an arbitrageable violation of how return works

Moontower #293

Friends,

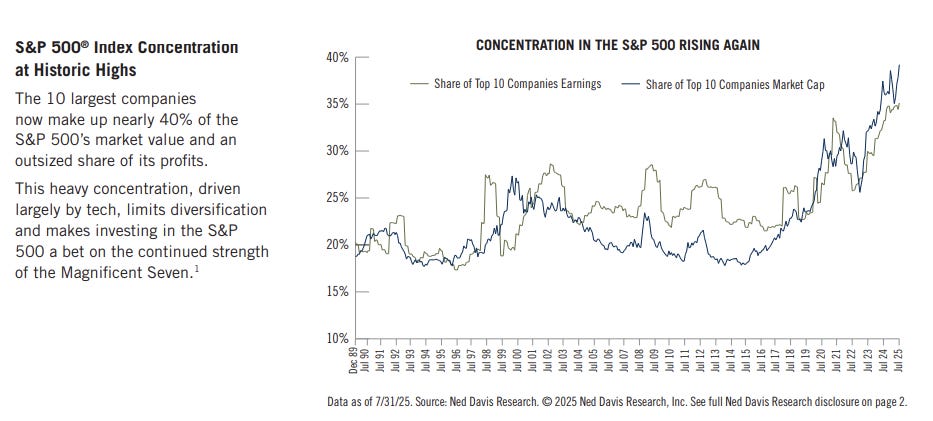

The largest firms in the world's capex doesn’t lie. They’re all-in on AGI. Since the so-called hyperscalers are also a historically disproportionate share of the SPUs, they are dragging the entire economy into that bet.

The “dog with a mouthful of bumper” outcome is they are right and actually eat the whole economy, only to be murdered by their own bunker guards. The irony of using Sama’s ChatGPT to query this:

OpenAI’s fundraising appetite and valuation requires AGI to be a thing, whereas a company like META will survive as a going concern and may even get stronger despite the capex blowing a big hole in their balance sheet temporarily if AGI is not a thing. Yann LeCun, META’s chief scientist and Turing award recipient, is leaving the company. He’s critical of the “scaling hypothesis” which claims that if you just keep throwing compute and data at the models, they will become “intelligent”. He doesn’t see how causal reasoning would ever emerge from pattern-matching even if it’s the most superior pattern-matching the world has ever seen.

This debate feels like mommy and daddy are fighting while the family’s future hangs in the balance. The naughtier kids are using the distraction to raid the cookie jar, while the market’s spirits are a thermometer on who the rest of the kids want to side with.

In a Carlota Perez framework, the prospect of AGI would suggest we are still early in the installation phase, but if the common knowledge surrenders to” AGI is never spawning from the current soil” then we are probably already in the deployment phase but not every middle-manager has taken Prompting 101 yet. In the first case, the calls aren’t hot enough, and in the second, you want your stocking stuffed with puts. Either way, we’ll take the electricity. But Santa, gas not coal, please.

Below the sci-fi (is that science fiction or science finance?) theatrics, we have the mundane business of actually using these things. Last week I shared the listicle voting app thing with some resources for those who want to make stuff with LLMs. This week Khe had a detailed post describing a CRM he built:

Vibe coding? More like “whack-a-mole” coding: The uncomfortable truth around my Pebblr CRM app (link)

Here’s another fantastic article that I think captures nuance between AGI breathlessness and very real capabilities of LLMs today.

Is Vibe Coding the Future of Skilled Work? (Scott H Young)

It’s written from a relatable perspective since I’m using these things so much, while easily admitting they are enablers rather than substitutes. And isn’t that a sweet spot? Like you can do more but still matter? Well for now I guess. We’ll see what happens. If the puts pay off maybe that’s bullish for humanity.

I’ll share some vibe-coding projects here and there.

Here’s my Car Lease Embedded Option Calculator.

Some background for the uninitiated:

Money Angle

A traditional way to think of a stock price is the expected value of its future prices weighted by their probability and discounted to the present. Ignoring the cost of money, in a binary world a $100 stock could be fairly priced if it was 50/50 to be worth $200 or $0. It is also fairly priced if there’s a 20% chance of it going to $500 and an 80% chance of $0.

