Friends,

More educational stuff today, much of which you can share with your kids or just explore for yourself.

Last Monday night, I taught a group of kids (and parents) from the neighborhood and social club a trading game as well as exercises to demonstrate how confirmation bias is always lurking even when a topic isn’t emotional. I also gave them some quizzes which never fail to demonstrate how overconfident we are.

Here’s the presentation flow:

1️⃣Open with Confidence Interval Tests

My notes on what to talk about (I didn’t cover all of it because you take the temperature of the room to see what’ll be boring)

Everyone thinks they are a better driver than the average driver. We are structurally overconfident. I say structurally because it’s a conspiracy of how our minds are wired. We don’t look at evidence then form beliefs. We form beliefs easily and then filter our observations through these beliefs — facts that reinforce our beliefs are preserved and evidence against our priors are ignored or discounted.

[Beliefs are like the first sperm to get to the egg — it forms a shield shutting off new assailants. Regardless of the merit of the first idea you heard, dethroning it is difficult which is why a lot of learning as an adult feels like unlearning. You come to realize that many of the things you believe are legacies of childhood, from parents who often times were just muddling thru themselves as many of do today]

2️⃣That leads to a discussion of…confirmation bias

Anyway, you’ve probably heard of this phenomenon— it’s called confirmation bias. You’ve probably heard of many so-called cognitive biases, thanks to the late Nobel laureate Danny Kahneman.

There’s a whole zoo of these biases but many of them can really be collapsed into confirmation bias. Notwithstanding Wu Tang’s objections, CREAM is “confirmation bias rules everything around me.”

Just think of survivorship bias — we look at some super successful person and suddenly everyone wants to know their morning routine or what they read. That 1000 other people who did what they did and didn’t get that outcome is easily ignored. We want to know the pattern, right? We are trying to confirm a belief that cause and effect are related by a string. The impulse is forgivable because that’s how the world works in common, tangible contexts — if I spill this drink, I will feel wet.

But complex contexts, like achieving outlier results, are governed by chaotic processes or what is more academically referred to as “complexity”. Jurassic Park is a great lesson in complexity science — it’s not an accident that Michael Crichton was a collaborator with the Santa Fe Institute (Cormac McCarthy was another), a research org devoted to the science of complexity and making sense of chaos. Great success, a complex outcome, is the result of long chains of serendipity, largely out of our control, resting on a foundation of sufficient conditions of which we have some control.

🧩Give this Confirmation Bias Riddle🧩

3️⃣In making decisions, it’s not necessarily about being right or wrong — it’s about calibration

[In investing, it’s not about predicting the future which nobody can do it’s about getting odds that have positive expectancy compared to your confidence — but you need to be effective at understanding your confidence. Which takes practice! I did not discuss this with the kids and in fact there’s a whole part 2 of this presentation that would make sense for an older group.]

But it’s important to learn about what calibration is because the next level of understandinf confirmation bias is to know that it is insidious because it often comes dressed as rigor.

I’ll give you an example.

CIA’s Psychology of Intelligent Analysis cites an unpublished 1973 study by researcher Paul Slovic demonstrating how horse handicappers confidence grew faster than their accuracy as they get more information. [Tell the story]

4️⃣Practice with quizzes and games

Give them the link to try to test their calibration at home:

