Friends,

I’ll be short up here because today’s Money Angle got the pen.

This article is b-r-u-t-a-l.

Fast Crimes at Lambda School (39 min read)

Benjamin Sandofsky

It’s also quite embarrassing that one of the first posts I ever wrote on my website could not have aged any worse.

Money Angle

The internet exposes us to a wide array of perspectives, beliefs, and behaviors that we might not encounter in our immediate, offline environments.

We are outraged by this.

Maybe this is our lizard-brain threat detectors tuned to primitive local survival requirements. An existence where the number of people and places you will encounter in 50 years of life expectancy can be tallied on your fingers. If our ancient white blood cells see modern connectivity as an intruder, our system 2 reasoning can be used to restrain that impulse…”chill sentry, these other ways of being were always there, we just didn’t see them before”.

There’s a particular brand of discourse that recurs constantly on #fintwit’s personal finance channels. It goes like this:

Original poster: "I need this much to retire"

Someone is 100% to be offended and responds:

"No you don't because [reasons]"

This is a surefire way to farm engagement. It’s a close cousin to NY Times favorite style of finance article “I make $1mm a year and can’t afford life”.

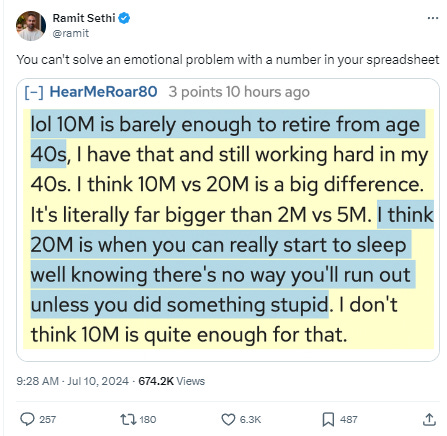

Here’s Ramit, whose personal finance content I usually like, playing the game:

Everyone’s entitled to their opinion. I find it difficult to get emotional or even conjure opinions on such a topic. It’s an impotent path of inquiry because it is absolutely crushed by the sheer magnitude of how our perceptions emerge from limitless forking paths of human experience.

I just short-circuit at normative questions of “what should be”. Feels arrogant to get riled up about what others think they need. We change. If you grow up with little and do well, your sights will get set higher. Is this bad? Seems like the wrong question. A misdirection from a more useful framing. And that framing is also a matter of opinion. But that’s one I have a view on.

To invite a personal perspective I’ll admit a simplistic desire. When it comes to what I want to afford, I wanna live in a nice town in CA and not have to count my pennies in the course of a comfortable existence. One in which a special occasion stay at 5 star hotel doesn’t require a separate savings account. But I don't expect to have a yacht or live-in maid.

At the same time, I don't pretend we can't have a lost decade or 2 of returns. It might be low probability but you don't need to catastrophize to think it's part of the distribution. Relying on even historical assumptions of investment returns feels uncomfortably fragile to me. Life is a single draw. Relying on non-stationary averages is a building a house like the first 2 little piggies.

[Note: This asset management marketing pitch called “evidence-based investing” offers useful heuristics but if it over-loads your “extrapolate from the past” muscle it’s a Trojan Horse.]

My no-shortcuts belief:

Find the mix of work and expectations that give you a chance of getting to a number with a very high margin of safety which is always going to look like a big number. But you don't make your happiness contingent on getting there.

My rebuttal to all these "you can get retire on as little as X" is sure you can go live in Egypt too for even less. Maybe I need X because I be living like Y. And it takes a lot of arrogance to yuck people's Ys. It’s possible they have distorted goggles on but, unless they want help, to assume they are broken feels like a strange position. The American who needs 20mm to retire vs the person who needs 1mm.

Does it really take that much effort to imagine either person without thinking one of them is crazy? You won’t unsee it once I say it — arguing over ranges where reasonable people can disagree is the gasoline of the internet.

The whole “what you need” discourse is a distraction from the plain truth — there is an “arrival” fallacy at play. It’s very well documented across the board. Win the championship, celebrate one night, then feel letdown. Living in the future (or past) sucks. Never overdose on hope or nostalgia.

So that bloke that gets to 15mm and won't stop "until he gets 25" is probably wrong on thinking there's an endpoint.* But calling him out for his mentality is judgmental at best and wrong at worst. Maybe that mentality was a prereq to getting to 15 in the first place. Every strength is also a weakness (or so I tell myself when I forget to buy milk because I was daydreaming).

*I don't think about a “number” because if you hit it you still have to contend with what you'd do with your time. You should stop pretending that is a problem you acquire when you "arrive". You have that problem right now.

Instead, we can choose grace and not think unusual people need fixing (again unless the person is seeking help). Should posters just write a boilerplate disclaimer: "I realize it's gauche to say I want 25mm to retire and any reasonable person could retire on less but..."? Do they need to splay themselves on the altar of “be considerate to the average human” before speaking?

There are subgroups of people that, for better or worse, have their own standards for how they want to spend their revolutions around the sun. We could simply choose rules of charitable engagement to assume that default belief instead of compressing variation. When someone posts on r/FatFire they are talking to a selected group of mutuals. You know what’s going to happen when you paste that in the internet’s town square.