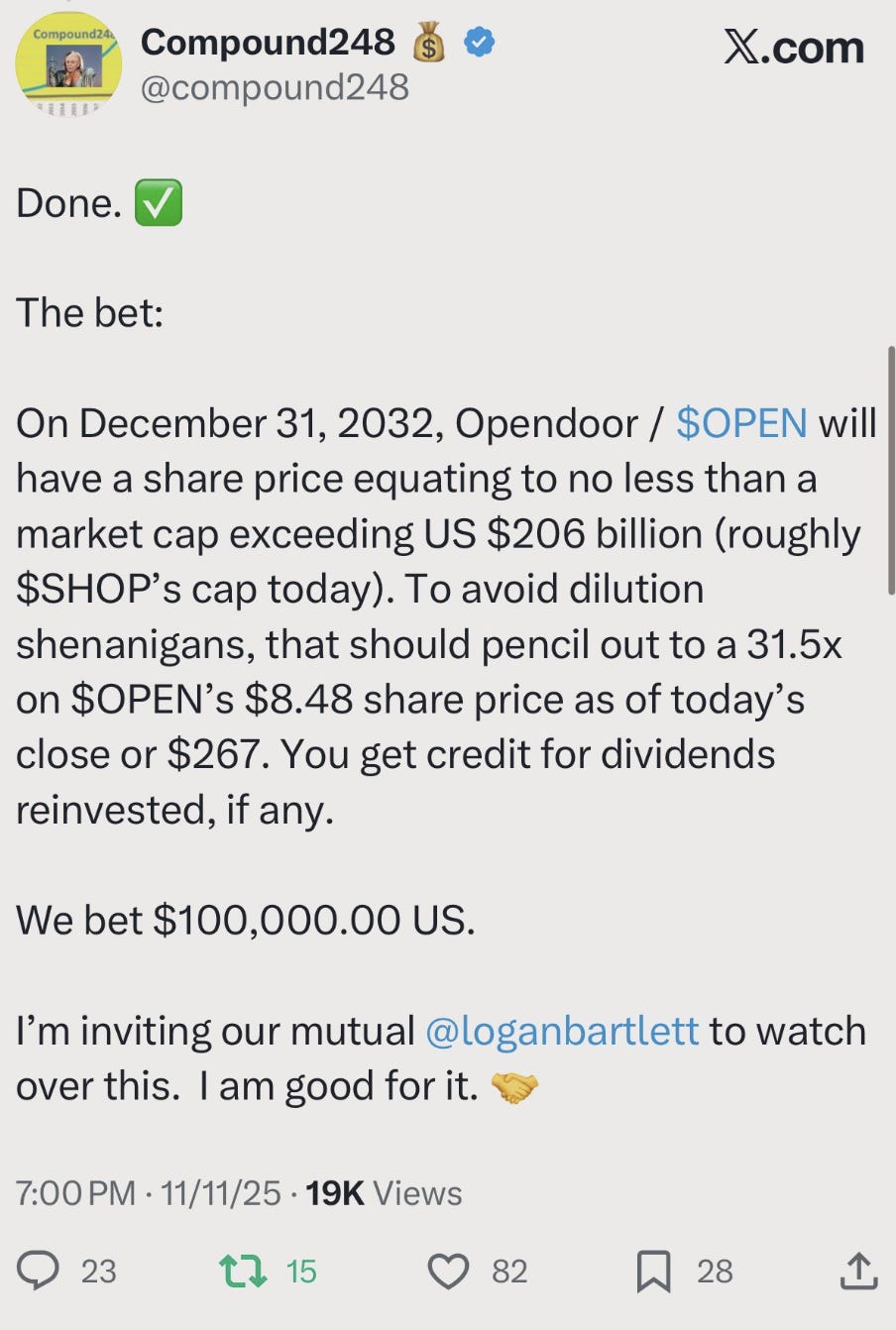

There’s this vocal VC named Keith Rabois who aggressively cheerleads his companies. I don’t know the guy. His online persona exudes many standard deviations of F-U confidence. Sounds par for the uber-rich these days, but he’s extra fun because he’s pugnacious. And got baited into a silly pride bet.

Here’s a tweet from investor @compound248:

We wouldn’t talk about this in the Masochists section because this is fairly basic financial reasoning. The type that really needs to obvious to everyone in a society is flirting with a simulcrum of the movie Rat Race. But it’s appropriate to spell out the opportunity here in gambling terms.

Keith is offering an even-money bet, his $100k to Compound248’s $100k on the stock multiplying by 31.5

If you think in odds:

Keith is offering even money on a 30.5-1 odds proposition

That might be more clear when you think of Keith buying the stock. If he buys $OPEN he risks losing the stock price or 1 bet and if the stock goes up 31.5x he wins 30.5 (because the 1 bet or amount of cash he spent for the stock is not part of his win or return).

It’s similar to how a stock 2x’ing is 100% return, or 10x’ing is a 900% return. A stock that 10x’s paid 9-1. You risked S, you won 9S if S is the stock price.

Normally when you buy a stock, you get paid dollar for dollar as it moves times the number of shares you have. If the stock doubles you make S in profits which is how much you risked when you bought it. You are paid in proportion to the move.

Keith needs a heroic move to simply get paid even money. His proposition is an arbitrageable violation of how return works. I don’t know anything about Compound248’s outlook on $OPEN by him taking the bet. He could be bullish or bearish. When you hear the proposition, your mind shouldn’t go to “Is $OPEN a good or bad investment?” because what you should do doesn’t depend on this assessment.

Keith’s offer is free money regardless of your outlook.

He’s laying 30.5-1 odds where the max loss is $100k.

So you solve for “How much OPEN do I need to buy to make a $100k profit if it pays 30.5-1?”

It’s simply:

1/odds * bet size

1/30.5 * $100k = $3,280.21

I need to buy $3,280.21 worth of shares. Since the stock was $8.48 that’s just about 387 shares.

