i can't wait to replace myself

Moontower #285

Friends,

My friend Khe has been working with hedge funds and Wall Street firms to help their teams get more out of LLMs (his weekly letter How To Future-Proof Your Career with AI is consistently practical. On a personal note I feel like Khe’s cadence is about 1-month ahead of my own LLM-discovery arc. I’m just getting started with Claude Code this week).

Khe’s is running an AI Accelerator program in October.

I feel compelled to volunteer that while I will host ads in Moontower this is not an ad. I asked Khe if I could tell my readers about this because I hear the same thing he hears from many people in finance and heck, even in my extended family: "Everyone talks about AI, but I still don't know how to use it effectively in my day-to-day work. I feel like I'm missing out on something that could make me 10x more productive."

Let’s talk about this a bit broadly.

I don’t consider myself a power user of LLMs compared to say devs or Khe who are building agents over their entire file systems (I’m not there YET, but Emi is giving me a tutorial soon!) but you can probably notice how much use I’m getting out of them in the work I have been sharing here.

I’m not comfortable saying it because it sounds like bragging, but I’ve had more people ask me how I’m able to produce “so much” especially this year and part of it is just the natural leverage embedded in these tools. I’m using them as tutors, research aids, sparring partners, summarizers, and the “connective tissue” of writing ideas not too mention all the vibe-code projects.

A few other examples:

My 12-year-old and I are collaborating with Claude to prototype a physical game I want to publish.

This week my 9-year-old is using ChatGPT in a loop to give it pictures that he draws, asks for feedback on how to improve the shading and lighting by words and example and then he goes back and tries to mimic it.

I have a Claude project where the LLM knows all my guitar gear and I can ask it how I can replicate the sound of particular songs. It provides the signal chain and suggestions for what effects I should get to make my set-up more versatile.

ChatGPT is helping not just with decorating but home maintenance crap. Well, while it did help me change the cartridge that blends the hot/cold in my sink faucet, it wasn’t until a simple Google search revealed that my problem was that my Delta 20 faucet batteries were dead. New house, new times. I never considered that a faucet takes AA batteries. I figured the LED & touch functions were powered by a plug.

While on the topic of AI, I’ll eagerly admit that it feels like every time I use it I’m training my replacement. I’m also rewarding companies that are so flush with funding that they can brazenly play the “ask for forgiveness, not for permission” game and account for IP lawsuits as COGS.

But I’m what Huxley warned of. The citizen who invites his colonization by embracing the products. I want certain things to exist. These tools lower the cost of making them. I suppose my revealed discount factor to the specter of being replaced is extremely high.

Something that might sound a bit weirder, which I’ve admit in a few private convos: I look forward to “replacing myself”. I make the stuff I do because I want it to exist but doesn’t to my satisfaction. If it did, I’d do something else.

I was just talking to a friend who has no background in robotics but is working with an engineering team at the intersection of AI + robotics on the business side. I felt kinda jealous. I probably get that feeling a few times a month. There is so much work that sounds fun that if I weren’t doing the things I prioritize now, it wouldn’t be hard to find something else to do. I wish I could copy myself. If everything on my current strand of thought were created, I could feel liberated to move on to something else. Be a beginner elsewhere.

Like if you’re a radiologist and you saw a path where technology could make radiologists unnecessary, would you root for it or would you protect your job? Of course, the necessity of making a living compels you to protect. I’m not judging that. The priority for anyone is survival. But if you removed the constraint, you’d likely conclude that there are many ways to use your humanity; why be attached to one that overlaps with a machine? The radiologists who “defect” and go train the machines are like the market-makers who tightened the spreads (the game theory bit towards the end of the art of paranoia applies far beyond trading).

Your own value will be maximized where the machine can’t compete yet. Protection is ultimately delaying your own growth unless you plan to have your career outrun adoption. That’s probably fine if you’re 55, but if you’re 40, it’s a tougher question. It’s impossible to hand-wave the constraint of making a living. But here’s food for thought (food that is probably not going to nourish anyone whose already mid-career or older but might timely for college-aged or 20-somethings):

Living below your means, or having cheap tastes (which is easier to do before lifestyle-creep moves in) is a valuable option. And what maximizes the value of an option?

Variance.

Look at the world. The internet is a volatility pump. Connectedness, the reduction of communication/info friction led to acceleration. Having a buffer makes you less fragile. More mobile. Closer to just-in-time adaptability to where opportunity is. Less protectionist. Less defensive. Less calcified.

As we learned from Wednesday’s making the most of your time on earth, everyone has different values. You may not value any of the things I’m referring to above*. Totally fine. One of the things I got from a Straussian reading of the Welch stuff is how so much of our disagreements come from different starting values. Given that the source of values is probably more random than anyone wants to acknowledge (birth lottery and who you happen to hang out with in formative years), we are really left with different guidebooks for everyone. The best I can hope for is my perspectives landed for some of you.

