This Newsletter Is Possibly Garbage

Moontower #205

Friends,

One of the Substacks I never fail to read is Range Widely by

, author of Range (my notes on his interview about the book) and The Sports Gene: Inside the Science of Extraordinary Athletic Performance.David is a journalist by trade. His writing is well-researched. Social science research, especially the kind of pop-sci stuff that climbs the heap to find itself in airport bookstores, should require a “grain of salt” rating (G: “germane”, PG: “possibly garbage”, R: “rumored at best“). David’s process and intellectual demeanor indicate care — he resists the temptation to oversell conclusions.

Personally, I rarely read social science books — I’ll just listen to a podcast with the author if I care. The insights in such books feel like they have an asymmetrical yield — if they confirm what you already thought then the opportunity cost of reading that book is high (I’ll be lucky if I read 500 more books before I’m dead) and if the book has a ground-breaking insight it’ll almost certainly be out of fashion within a decade (“the game theory of getting published in social science” is a comically fractal idea. If you google that phrase, you’ll see why).

Anyway, David’s history of intellectual care makes him an ideal candidate to interview other social science authors about their books — critical enough to ask good questions but friendly enough that he can get the interviews in the first place.

Enough preamble…some excerpts I enjoyed from David’s Q&A with psychologist Adam Grant on his new book Hidden Potential: The Science of Achieving Greater Thing (emphasis mine):

Many people believe that if you’re not precocious, it’s a sign that you lack potential. But potential is not about where you start — it’s a matter of how far you’ll travel. And the latest science reveals that we shouldn’t mistake speed for aptitude. Our rate of learning is driven by motivation and opportunity, not just ability. Think of all the late bloomers who weren’t lucky enough to stumble on a passion, or to have a parent, teacher, or coach early on who recognized and developed their hidden potential.

This doesn’t mean we should ignore “gifted” students. We need to think differently about how we nurture their potential too. Empirically, the rate of child prodigies becoming adult geniuses is surprisingly low. I suspect one of the reasons is that they learn to excel at other people’s crafts but not to develop their own. Mastering Mozart’s melodies doesn’t prepare you to write your own original symphonies. [Kris: this is exactly the point Trent Reznor made to Rick Rubin as he wrestled with his own potential]. Memorizing thousands of digits of pi does little to train your mind to come up with your own Pythagorean theorem. And the easier a new skill comes to you, the less experience you have with facing failure. This is a lesson that chess grandmaster Maurice Ashley drove home for me: the people who struggle early often build the character skills to excel later. We need to start investing in character skills sooner.

Because Glennie is deaf, she had to find nontraditional ways to learn, like using different parts of her body to feel vibrations that correspond to different pitches. She and her teacher were constantly trying different ways to do that, and different ways to do everything, really. As you write: “Continually varying the task and raising the bar made learning a joy.” I’ve long been fascinated by this issue of variable practice. Mixing things up constantly might seem counterintuitive, but it turns out to be better for learning.

You note that concert pianists who reach international acclaim by age 40 typically were not obsessed early on, and that they usually had a slow but steady increase in their commitment to music. It just made me think of the first page of Battle Hymn — in which the author promises the secrets to raising stereotypically successful children, and recounts assigning her daughter violin and soon she’s supervising five hours of deliberate practice a day. That part was excerpted in the Wall St. Journal, and it was the Journal’s most commented upon article ever! It really seeped into the public consciousness, I think. What didn’t make as much of an impression was the part later in the book where the author (to her credit) recounts her daughter turning to her and saying: “You picked it, not me,” and more or less quits. [Kris: I’m very careful riding our kids in areas that they are naturally drawn to because of such “reactance”. I don’t want to turn “their thing” into “my thing”. You have an extra gear to give for those things that you discover independently.]

The issue of “learning styles.” This is the very popular idea that some people learn best by listening, others by reading, others by looking, etc. Maybe someone prefers podcasts to books because they style themself an “auditory learner.” Trouble is, a mountain of research has failed to back this idea up [Kris: Veritasium calls this “the biggest myth in education”. Although I suspect the testing design for experiments that dismiss the idea might be strawmanning the contention or interpreting it too narrowly].

People may indeed have a style of learning that feels most comfortable, but that doesn’t mean they’re actually learning more that way. In fact, to use a line from Range, in many cases, difficulty is not a sign that you aren’t learning, but ease is [Kris: I’ve found that many teachers I respect agree with this so it’s not as bold a statement as it might appear even if this is the first time you’ve heard that. I remind my kids — if it’s easy it’s just review, not learning. Non-superficial learning hurts. I might even go as far to say that learning and pain are nearly synonyms. To be clear, such a statement is more useful as a reminder than a universal truth. Experiential learning is an easy counterexample]. As you write: “Sometimes you even learn better in the mode that makes you the most uncomfortable, because you have to work harder at it.” I was just reading a study (“Measuring actual learning versus feeling of learning”) which showed that Harvard physics students preferred lectures from highly-rated instructors to active learning exercises. But they learned more from the latter. The main difference in the active group was that students had to try to solve problems in groups before they really knew what they were doing, and so they would discuss, generate questions, and hit dead-ends, all before seeing correct solutions. We know that forcing learners to try to generate solutions before seeing them enhances learning (the so-called “generation effect”), but it doesn’t feel great, so we may avoid it.Back in December, you helped me get in touch with RA Dickey, and he was every bit as stellar of an interview as you promised. His story helps to illuminate why so many people fail to try new methods when we get stuck. It’s not so much that we’re stubborn or resistant to change. We hate the thought of giving up the gains we’ve already made. We forget that sometimes, the best way to move forward is to go back to the drawing board. [Kris: Feeling seen] If your fastball is slowing down and your career is stalling, you have nothing to lose by tinkering with the knuckleball. We shouldn’t be so afraid of failing that we fail to try.

