Friends,

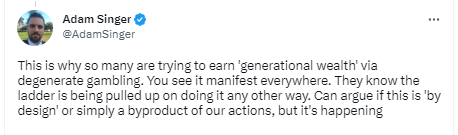

Let’s start with this single reply in a thread that caught fire.

I encourage you to scroll the thread — it’s like having a listening device inside a confessional. Every living generation’s gripes being aired out. Enough baggage to weigh down an Airbus A380.

If you have been reading Moontower for at least 2 years you know where some of my sympathies lie:

In Adding My .02 To The WSB Insanity, I offered:

A hypothetical.

Suppose there are 15 courses of actions one can take. 5 are illegal, 5 more are unethical. That leaves 5 acceptable actions. It feels like our collective calculus is moving to a rule of “if it’s legal, why not?”

The ethics ozone layer between what’s legal and what we should do is fully depleted. The air is irrevocably polluted. I’m not pointing fingers solely on daytraders who are openly coordinating behavior in ways that stun anyone who has ever sat through securities compliance training. There is a sense that the game is rigged and while I think the specific targets in these trading examples are misdirected, it certainly feels that way in a broader sense. Especially when we consider the runaway examples of inequality I’ve discussed [see Is Social Harmony The Last Collateral?]

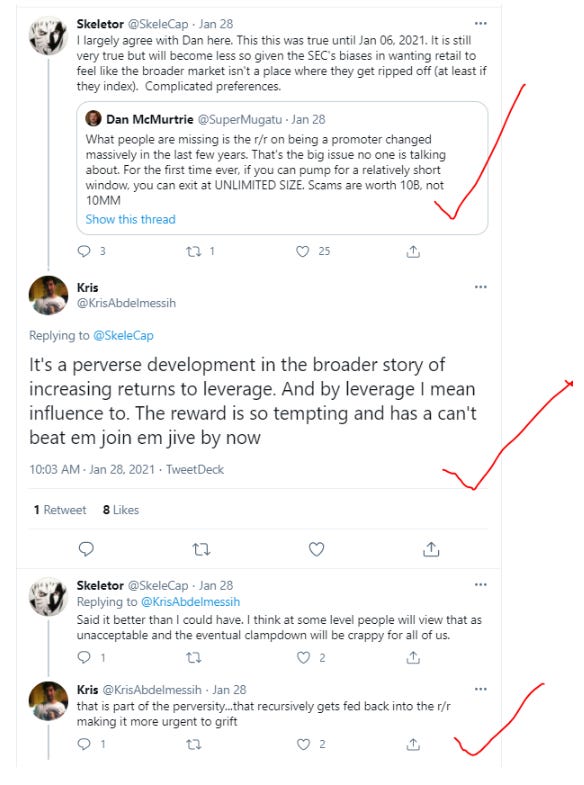

The last tweet in the side chat below is an echo of Adam Singer’s tweet at the start of this post.

Browsing Twitter this week I saw an account announce that people have an imperative to make as much money as they want within the confines of the law.

Look, last week I admit I have a fast cringe reflex. Hustlers are quick to say that instead of abstaining from cringey activity, the key to your dreams is killing the cringe reflex. This is reasonable. And that’s why it’s dangerous — it’s written in the same ink as the grift manuals. It’s the raw material for collapsing the firewall known as ethics that runs along the letter of the law and its spirit. It takes but 1 second of second-order reasoning to understand this does not scale. The proverbial picture replacing 1000 words:

Annoyed by the profit-as-religion tweet, I crafted a thread response (because I’m childish) and the janky Twitter app failed to send it. 4x. There was 2 silver linings to my frustration:

I deleted the Twitter app (again)

I hopped on a video call with Dave, Tom and Adam — a group of investors who have been thinking deeply about how we climb out of the collective Molochian quicksand.

Here’s the recording:

PolyCrisis, Institutional Decay, and AI in Q2 2023: An Update with Dave Nadig (53 min)

There’s a sense that life is increasingly turning into a tournament. There will always be some group of psychopathic wealthy with self-serving comprehensions of evolution and a strain of ambition who would have been warlords in a different era. Today, most of those outliers express their sociopathy in token-collecting.

But there’s a thick layer of grounded rich people who don’t feel rich enough because they see the minimum acceptable life as becoming increasingly unattainable for younger generations and their perfectly rational individual response is to make even more money so they can self-insure their children’s safety nets. This mindset taken to its extreme closes the self-fulfilling behavior loop promoted by the cringe-merchants.

I guess if prisoner’s dilemmas were a cinch to solve we wouldn’t have needed Nash-level minds wasting cycles on them. But alas, it’s still fun to bang your head on such puzzles.

If you are interested, Dave hosted a panel at a conference with Adam, Tom and several finance minds to discuss these topics. I reached out to tell him how much I enjoyed it. Our ongoing conversations on these subjects is what earned my naive role on the video call in the first place — the Straussian inference here is to listen to the panel talk if you only have time for one.