My wife and I come from middle to lower class families. Yet, because of our professions have seen a lot of how the other half lives. And we’re part of the other half as our childhood selves would conceive of it. I thought any kid with a GI Joe aircraft carrier was rich. My wife’s “this person must be rich moment” was when she had dinner at a friend’s house and they had Ranch dressing. I only have to drive around my town to know there’s “another half” compared to our current perspective. And to them there’s “another half” flying private everywhere. You get the point.

Not relating to someone else is not news. It’s what should be expected because of how wide the range is. How can something that shouldn’t surprise you, get you fired up? The whole discourse is low-brow projection.

Here’s an experiment to undo this impulse. Consider the Guinness Book. Longest fingernails? Is there any point in trying to relate to someone who goes for that. We don't try because it's absurd. The range of humanity is blindingly obvious when you turn those pages.

But when people start talking about money (as opposed to their time, which Guinness people used in wild ways) we somehow think that should be more relatable. Resist that illusion.

You don't need worry about what everyone wants. These are not matters of right and wrong (vs the boring problem of someone making the equivalent of a counting mistake in describing the how of their money pursuits).

You need $100mm, cool. You wanna live in a van. Right on. For all I hope your expectations are met.

But I don't think that's how anything works. Solving for the best way to be useful and happy is a lifelong endeavor. It's not where you are gonna eventually plant your flag it's how you carry its weight every day.

It’s true and forgiving to recognize that a lot of people don't have the luxury of the thought — but what’s much worse is how many don't have the nerve.

Money Angle For Masochists

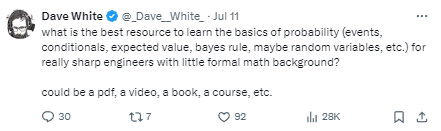

Dave is a quant at Paradigm. He asked:

The thread is full of recs. I mentioned David Sklansky whose books were assigned reading at SIG 20 years ago. Gambling literature is going to be a great place to search since it will likely balance academic and applied considerations.

To that end I also recommended the OG website —> wizardofodds.com

For decades, they’ve been publishing the combinatorics on casino games and so much more. They even had a list of all the specific video poker machines that had positive edge (yes, there were some. At SIG there was a group that actually exploited this as a fun side extracurricular).

The host of the exceptional gambling podcast Risk of Ruin @halfkelly immediately recommended:

Harry Crane’s First Course In Probability

Others recommended video courses such as:

Statistics 110: Probability by Harvard University

Course in Bayesian Statistics via Virginal Commonwealth University

Fun

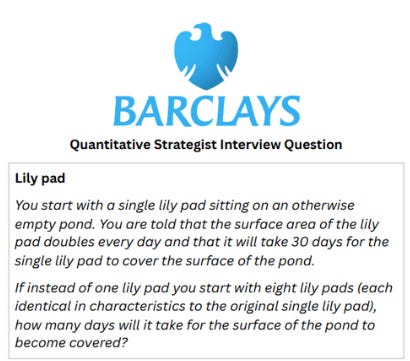

This isn’t probability but I came across this question on Twitter (answer at the end of the post. My answer anyway. Hopefully it’s the right one but I never saw the solution):

From My Actual Life

I turned 46 on Friday. The thought I tweeted:

21 years ago today @BrendaDellaCasa introduced me to this wife & life at my surprise bday party at Climate 8 in NYC. Forever in debt.

My lovely wife informed me tonight we'll be seeing Nate Bargatze in Vegas on our 15 year anniversary. I actually haven't been to Vegas since covid but used to get there every year at least once since moving to CA in 2012.

Anyway, thanks for all the shouts today...I’ll say I didn't care about birthdays when I was younger but they are days I remember now and just not taken for granted.

I had a bit of a scare 2 years ago on my bday and went to the ER in the middle of the night with my heart not feeling right. Just a fluke but gave up drinking the next day for health reasons (I have sake every few months and I have a standing rule to have a drink if I find myself in a tiki bar)

Anyway, I feel grateful and motivated, and as a matter of being on your timeline — flattered that I would have people follow/read my shit.

Keep going.

Stay Groovy

☮️

Solution to the Barclays question

I solved this in 2 ways. Both start with the basic observation that the pond will be covered by 2³⁰ lilypads

The first way I saw this problem was that starting with 8 lilypads is equivalent to starting with one but on the 3rd day. So instead of taking 30 days to fill the pond, you will need just 27 days.

The second way to see the problem is by noticing that each starting lilypad will contribute 1/8 of the full coverage.

What’s 2³⁰ / 8?

2³⁰ / 8 = 2³⁰ / 2³ = 2⁽³⁰⁻³⁾ = 2²⁷

Again, 27 days.

Moontower Weekly Recap

Need help analyzing a business, investment or career decision?

Book a call with me.

It's $500 for 60 minutes. Let's work through your problem together. If you're not satisfied, you get a refund.

Let me know what you want to discuss and I’ll give you a straight answer on whether I can be helpful before we chat.

I started doing these in early 2022 by accident via inbound inquiries from readers. So I hung out a shingle through the Substack Meetings beta. You can see how I’ve helped others:

Moontower On The Web

📡All Moontower Meta Blog Posts

👤About Me

Specific Moontower Projects

🧀MoontowerMoney

👽MoontowerQuant

🌟Affirmations and North Stars

🧠Moontower Brain-Plug In

Curations

✒️Moontower’s Favorite Posts By Others

🔖Guides To Reading I Enjoyed

🛋️Investment Blogs I Read

📚Book Ideas for Kids

Fun

🎙️Moontower Music

🍸Moontower Cocktails

🎲Moontower Boardgaming