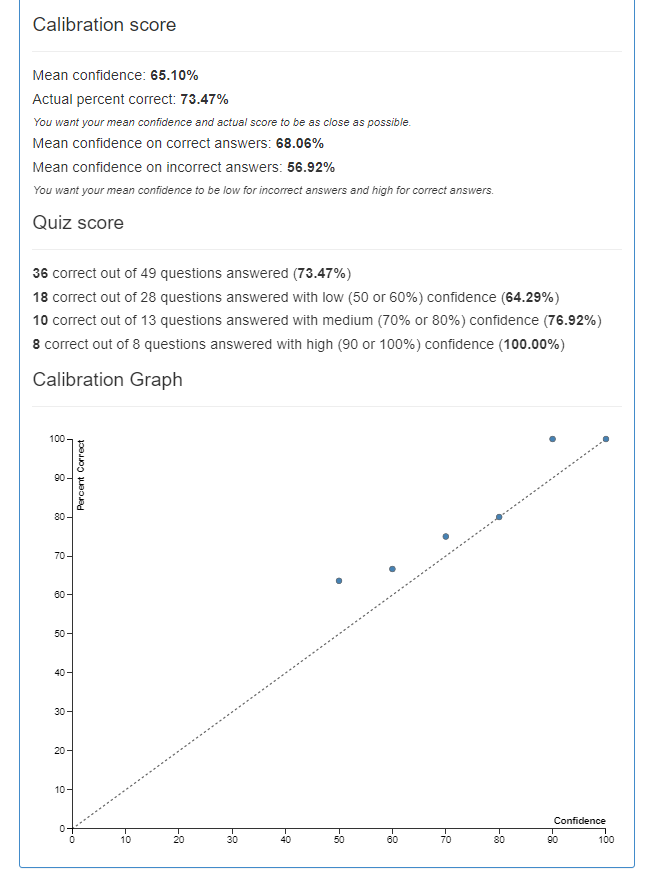

http://confidence.success-equation.com/

I shared my results. If anything they show caution — which tracks…my biggest risk as a trader was not that I was gonna blow up, but I wouldn’t maximize because I was always paranoid about what I didn’t know. That’s no excuse of course, it’s just diagnosis.

Evergreen:

Targeting adults…

Why do I bring this up?

This is a hazard in a world that tempts you to lever yourself on confidence as asset returns from stocks to housing to gold to crypto all sit near all-time highs at the same time trading & gambling, including the recent developments in prediction markets (Robinhood/Kalshi CFTC going around states rights to regulate gambling) is shoved down our throats.

One of the most helpful things I can do is offer some perspective on the nature of markets. My goal, as you’ll see, will actually be to have you viscerally feel their nature through a game we will play.

⭐Bonus Section inspired by the confirmation bias riddle…

I’ve long thought that a good barometer of intelligence was asking good questions. I think this will be more obvious in the age of AI where people who are skilled at prompting, ie asking questions to LLMs, will get a lot more mileage out of the technology as opposed to using it as a glorified dictionary.

So I posed the famous fork in the road riddle:

You reach a fork in the road. A sign explains that in one direction is Heaven and the other is Hell. Each path is blocked by a Guard. The sign goes on to say that one of the guards will always lie and the other will always tell the truth, it does not say which guard is which. We assume that the guards do know which path leads to where.

You may ask one question of only one guard in order that you can determine, with certainty, the way to Heaven. What is that question?

You can see the solution here. I always think of it as an electric circuit question because it’s positive (truth-teller) x negative (liar) or vice versa which always means the response is a “Not”.

An IRL friend who happens to be one of the best long/short pod shop folks in the world (no exaggeration — one of the people that gets offered those 9-figure guarantees you hear about) once described his craft as asking the right questions. Getting someone to tell you something you care about with a question that seems to have nothing to do with what it seems you asked about. Layered on top of the whole quant alpha-isolation architecture that these firms sit on, it’s always stuck with me as sounding so interesting. But it also makes me think of this riddle.

I’m gonna re-do the event for another group in town on the recommendation of one of the attendees. If that group skews more towards adults, I’ll bridge it into a discussion of markets and what it means for investing, which is what the unused notes were about. Like a comedian testing nerd shit instead of jokes I guess. Whatever lands can find its way back here. You notice a lot of blindspots in your understanding when you try to explain something to laypeople, making the the effort conveniently self-rewarding.

Money Angle

Matt Zeigler hosted myself and Mat Cashman to explain gamma. This is the 3rd episode I’ve done in this ELI5 series and I think it’s forced some of the better educational stuff I’ve done because I can’t assume too much knowledge.

🖼️These are the slides I used to bridge middle-school math to gamma.