Exchange 2023 - The Future of Finance (98 min)

Money Angle

Flirting With Models: Designing the Cockroach Portfolio (55 min)

Corey Hoffstein interviews Jason Buck. I’ve hyped the hell out of these guys before (The Most Underrated Finance Channel On YouTube) because I want you to see why I weaseled my way into being their friends. They are brilliant guys who don’t take themselves too seriously. And their investing approaches are highly resonant with the principles I espouse in Moontower.It’s very much why I’m an investor in Jason’s cockroach fund and had Mutiny be the first sponsor of this letter. I knew Jason before he ever launched this fund and was honored to be a general sounding board on his ideas. I can’t believe how well he synthesizes and articulates complex trade-offs so the average investor can understand. The whole episode goes down extra-easy because Jason is the Dos Equis guy.

Don’t miss this one.The Mindful Money Playbook (RadReads)

”Reimagine your relationship to money, status and joy”

I’d like to say I have a hand in this because I’ve been urging Khe to re-factor and package his thoughts about money and life into a book. He thinks and communicates lucidly for laypeople despite a highly professional background (months after we got to know each other I learned that when he was at Blackrock he was on the team that studied the types of strategies I worked in!).

The book is totally free and built on Notion.How To Get Rich (Netflix)

Ramit Sethi is one of the personal finance gurus I recommend (there’s a lot of nonsense out there). Yinh and I started watching these 8 30-minute episodes and I’m struck out how good Ramit is at meeting people where they are in terms of dealing with their finances. He is a perfect mix of tough but compassionate and this is not easy when mass media often selects for a more mono-approach to establish a brand. Instead, Ramit builds his message and therefore brand around the concept of “how to build YOUR rich life” which means questioning conventional wisdom and ruthlessly cutting desires which are not truly yours while doubling-down on what you care about.

I’ve wrote about him 4 years ago and his message is still the same. See He Will Teach You To Be Rich (2 min read)

Money Angle For Masochists

Option amateurs underappreciate the role of funding in pricing derivatives. Professional options traders need to be obsessed with funding costs because they are trading for tiny, often sub-penny, margins.

Here’s a simple example to demonstrate the tyrannical effect of funding on pricing:

What is a 1-year American at-the-forward call option on a non-div paying, 20% implied vol, $100 stock worth?

You need to feed the model an interest rate to get an answer. You look at the yield curve and see a 5% rate (making this up) for 1 year. This yields a forward price of $105 (we can hand-wave simple vs compounded rates for this purpose).

Imagine the bid-ask for this call is 40 cents wide $7.80 - $8.20

If you buy on the bid and sell on the offer you make a .40 profit. Easy-peasy.

Now imagine you buy the bid and hedge the position until expiry. What implied vol did you buy?

The first thing to recognize is that you will be shorting the stock to hedge. Assuming it’s easy to borrow, you are still not going to receive a 5% rate on the cash proceeds. Your prime broker needs to earn its margin. If 5% is the risk-free rate, let’s assume they pay you 4.5% on cash balances. Conversely, the prime broker will at 5.5% (this is known as the “long rate” and it’s the rate you finance long positions at). If you sell the call on the offer you will need to pay that rate to finance the shares you buy.

Uh oh.

If you buy the call you need to use a 4.5% rate in the model to back out an implied vol and if you sell the call you need to use a 5.5% rate in the model. You can see where this is going.

If you buy the call on the bid you are paying 20.06% implied vol.

If you sell the call on the offer you are selling 19.95% implied vol.

(Check the math if you want)

You think you’re trading vol but because of the bid-ask spread on your funding rate, you are basically trading the same implied vol even if you buy the bid and sell the ask.

Rho is the sensitivity of the option price for a 1% change in the interest rate. The vega of an option is the sensitivity of its price for a 1-point change in volatility.

The rho of this call option is 46 cents vs a vega of 40 cents.

A 1% difference in funding rate (ie 4.5% vs 5.5%) is an institutional level bid-ask. It can be much worse for retail.

If you are trying to make markets you think you’re trading vol but are you even?

Pricing and carrying longer-dated options is crucially dependent on funding costs and the bid-ask spreads might not even be wide enough to compensate a market maker for their funding spread.

Another way of saying this: the market-maker with such a 1% wide funding rate is making a 20% “choice” market in the vol. If the bid-ask was tighter they would be bidding a higher vol than they were offering!

(Again this assumes they hold and manage the position as opposed to spreading the options off by say buying one call and selling another or having the privileged position of just getting ping-ponged on their posted bid-ask all day)

Stay groovy

☮️

Substack Meetings

I was invited to be a part of the Substack Meetings beta. You can book a time to chat. I’m more expensive than a 900 number from 1988 and have a less sexy voice.

Book a meeting with Kris Abdelmessih

Moontower On The Web

📡All Moontower Meta Blog Posts

Specific Moontower Projects

🧀MoontowerMoney

👽MoontowerQuant

🌟Affirmations and North Stars

🧠Moontower Brain-Plug In

Curations

✒️Moontower’s Favorite Posts By Others

🔖Guides To Reading I Enjoyed

🛋️Investment Blogs I Read

📚Book Ideas for Kids

Fun

🎙️Moontower Music

🍸Moontower Cocktails

Becoming a patron

The Moontower letter is and will always be free. My writing is a search “for the others”. The “others” are people like you who are unlearning the mental frames that artificially narrow our choices.

If you are here you already understand that inspiration is a tradable good. It’s not as tangible as a cup of coffee, but it packs 10x the adrenaline with an infinitely longer half-life than caffeine.

If you feel inspired, you can upgrade to becoming a patron.