Involution

Moontower #242

Friends,

We’ll start with a few things I enjoyed:

🎙️Nate Silver on the Bet The Process Podcast (Spotify)

Bet The Process is hosted by Jeff Ma and Rufus Peabody are famous pro gamblers. The main character of Bringing Down the House, the story of the MIT blackjack team, is based on Jeff. (You can hear them on an MIT Sports Analytics panel with Jeff Yass)

Nate’s doing interviews with a new book out, On The Edge: The Art of Risking Everything. It’s a good conversation with tons of info in the grout. They’re all seasoned so even the knowledge being assumed from sentence to sentence is super interesting.

The interview is pretty short. Jeff and Rufus talk about the interview afterward in a breakdown segment. Really good stuff.

🔗On the Folly of Rewarding A, While Hoping for B (7 pages)

Prof. Steven Kerr

A great paper on the power of incentives. Makes you think.

Executive summary:

This article, updated for AME, needs no introduction. Even today, the original article is still widely reprinted. Now part of the lexicon, it truly qualifies as an Academy of Management Classic. For almost twenty years, its title has reminded executives and scholars alike—“it’s the reward system, stupid!”

The last few issues I’ve talked about mathacademy.com (no less than 7 readers are now doing it for themselves and/or for their kids!).

My mother was visiting this week and was doing the diagnostic over my shoulder while I was working on it. It really bugged her to realize how out of practice she was in elementary math so we went through some refreshers.

We reviewed a bunch of exponents stuff, for example, why 1/2 of 2²⁰ is 2¹⁹.

This is apparent when you think about it. But one of the things I noticed about how she and I do math is how methodical she is with trying to find the formula and how that’s not my first instinct at all. My first reach is always “what’s a simpler analogy and then extrapolate”. If that doesn’t work then get the pencil. I mean a lot of my motivation for retaking math ed is because my only mode is ‘trader math’. Formulaically, I reminded her that multiplying by 1/2 is the same as 2⁻¹ which is how she relates to the problem — she knows the rule for multiplying exponents with the same base is to add the exponents.

[My mom reads moontower believe it or not so it’s nice to share this in print even if a bit corny— we’ve always bonded over math. She went back to school in her 50s to get a college degree. She even took Java and C++. She is a determined learner at heart even if formal education took a backseat to more urgent pragmatism. She cut her college days short to work and get married back in the 70s. I was born the week she turned 24. Meanwhile, my eldest was born hours after my 35th birthday. Just acknowledging the change in norms in a single generation makes me feel like a flea in the sweep of time — no need to invoke cosmic proportion or even geographic birth lottery to think of how lucky I am to feel even remotely resourced while my kids are still kids.]

If you want a similar math problem to practice I shared Barclays quant question back in July:

Lily pad

You start with a single lily pad sitting on an otherwise empty pond. You are told that the surface area of the lily pad doubles every day and that it will take 30 days for the single lily pad to cover the surface of the pond.

If instead of one lily pad you start with eight lily pads (each identical in characteristics to the original single lily pad), how many days will it take for the surface of the pond to become covered?

A thought on the Lily Pad question and more:

[My son Zak solved it just like I did — by realizing the answer is the same as if you started after Day 3. My mother preferred the 2³⁰ / 8 = 2³⁰ / 2³= 2²⁷. The different ways we reason through a problem show up yet again.

I suspect my son is railroaded into my method because it wasn’t natural for him to see that representing 8 as 2³ was desirable for the purpose of doing exponent division (which follows a mechanical rule of subtracting exponents).

But getting to the formulaic version is what my mom searches for first.

Even when I was on the trading floor where you had to do mental math quickly to make markets, I enjoyed asking the people standing next to me how they priced the structure. There was a lot of variation. It’s a fun thing to ask others and, as I discovered, people usually like explaining how they mental math so it’s an all-around feel-good exercise.

One of the things I like about common core math is the emphasis on seeing numbers in different ways. My 8-year-old reflexively turns numbers into “friendly numbers” ie ending in 0s before doing operations, then undoing the adjustments before finalizing his answer. They are taught to do this. People my age usually landed on this method organically. But it’s good to teach it.

