JEPI and the...Atlanta Falcons?

Friends,

This is a follow-up to Derivative “Income” Bumhunting where I shared skeptical takes on derivative income ETFs from:

quants (Roni Israelov, David Nze Ndong, the Alpha Architect)

a former options market-maker who runs an RIA that uses options (Mark Phillips)

a relative value vol manager (QVR)

a tax specialist (Brent Sullivan)

I also gave the moontower take which was more of an eye test that rhymed with Mark’s take — an alpha approach to vol is simply not going to be rules-based. Option alpha is built on quicksand because the direction, size, and persistence of opportunity depends on the opponent (the market’s bias). When fear is dominant, you get paid for selling volatility but when the adversary is complacency the job to be done is to pay theta and warehouse options. You get paid for taking what the market gives you.

An ETF with an options mandate is a point guard than can only go right. So the onus is on the investor to know when to put that point guard in the game. It’s not a set-it-and-forget-it choice — you have to be the coach.

No asset gatherer is going to tell you that. This isn’t index investing where you get paid for time and tolerating swings.

Let me revise that.

Part of it is — you are effectively selling in-the-money puts so you are getting some exposure to equity risk premium and then some exposure to a risk premium that is sometimes consciously taking away your right hand dribble. Algebraically you are paying that point guard a lot in fees and tax treatment considering the pure equity risk premia piece can be had for zero.

You can make a valid argument that options can be used to change the shape of your payoff instead of alpha. But this works because options are surgical tools priced for specificity. The logic of passive call-selling is anything but that. Even if I granted such logic, you still need to show why you aren’t just better off buying less shares to match the delta (the ETF’s are less volatile because selling calls means they aren’t 100 delta like SPY) of the ETFs you’re considering hence saving on explicit and hidden costs for a payoff shape that does significantly better in every case except where the market sits relatively still.

[Personal bias warning — the utility preference to outperform when nothing is happening is bizarre. I want to outperform on the downside because I get the double whammy of my wealth holding up better PLUS all the things I want to buy getting cheaper. If you think of your future purchases as a liabilities, ie maybe you want to buy a condo in Miami, your assets are not only holding up but your liabilities are shrinking on the downside. Likewise — there some component of the upside distribution that is an inflationary, blow-off top. This is a disaster to underperform in — or more directly, the stupidest call option you ever sold. I’m being dramatic to mention this in the admittedly narrow context of covered call ETFs but I’m just sharing why I think shifting payoffs from large moves to small moves has never really appealed to me. And just to get ahead of the “the real distribution has more small moves than the Gaussian assumption” — yea I know. So do the vol markets which use surfaces to “correct” the bell-curve. If you want to parse the price beyond that you are now in the club of “one’s life’s work”. That speakeasy’s password changes monthly and won’t be found in the VRP article you read one time in 2011.]

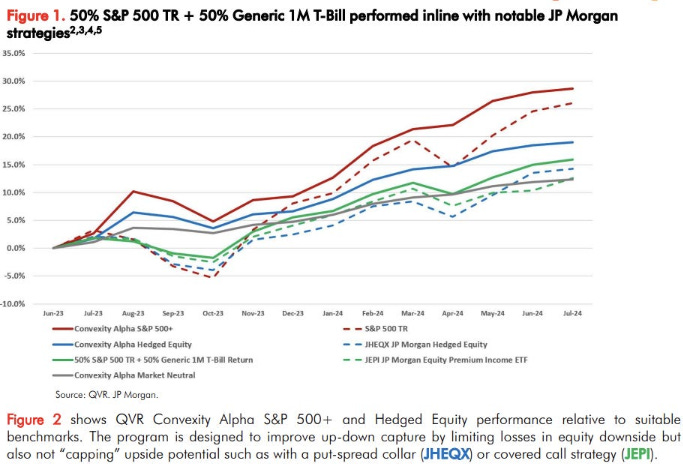

So far, this is all high-level take based on why alpha can exist, how options work, and their adversarial zero-sum nature. Let’s look closer shall we. I grabbed returns for the largest derivative income ETFs to do my own up/down capture analysis. Up/down capture is the metric QVR used — it’s a solid choice. I’m familiar with it from my days at Parallax. You’ll see why it lends itself well to hedged funds.

Learn:

how I did the analysis (including normalizations)

why I think the up/down capture formula you find all over the internet deserves adjusting

how to interpret the results

Draw inferences about:

the actual performance

what performance depends on

I’ll focus on JEPI because the findings are interesting and as you’ll see — there’s more to the story than QVR’s picture:

Onwards…