*I didn’t share it in that post but my top 4 values on the values bridge assessment are below. Belovedness is about the primacy of your partner relationship and family-centrism were high — it feels horoscopic, I personally think the exercise of doing the questions is better than the output. The “voice” and “non-sibi” explain the newsletter, I guess.

Money Angle

Speaking of partner, this week was a rare public glimpse of the investment manager my wife works for — Eagle Capital. They are private manager but in 2024 they launched a public version of their portfolio, EAGL. I believe it was the largest ETF conversion to date when it launched. Of course this is where we get most of our beta and it’s the only ticker my kids probably know.

One of the heads of the investment team, Adrian Meli, went on Ted Seides show and I hear it was one of the most listened to episodes despite the vanilla category of “long only” investment manager.

They fly under the radar but I know many on the team. Very clever cats. When you hear Adrian you’ll understand.

🎙️Adrian Meli on Capital Allocators (link)

When Yinh asked me how I thought it sounded, I said “it confirms what I suspected — I wanna work there. Glad you do.”

Gamma: one rung at a time

Last weekend I shared a delta hedging simulation tool where anyone can learn exactly how long gamma mechanically lets you “buy low and sell high” for the cost of theta. I made this video Monday to step through 30 days of simulation to break it down as much as humanly possible.

Money Angle For Masochists

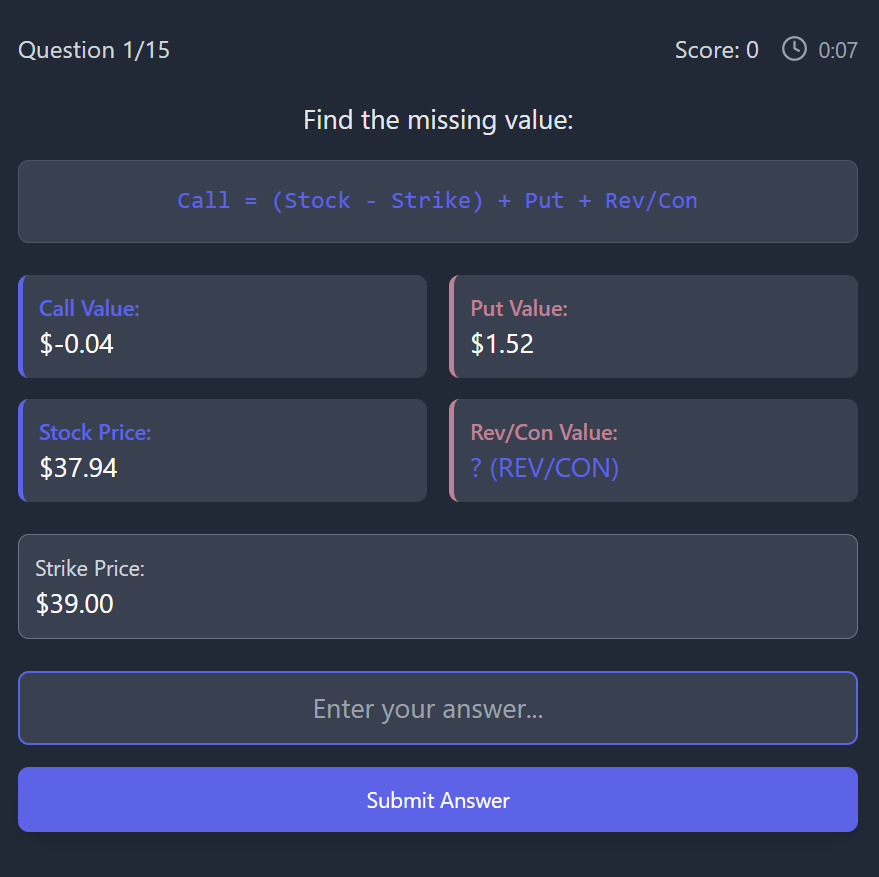

Yet another vibe-code project. This one went viral because…it’s a game!

It's a replica of the one we trained on an eon ago at SIG. It’s a put-call parity game.

The formula for put/call parity is:

C = (S - K) + P + RC

where:

C = call value

P = put value

S = stock price

K = strike price

RC = cost of carry til expiry (ie “reversal/conversion” value)

In the game you are given the strike price and 3 out of 4 of the remaining variables. Solve for the 4th. The game is timed.

Try it for yourself:

🕹️Put-Call Parity Trading Game

Contextualizing the formula

You don’t want to just raw-dog the formula. You get faster if you can contextualize it because with practice your mind collapses multiple operations into just one or two. You need to try it for ahwile to appreciate what I mean.

