Volatility term structure from multiple angles (part 2)

Friends,

In part 1 of Volatility term structure from multiple angles we opened by discussing how nearer dated implied vols move around more than deferred implieds. Recognizing that dynamic, our net vega position for a time spread can be ambiguous.

Just as stock traders use beta to normalize risk to a benchmark such as SPX, volatility traders will normalize their vega to a fulcrum month. √t scaling corresponds to a model world where time spreads between months remain relatively stable. It’s not reality but it’s a vast improvement over summing raw vegas.

In comparing vols between 2 months, vol ratios are popular. If M1 is 18% vol and M6 is 20%, the vol ratio is 90%. It’s a measure of how steep the term structure is. If you track the ratio for constant maturities then you can get a quick sense of the relative supply/demand for IV. If the ratio is less than 1.0, the term structure is ascending, a shape typical of “it’s quiet now, but we expect mean reversion to typical higher levels of vol”. A downward sloping vol curve is more closely associated with high vol periods or the market’s anticipation of an even such as earnings or the election.

Vol ratios are only one way to measure the slope of the term structure. We saw that implied forward vols are a complementary measure that also describes the relationship between 2 volatilities on the term structure. The computation tells what volatility is baked into the period between the 2 expirations. The logic is that the deferred expiration accounts for all the volatility from now until the option’s last trading date while the near-dated expiry isolates the early period’s expiration. If you consider an extreme example where the time spread is worth 0, ie the deferred option and the nearer-dated option are the same price, the forward vol is zero.

So why look at 2 measures, vol ratio and implied forward vol, if they both tell us about the relative price of implied vol on the term structure?

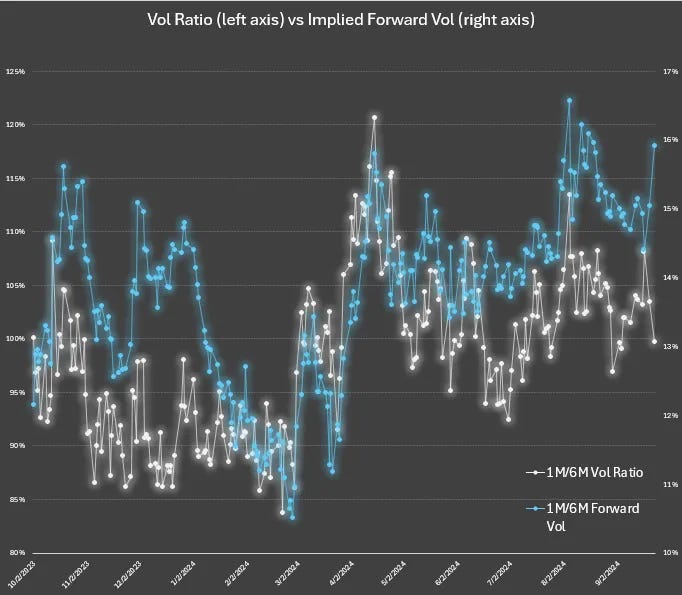

Remember, we were looking at GLD 1m/6M vols for the 1-year range 10/2/23-9/23/24:

We saw:

The forward vol is sometimes high and sometimes low regardless of the ratio!

But look at early March — not only was the vol ratio low, the forward got crushed. If you only look at vol ratio, you missed this.

Implied forwards are an orthogonal or complementary measure of relative volatility that is additive to your perspective.

Today, we will dive further into the relationship between vol scaling, forward vols, ratios. We will come out on the other side with what this all means for finding trades and managing risk.

Off we go…