the question “how much does my bond change in value for a 1% change in rates?”

So where does the curvature in bond payoff come from? The fact that the bond duration changes as interest rates change. This is reminiscent of how the option call delta changed as the stock price rallied.

The red line shows the bond duration when yields are 10%. But as interest rates fall we can see the bond duration increases, making the bonds even more sensitive to rates decline. The payoff curvature is a product of your position becoming increasingly sensitive to rates. Again, contrast with stocks where your position sensitivity to the price stays constant.

Corporations

Companies have all kinds of greeks. A company at the seed stage is pure optionality. Its value is pure extrinsic premium to its assets (or book value). In fact, you can think of any corporation as the premium of the zero strike call.

[See a fuller discussion of the Merton model on Lily’s Substack which is a must-follow. We talk about similar stuff but she’s a genius and I’m just old.]

Oil drillers are an easy example. If a driller can pull oil out of the ground at a cost of $50 a barrel but oil is trading for $25 it has the option to not drill. The company has theta in the form of cash burn but it still has value because oil could shoot higher than $50 one day. The oil company’s profits will be highly levered to the oil price. With oil bouncing around $20-$30 the stock has a small delta, if oil is $75, the stock will have a high delta. This implies the presence of gamma since the delta is changing.

Games

One of the reasons I like boardgames is they are filled with greeks. There are underlying economic or mathematical sensitivities that are obscured by a theme. Chess has a thin veneer of a war theme stretched over its abstraction. Other games like Settlers of Catan or Bohnanza (a trading game hiding under a bean farming theme) have more pronounced stories but as with any game, when you sit down you are trying to reduce the game to its hidden abstractions and mechanics.

The objective is to use the least resources (whether those are turns/actions, physical resources, money, etc) to maximize the value of your decisions. Mapping those values to a strategy to satisfy the win conditions is similar to investing or building a successful business as an entrepreneur. You allocate constrained resources to generate the highest return, best-risk adjusted return, smallest loss…whatever your objective is.

Games have mine a variety of mechanics (awesome list here) just as there are many types of business models. Both game mechanics and business models ebb and flow in popularity. With games, it’s often just chasing the fashion of a recent hit that has captivated the nerds. With businesses, the popularity of models will oscillate (or be born) in the context of new technology or legal environments.

In both business and games, you are constructing mental accounting frameworks to understand how a dollar or point flows through the system. On the surface, Monopoly is about real estate, but un-skinned it’s a dice game with expected values that derive from probabilities of landing on certain spaces times the payoffs associated with the spaces. The highest value properties in this accounting system are the orange properties (ie Tennessee Ave) and red properties (ie Kentucky). Why? Because the jail space is a sink in an “attractor landscape” while the rents are high enough to kneecap opponents. Throw in cards like “advance to nearest utility”, “advance to St. Charles Place”, and “Illinois Ave” and the chance to land on those spaces over the course of a game more than offsets the Boardwalk haymaker even with the Boardwalk card in the deck.

In deck-building games like Dominion, you are reducing the problem to “create a high-velocity deck of synergistic combos”. Until you recognize this, the opponent who burns their single coin cards looks like a kamikaze pilot. But as the game progresses, the compounding effects of the short, efficient deck creates runaway value. You will give up before the game is over, eager to start again with X-ray vision to see through the theme and into the underlying greeks.

[If the link between games and business raises an antenna, you have to listen to Reid Hoffman explain it to Tyler Cowen!]

Wrapping Up

Option greeks are just an instance of a wider concept — sensitivity to one variable as we hold the rest constant. Being tuned to estimating greeks in business and life is a useful lens for comprehending “how does this work?”. Armed with that knowledge, you can create dashboards that measure the KPIs in whatever you care about, reason about multi-order effects, and serve the ultimate purpose — make better decisions.

Last Call

✍️Notes From C.Thi Nguyen Interview About Games and Society (14 min read)

This is a re-post from one of my favorite all-time interviews.

C. Thi Nguyen received his Ph.D. in philosophy from the University of California, Los Angeles. He is currently associate professor of Philosophy at the University of Utah. He has written public philosophy for venues such as Aeon and The New York Times, and is an editor of the aesthetics blog Aesthetics for Birds. He was the recipient of the 2020 Article Prize from the American Philosophical Association. His recent book is Games: Agency as Art.

But here’s the most fun part:

Nguyen’s Board Games: so many recommendations

I’ve played several of these. The list and descriptions are glorious.

Stay groovy!

Moontower On The Web

📡All Moontower Meta Blog Posts

👽Moontower Volatility Wiki

🧀Moontower Money Wiki

✒️Moontower’s Favorite Posts By Others

🔖Guides To Books I Loved

🎙️Moontower Music

🍸Moontower Cocktails

as opposed to a probability which is only 1 of 2 inputs into the concept of mathematical expectation

Excellent write-up. I really enjoyed both the career advice and the greeks are everywhere. Hadn't really thought about it, but the idea of immediate payoff being an incentive can really warp what is important. Not sure about the need to be 100% on target (not sure that is even possible), but thinking that way is important as it does keep us close as opposed to "well this won't matter."

Some thing's amiss here.. Applying your example to the ATM call. "correction ...I just realized why the ATM call does not have a fifty delta", however I still calculated two distinctly different delta's for the up and down cases 1.01 and .9 respectively. of course Delta's max limit is one but my concern is why the non equalities.