That said, Nate Bargatze owns the best common core bit:

Money Angle

Here’s a question I made for my mother to drill the exponent stuff that doubles as an investment problem.

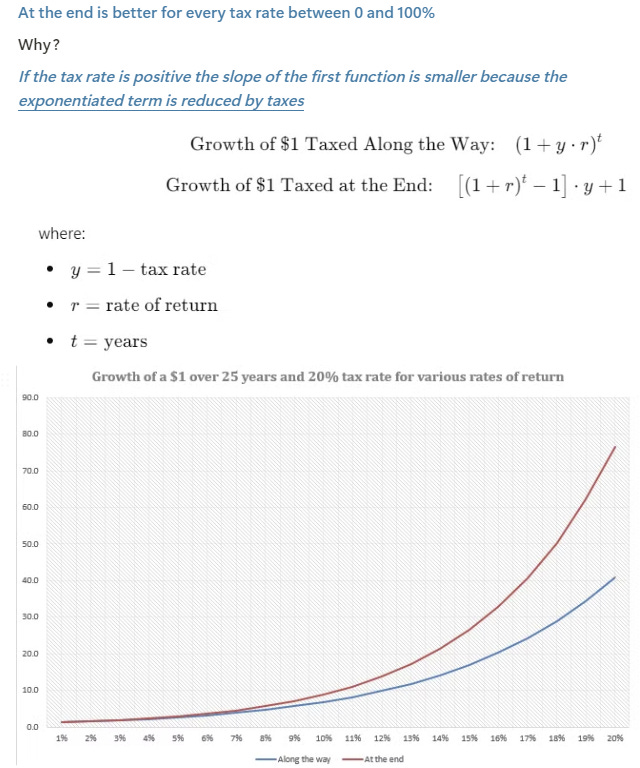

For a fixed tax rate and rate of return is it better to have your return taxed every year or wait to be taxed on the gains all at once at the end?

Knowing the answer to the question is useful in itself but I also want to mention a collateral benefit. The meta-process for approaching the question can help organize your numerical intuition.

Think of what is required to answer:

1) recognition

What kind of problem is this?

Well, it’s a compounding problem.

What does that tell us about the function?

It’s exponential. It takes the form y = abˣ

2) ask yourself where the variable in question (in this case the tax rate) makes the largest impact

Is it as part of the a or the b?

Since the b gets exponentiated (the historical term for this is “involution” or “involuted”) the tax term will have its largest impact there.

Money Angle For Masochists

In Thursday’s paid post JEPI and the…Atlanta Falcons? I promised to follow up on a few other derivative income ETFs. In that post you get a dose of evergreen education on methodology. Today I’ll just present the charts with quick observations.

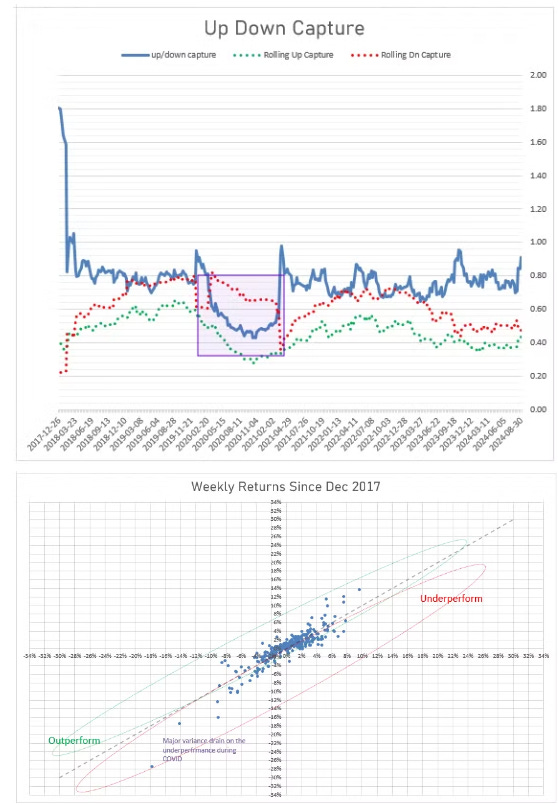

XYLD

This is the Global X SP500 covered call ETF. While JEPI manages $35B and has been around close to 5 years, XYLD was born in 2013 and manages $2.8B. It’s one of the largest derivative ETFs which shows just how big JEPI is!