If the stock goes to 0, you lose the $3,280.21, but Keith hopefully pays $100k. If the stock does go up 31.5x, you break even.

You could also structure the hedge so that at a stock price of 0, you break even. You buy $100,000/$8.48 or about 11,792 shares. If the stock hits Keith’s bogey you get paid 30.5 on your $100k and you happily peel off 1 bet size to him as a tip. Any share quantity you buy between 387 and 11,792 is a guaranteed win.

An amusing post-script to this story is HF manager Benn Eifert requesting $10mm of action on this proposition. Of course, Keith said no — he’s confident not stupid. Keith said he did the bet with Compound248 just to shut the “troll” up or something.

I don’t understand how rewarding a troll with the easiest money I’ve ever seen is anything but encouraging future trolls, but maybe this is why Keith is rich and I’m writing on the weekend.

Money Angle For Masochists

Tomorrow, we are going to launch the annual Black Friday/Cyber Monday discount for moontower.ai. It’s the only sale we offer during the year (current subscribers will be able to extend at the discounted price as well).

The app’s selling point, what makes it different, is its “point of view” on vol. It really starts from “what’s normal in the options market now” vs what sticks out. The analytics are geared towards answering that question because that’s how you find contradiction.

If sunscreen and umbrellas are simultaneously expensive, it might be because there’s a sunshower expected — but do the odds make sense? Before you could even reason about that you needed to know that sunscreen and umbrellas were both expensive in the first place, otherwise you wouldn’t even consider the question. Questions are where opportunities live.

The price of options is summarized by properties of vol surfaces, which in turn, can be compared to each other. We do the measuring and comparing to point out where the questions are. Options are not as simple as point spreads. Strikes themselves are fixed but the stock price changes, time passes. That same contract’s properties morph like natural landscape seen through a time-lapse camera. We are your guide in this wilderness.

We surface what types of trades look relatively attractive from the vol trader’s vantage point. You can think of that as a solid hypothesis based on the data, but from there, you can adjust based on your knowledge or opinion of what is going on in the name.

We don’t make guesses about the future. We don’t say do X and you will make money. It’s obvious to anyone who has ever taken risk that handicapping the future is not enough to make money. Think about it. How confident are you that the current price of SPY is not the all-time high? Probably 100% and rightfully so. The “SPY to be up 1 cent” one-touch option would be priced at 99.99999% percent. The knowledge is replacement-level not value-add.

You don’t sign up for Bloomberg because it tells you how to make money. You sign up because it helps you see*. And seeing in the correct terms is a prerequisite to profitable decisions. It’s the base of the pyramid upon which you layer the rest of your process.

That’s what we’re solving for in the options niche. The vol trader’s lens.

I made these vids this past week to offer a concise description of some of the key tools for seeing like an option trader:

*When you sign up for analytics, you usually do so knowing what you want to see. But also, there’s a built-in education. You learn what matters to others as well. Digital real estate is not scarce but deciding how to fill it is still constrained by taste and demand. The option pricing software that I used in market-making was also full of clues about best practices because professional users drove the features. What’s interesting when you have an analytics product that serves both retail and enterprise is the features can be a weaker signal about what matters. B-to-B vs B-to-C.

Stay groovy

☮️

Moontower Weekly Recap

Posts:

Need help analyzing a business, investment or career decision?

Book a call with me.

It's $500 for 60 minutes. Let's work through your problem together. If you're not satisfied, you get a refund.

Let me know what you want to discuss and I’ll give you a straight answer on whether I can be helpful before we chat.

I started doing these in early 2022 by accident via inbound inquiries from readers. So I hung out a shingle through the Substack Meetings beta. You can see how I’ve helped others:

Moontower On The Web

📡All Moontower Meta Blog Posts

👤About Me

Specific Moontower Projects

🧀MoontowerMoney

👽MoontowerQuant

🌟Affirmations and North Stars

🧠Moontower Brain-Plug In

Curations

✒️Moontower’s Favorite Posts By Others

🔖Guides To Reading I Enjoyed

🤖Resources to Get More Out of AI

🛋️Investment Blogs I Read

📚Book Ideas for Kids

Fun

🎙️Moontower Music

🍸Moontower Cocktails

🎲Moontower Boardgaming

The Rabois bet breakdown is brillant. Laying 30.5-1 odds for even money is textbook mispricng. Your calculation showing you only need $3,280 worth of shares to lock in arbitrage profit is exacty the kind of clarity that seperates real vol traders from people who just trade delta. The attention economy angle makes sense, but rewarding trolls with free money seems like an expensive PR strategy. Also appreciate the Carlota Perez framework for thinking about where we are in the AI cycle.

"LeCun, META’s chief scientist and Turing award recipient, is leaving the company. He’s critical of the “scaling hypothesis” which claims that if you just keep throwing compute and data at the models, they will become “intelligent”. He doesn’t see how causal reasoning would ever emerge from pattern-matching even if it’s the most superior pattern-matching the world has ever seen."

I'm not a Turing award recipient, but this is a self-evident truth.