Money Angle

Let’s moan about the reality of realty today.

My quick take when I saw that tweet and the comments:

This tweet is getting a lot of hate but…it’s exactly what I did for every place I've bought. Got an agent from the same firm so they can double dip. I mean the whole options market revolves around understanding the dynamic of billing both sides.

You'll get better allocations when there's a judgment call (there usually is) on the splits if you are a regular client of the broker. Give up a half-cent commission on a 5k lot a couple times a month lot so you can get 1/2 instead of 1/4 allocation on the 10k lot good by a dime.

In the options world, the analytics and nerd stuff get s a lot of attention but it’s also the most democratic aspect. The highest edge (although least scalable) part of the game is relationship maintenance. There’s an equilibrium of tit-for-tat that resides within a snapshot of time that is defined by prevailing technology and the split of predator/prey populations. Large shifts in either the tech or the populations alter the parameters of the equilibrium pecking order. There is one constant — middlemen “control” the flow. Flow is the plankton at the bottom of the food chain.

I think as a metaphor for many businesses — AI is gonna handle the calculus. But getting close to the people who wake up in the morning with opinions that lead them to buy and sell will always be the job to be done. The nerd stuff is satisfying. But making money is just grimy work.

It’s important to have the right expectations lest you cry when you find out who makes the most money (especially per unit of risk).

[A prior riff on the idea: The Juicy Stuff Doesn’t Hit The Pit]

One last thing…if the persistence of 6% broker commissions in our Zillow-enabled world has you puzzled, it seems like times might be changing. A recent settlement seems watershed:

🔗The Middleman Economy: Why Realtors Just Took a Big Loss and Homebuyers Might Benefit (9 min read)

by Matt Stoller

A shocking $1.8 billion antitrust decision by a jury against the National Association of Realtors for price-fixing could rearrange housing markets.

Money Angle For Masochists

🔗New post: A Simple Demonstration of Return Vs Volatility

Expected return for a bet is the simple probability-weighted average of outcomes.

If there is a 50% chance of a bet making 21% and a 50% chance of it returning 19% this it’s a good bet that is also not volatile. You expect to make 20% on average (despite the fact that you can’t ever make that on any single bet since you can only earn 19% or 21%).

Your expected terminal wealth after a single trial is 1.2x what you started with.

Since we took a simple average of the outcomes we computed an arithmetic mean return of 20%

Compounded returns

For multi-period investing where we do not take any distributions or “money off the table” we cannot use simple arithmetic means to compute an expected return.

Consider the same bet after 2 trials. These are the 4 possibilities each equally likely:

Best return, best return

Best return, worst return

Worst return, best return

Worst return, worst return

If we look at the summary table, there is no difference between the mean expected return and the median.

Let’s keep the mean return the same but raise the volatility. An investment that is equally likely to:

go up 100%

fall by 60%

Even though this is more volatile than the first investment, the mean expected return is still 20% per trial. You can compute this in 2 ways:

50% * +100% + 50% * -60% = 20%

or

Terminal wealth = 50% * 2 + 50% * .4 = 1.2 or 20% return

But let’s see what happens when we look at the compounded scenario where we fully re-invest the proceeds of the first period into a second period.

Now the mean compounded return has dropped from 20% to just 4.72% and the median outcome is a loss of 10.6%!

The divergence between mean and median returns comes from the compounded effect of volatility.

Investing Is a Multiplicative Process

When it comes to investing, we are usually re-investing rather than taking our profits off the table each year. We hope to grow our wealth year by year like this:

1.10 * 1.10 * 1.10 … or 1.10n where n is the number of compounding intervals (typically years).

Therefore, we want to look at compounded not mean rates of return. To compute them we simply take the n-th root of our terminal wealth where n is the number of years.

If you doubled your money in 5 years then your CAGR = 21/5 – 1 = 14.9%

Note that if you took the naive average return you could say you earned 100% in 5 years or 20% per year. But this defies reality where you re-invested a growing sum of capital every year.

CAGR is a median return

It’s important to note that the expected mean return of these investments is still 20% per year. It’s just that the median is much lower. In the high volatility example, your lived experience usually results in a loss of 10.6% but the mean 2-period return is still positive 4.7%. The complication is that the avergae is driven by the 25% probability that you double your money in 2 consecutive year. In every other scenario, you lose money.

Volatility is altering the distribution of your outcomes not the mean outcome.