Like JEPI, it’s perfomance degraded by mid July 2022. The second chart shows XYLD weekly returns on the y-axis vs SPY returns.

In this chart I note 2 things:

A general observation: the rolling 1 year SPY sharpe has gotten over 2.0 4x in the past 6 years It spent all of 2021 up there and it touched 3.5 in late 2017!

XYLD sharpe has been underperforming recently and massively underperformed during COVID. I do wonder to what extent it’s outperformance captured in the lookback thru early 2022 might have been due to call skew being strongly bid (overbid?) in 2021 — the year of mania, SPACs, NFTs, etc.

JEPQ

JEPQ is JP Morgan’s ETF that overwrites Nasdaq calls. It currently manages over $16B. It has a shorter history than JEPI and it’s performed quite well. But I would pause before inferring this to being Nasdaq specific before reading below.

QYLD

This is the Global X version of a Nasdaq call-overwrite ETF. It manages $8B.

Growth of $1 is not great relative to QQQ, but QYLD is also lower vol. So we look at the rolling sharpe. This has a longer history than JEPQ.

The sharp is often in line with QQQ but again has this skewed left tail to it where it can fall apart relatively. Zooming in on that Covid period, you see an extreme dip in the up/down capture driven by the up capture getting shelled plus the down capture spiking on that first Covid sell-off.

The behavior of the second chart is a bit strange. There is steeper underperformance than I’d expect on the downside (after all, the delta should roughly go to 1 and simply mimic the index) and the put performance is a stronger on some of the larger up moves than I’d expect…heck, I’d expect underperformance.

I have a subtle hypothesis for why we observe this. Perhaps the call skew and vols are sticker on the downside — the market drops but the call vols blow out so much that their realized delta is small. So it feels like you are riding stocks down with little offset from the calls depreciating.

On the up moves the calls which might have been too high to begin with massively underperform causing the ETF to do quite well. In other words, Nasdaq call deltas are much lower than you think!

This is just a guess and it’s a muddy one at that since we don’t see the same behavior in JEPQ and overall JEPQ has performed much better than QYLD and quite well on absolutely.

Could just come down to a skill issue? Hard to know without getting more into the details of the strategies for a finer attribution.

Just reminding you of this promotion (first mentioned last Sunday) ends by Sep 30th:

Get 12 months of PiQ premium access to the Hi-IQ tier with the code 'MOONTOWER'.

Just apply it at checkout:

From My Actual Life

I gotta run — I only have hours to secure my spot in mathacademy’s Iron League. I can’t not be gamified.

Stay Groovy

☮️

Moontower Weekly Recap

Need help analyzing a business, investment or career decision?

Book a call with me.

It's $500 for 60 minutes. Let's work through your problem together. If you're not satisfied, you get a refund.

Let me know what you want to discuss and I’ll give you a straight answer on whether I can be helpful before we chat.

I started doing these in early 2022 by accident via inbound inquiries from readers. So I hung out a shingle through the Substack Meetings beta. You can see how I’ve helped others:

Moontower On The Web

📡All Moontower Meta Blog Posts

👤About Me

Specific Moontower Projects

🧀MoontowerMoney

👽MoontowerQuant

🌟Affirmations and North Stars

🧠Moontower Brain-Plug In

Curations

✒️Moontower’s Favorite Posts By Others

🔖Guides To Reading I Enjoyed

🛋️Investment Blogs I Read

📚Book Ideas for Kids

Fun

🎙️Moontower Music

🍸Moontower Cocktails

🎲Moontower Boardgaming

Hah, the title grabbed me, but not for the reason I expected! "Involution" (内卷) has quite a different meaning in China.