But let me give the context.

First, note that (S-K) is just “intrinsic value”. If positive, the call is in-the-money, if negative, the put is.

The extrinsic portion of the ITM [call/put] is the value of the OTM [put/call]

For calls, we add the rev/con (ie cost of carry) for puts we subtract it

Contextualizing the game

The game spread quickly when I shared the link on X. I even had some more recent alum of SIG and one from another MM tell me even in recent years they use a game like this in training.

When I started in 2000, this game was actually in fractions ("steenths") but decimalization pilots were happening in my clerking months. Even though I started on fractions, I was doing decimals about halfway through assistant year. As clerks we were supposed to play this game when things were slow so you could be fast in mock-trading in class after work so you could actually get selected for the bootcamp (which alone got you a raise) and get on with a trading account.

Speedy mental math was more important back then. Different era obviously, but interesting that they still find use in it. I could speculate as to why but maybe someone reading this will give me the official reason. I would admit that even when I’d get a broker look at an outright option when I was at Parallax I’d automatically do the calc in my head to compare to the same strike option on the chain. Being facile with the calculation was also a requirement on the rare occasion that a broker asked for a synthetic (a topic I discussed in the art of paranoia as well).

It only took about 20 minutes of iteration to make the game with Claude. Which is not much longer than it takes me to play :-(

I used to get perfect accuracy in the 30-40 second range at my best. My friend Tina was the firm champ at about 18 seconds. Just over 1 second per question.

Being fast was a job requirement, but you knew who the aliens were. It’s often hard to appreciate just how steep the performance curve is at the right tail of any skill in a competitive domain. We tend to get a glimpse of it in sports where everyone knows someone who was extreme (a friend of mine who was top 50 soccer player in US college soccer, another friend whose sister is bottom half of the top 100 tennis players on the women’s tour) but readily concedes there is still a world of difference between them and anyone famous in the field.

The trading floor was a humbling place because it’s very obvious that not all synapses are created equal. The strategic inferences and therefore actions you make with this information is heavily modulated by how much self-awareness you have. Sometimes being overconfident comes from never being exposed to the right-tail (your local big fish in a small pond) but it also comes from not realizing how far apart 2 standard devs is from 3 standard devs is in probability space.

[I tried to teach my older kid this idea recently in the context of his math MAP score. He is 99.5 percentile for 7th grade fall testing. He has a friend that is 99.8. Sounds similar. But my kid’s score is 5 in 1000 or 1 in 200. His friend is 1 in 500. In the population of Bay Area burbs with a good public school ranking, my kid is more like 1 in 40 and doesn’t make the gifted and talented cut, but those extra .3 percentiles keep you in the 99th percentile of the local pool.

99.8 vs 99.5 is 2.5x more rare. Proportionally those .3 percentile points are as wide as being in the 50th perentile, or 1 in 2, vs the 80th or 1/5. That range covers 30 percentile points!

The extreme is yet steeper.

99.9 percentile is half as common as the 99.8…almost a similar jump in rarity from my son to his friend for just .1 percentile points.

💡See Tails Explained to see more application to everyday reasoning]

If you do Tina’s morning routine, you’re not gonna be Tina. It’s more obvious when the Tina’s of the world look like Lebron. But don’t be fooled when they don’t. Figure out the games you can win. Playing to your strengths is wisdom but first you must identify them. Self-awareness means stop wishcasting, see reality, and adapt to it.

Stay groovy

☮️

Moontower Weekly Recap

Posts:

Need help analyzing a business, investment or career decision?

Book a call with me.

It's $500 for 60 minutes. Let's work through your problem together. If you're not satisfied, you get a refund.

Let me know what you want to discuss and I’ll give you a straight answer on whether I can be helpful before we chat.

I started doing these in early 2022 by accident via inbound inquiries from readers. So I hung out a shingle through the Substack Meetings beta. You can see how I’ve helped others:

Moontower On The Web

📡All Moontower Meta Blog Posts

👤About Me

Specific Moontower Projects

🧀MoontowerMoney

👽MoontowerQuant

🌟Affirmations and North Stars

🧠Moontower Brain-Plug In

Curations

✒️Moontower’s Favorite Posts By Others

🔖Guides To Reading I Enjoyed

🛋️Investment Blogs I Read

📚Book Ideas for Kids

Fun

🎙️Moontower Music

🍸Moontower Cocktails

🎲Moontower Boardgaming

Damn, I'm so honored man. Thank you for your continual and enduring support over the years. I'm terrified of what happens when you narrow that one month difference

This made me realize I’m the center guy on the twitter intelligence distribution regarding my llm use. Very interested in hearing more about how your kids/kids in general approach using ai. Whatever they’re doing is probably the way to go