Money Angle For Masochists

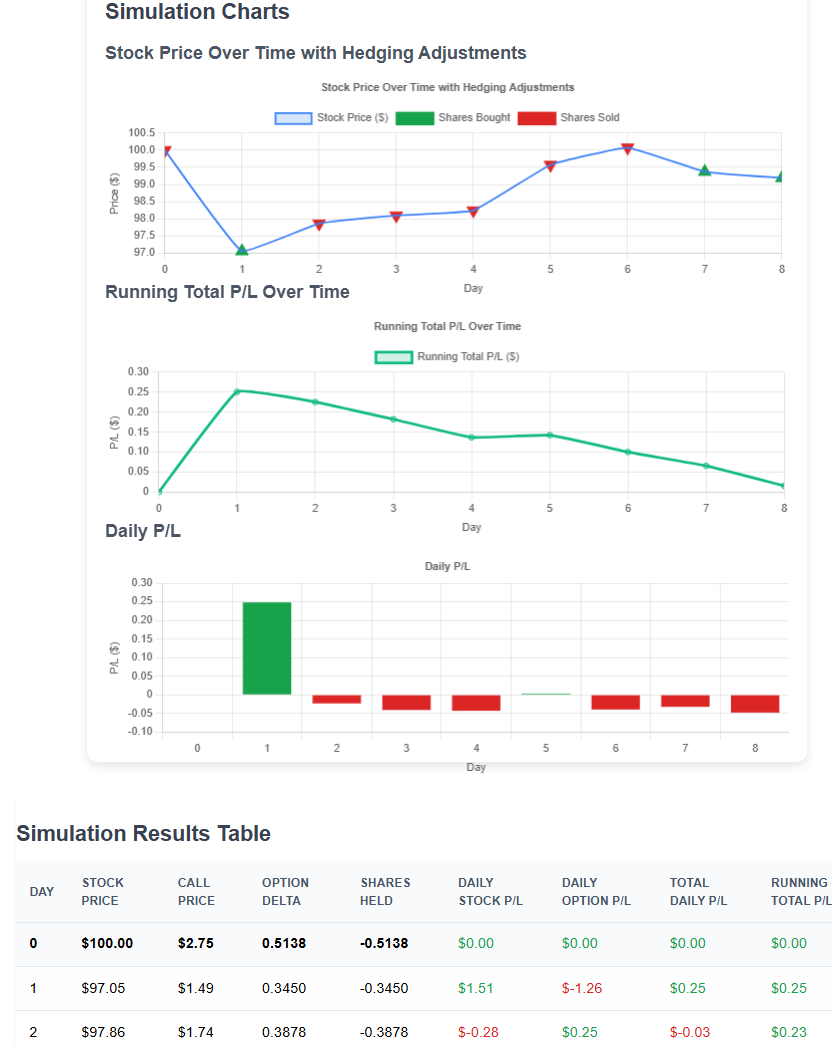

One of the most common questions I get is about how “gamma scalping” actually works.

A few weeks ago I vibe-coded a simulation that I demo’d in the interview.

You can try it yourself. There’s probably no easier way to learn the concept than let this stock tick and then look at the chart/table to witness “scalping”.

From My Actual Life

Had a moment of serendipity after publishing Wednesday’s how I explained vol drag to a 12-year-old.

That same day, I was devising a composite score for some metrics and I needed 2 input measures to both be high as opposed to just the average being high. For example, [80, 80] is better than [60, 100]. Scaling the geometric mean instead of the arithmetic mean worked beautifully because it penalized dispersion (variance) between the 2 numbers.*

That experience also triggered another thought:

On the occasion when I notice stuff like that, I wonder how nice it must be to actually retain for use the stuff you learn formally. This trend of "why know anything, I can look anything up" that pervades modern opinions about education is gonna be a mistake.

There's a satisfying and salutory grout in our thinking patterns that comes from making connections that solidify understanding. It's out of fashion to acknowledge this (can't put my finger on exactly why I feel this way). It's like we have no appreciation for the invisible.

I haven't been prioritizing formal learning; I will again at some point, but little moments like this are my biggest sources of fomo (but obviously a choice).

*A little clue about what I mean regarding the measure which I've been working on…I said this in the Discord: The key to the summation is acknowledging that you really care about IV score & term structure being simultaneously “high”...so the product of the 2 should be penalized by dispersion between the 2 numbers.

Stay groovy

☮️

Moontower Weekly Recap

Posts:

Need help analyzing a business, investment or career decision?

Book a call with me.

It's $500 for 60 minutes. Let's work through your problem together. If you're not satisfied, you get a refund.

Let me know what you want to discuss and I’ll give you a straight answer on whether I can be helpful before we chat.

I started doing these in early 2022 by accident via inbound inquiries from readers. So I hung out a shingle through the Substack Meetings beta. You can see how I’ve helped others:

Moontower On The Web

📡All Moontower Meta Blog Posts

👤About Me

Specific Moontower Projects

🧀MoontowerMoney

👽MoontowerQuant

🌟Affirmations and North Stars

🧠Moontower Brain-Plug In

Curations

✒️Moontower’s Favorite Posts By Others

🔖Guides To Reading I Enjoyed

🛋️Investment Blogs I Read

📚Book Ideas for Kids

Fun

🎙️Moontower Music

🍸Moontower Cocktails

🎲Moontower Boardgaming

The delta hedge simulation is awesome!

Nice vibe coding skills!