Mathematically the median is the geometric mean. In a multiplicative process, you care more about the geometric mean. After all, you only get one life.

A note on log returns

A logreturn is a compounded return where we assume continuous compounding. So instead of every year, it’s more like every second. Of course, if our wealth grows from $1 to $2 in 5 years but we assume tiny compouding intervals, then the rate per interval must be small. After all the start and end of our journey ($1 to $2) is the same, we are just slicing it into smaller sections.

Computing an expected logreturn is simple. Using the volatile example:

.5 * ln(2) + .5 + ln(.40) = -11.2%

Note that this is slightly worse than the geometric mean return (aka median) we computed earlier of -10.6%

Volatility’s effect on compounded returns

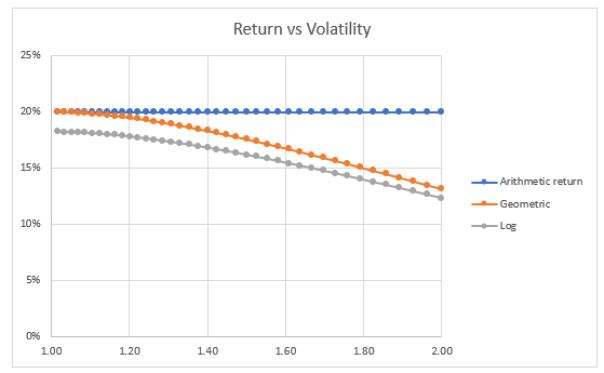

The following table presents different investments that each have an expected arithmetic return of 20%. Just like the examples above. But the various payoffs are altered to proxy different levels of volatility. An investment that can earn 21% or 19% is much less volatile than one that can return 100% or -60% even though the average return is the same.

We use the simplest measure to represent the volatility — the ratio of the best return to the worst return.

The stable investment volatility proxy is 1.21 / 1.19 = 1.017

The volatile investment above is 2 / .4 = 5.00

Table snippet:

These charts show the divergence between arithmetic and median returns as we increase the volatility (the ratio of the best return to the worst return):

An investment that is equally likely to return 60% as it is to lose 20% has a 20% expected return but if you keep re-investing your long-term median outcome is closer to a 12-13% CAGR.

What if we raise the volatility further to a ratio of 5 (terminal wealth of 2x vs .4x):

At a ratio of 3.5 (1.87x vs .53x) our median result is zero. At a ratio of 5, the average return remains 20% but the median return is losing 10%. Almost all the paths are losing they are just being counterbalanced by the unlikely event that you keep flipping heads.

Takeaways

Investing is a multiplicative process so we want to look at compounded or log returns not simple returns

Compounded returns ask “what growth rate when multiplied from period to period gets us from the start point to the end point?”

Compounded and logreturns are always less than arithmetic returns

Compounded and log returns are better measures for what you expect to find in your bank account after volatility has taken its toll. Remember if you lose 50% on an investment you need 100% to get back to even. If you earn 50% on an investment you only need to lose 33% to be back at even.

If there was no volatility there’d be no promise of return, but volatility is a quadratic drag on returns. The sweet spot for your portfolio likely falls in the realm of the volatility of broadly diversified portfolios. By rebalancing you can reduce concentration risks that threaten to turn your entire nest egg into a coin flip. Even if this coin has positive expectancy, remember you can’t eat theoretical edge.

Substack Meetings

I was invited to be a part of the Substack Meetings beta. You can book a time to chat. I’m more expensive than a 900 number from 1988 and have a less sexy voice.

Book a meeting with Kris Abdelmessih

Moontower On The Web

📡All Moontower Meta Blog Posts

Specific Moontower Projects

🧀MoontowerMoney

👽MoontowerQuant

🌟Affirmations and North Stars

🧠Moontower Brain-Plug In

Curations

✒️Moontower’s Favorite Posts By Others

🔖Guides To Reading I Enjoyed

🛋️Investment Blogs I Read

📚Book Ideas for Kids

Fun

🎙️Moontower Music

🍸Moontower Cocktails

Becoming a patron

The Moontower letter is and will always be free. My writing is a search “for the others”. The “others” are people like you who are unlearning the mental frames that artificially narrow our choices.

If you are here you already understand that inspiration is a tradable good. It’s not as tangible as a cup of coffee, but it packs 10x the adrenaline with an infinitely longer half-life than caffeine.

If you feel inspired, you can upgrade to becoming a patron.

Without knowing the legalities of it, hiring the listing broker as your buyers agent would give them a massive incentive to help you. If you assume a $500,000 listing that’s around the right price point and a regular 6% commission split 50/50 between the selling agent and the buying agent, the selling agent gets $15,000. Now assume that the agent is on both sides of the transaction, and there is no realistic bid possible that allows the agent to make more money, it would literally have to be double the price. So the selling agent would be massively incentivised to have the current owner sell the property to you over any other bidder, and they’re in a prime position to play up the reasons to accept your bid over any other, and downplay any other bidders for the house.

Obviously no real estate agent would ever be so unethical as to do any of this of course regardless of the legalities of it, but still it’s an interesting thought experiment right?