Friends,

I published a large option post this week which drained my writing time. You can check it out in Money Angle. So here is just a quick take on Jack’s tweet:

I agree. Whenever I see “creator” my impulse is just say what you do. “I write words on the internet” or “I make videos on YT.” The internet is a frontier of wildcatters making ends meet in all kinds of ways but showbiz has plenty of precedents. Every time a Smartless host introduces a guest it’s:

“Please welcome actor/producer/writer/musician/comedian/origamist/trainer [famous person’s name]”

When Fabio accepts the “slashie” award in Zoolander, it’s satire. Now it’s just a Tuesday. What a great time to be many things. Why force yourself into an old box with a generic label “creator”?

I remember joining a HF after 12 years in the slop of floor trader land. I needed a business card but I didn't know any lingo (I’d refer to edge as vig not alpha, PMs as traders, execution traders as clerks, and asset managers as punters. Shoot me for not having an MBA. Also sorry mom, I’m still not going back to school). I asked someone more senior about what the hell I should put on the business card and the response was “whatever you want, we don’t give AF”. I was like cool, that's how I feel about it too. Labels are conveniences for others but if you would be better served by just making yours up, knock yourself out. Everyone is gonna have an opinion anyway. But “creator” does conjure a worker assembling memes on a conveyor belt.

Mother of ironies on this rec:

This interview with Justin Moore, aka the “Creator Wizard” is a great interview that caters to internet hustlers but is loaded with great business ideas. Justin is super transparent and the depth of his strategic thinking shines in his conversation with ConvertKit founder Nathan Barry:

🎙️Game-Changing Newsletter Sponsorship Strategies (podcast)

The title suggests a narrow discussion but the principles extrapolate well. Consider this [somewhat edited] section:

I'm a big fan of disruption, where instead of charging what everyone else does, I give it away for free. I’ve adopted this model with my newsletter and offered free advice during my early days to build credibility, helping people with DMs. Currently, I've never shared this publicly, so this is an exclusive insight.

I've incorporated a pricing calculator with my course. I added it because people kept expressing confusion about various aspects. The calculator has grown sophisticated, accounting for goal types such as conversion, brand awareness, and content repurposing, among others. It also considers different usage rights, exclusivity, and various factors. While it's a part of my course now, I plan to release this calculator for free in the future. Many platforms charge for similar tools, but mine will be a free resource.

The idea is to use it as lead generation. If someone wants to determine sponsorship charges, they can use my calculator. For more in-depth insights, they can either enroll in my courses or hire me for consulting. This approach to offering free resources will be a constant in my ventures, especially because I have other sources of income.

Looking at the broader picture, diversification is essential. My wife and I already run a thriving business. I see my creator project as an extension, which has grown over time. I didn't initially view it as a primary revenue source. For instance, I hired a content strategist a year and a half ago. The goal was to establish my reputation as the go-to expert on sponsorships across social platforms. I invested heavily in content, even before I had a direct monetization strategy.

Regarding the newsletter, I invest around 2,500 bucks monthly for its creation. Although it's a free newsletter, I've begun to monetize through courses and consulting. From a creator's perspective, this might seem like a loss. However, with a strategic vision and understanding of the future trajectory of my business, I'm willing to take that bet every time.

The sections in bold are great examples of

giving away a low-margin product to upsell a higher-margin service

diversification as risk absorption — the highest bidder for a risk premium is the entity that can best warehouse the risk. When you can warehouse risk you attract more business, that leas to more info which can be recycled to strengthen your position further by leading you to new product/service offering to sell to existing clients. Mathew effect in full force.

This actually reminds me of the option business. Banks will “put up trades” with some clients at terrible prices because the option trade is really just a loss leader. The bank makes money on a holistic investment banking relationship with the client. As an option market maker, watching your primary business become a throw-in sweetener that a larger entity just gives away is disheartening.

The bank is just more diversified and therefore the highest bidder for the risk. It’s a profound idea that means most investments, when viewed in isolation, are overpriced. You typically need a synergetic reason(a reason why you can capture adjacent value) to compete with the highest bids.

[h/t to my buddy

for turning me on to Justin]Money Angle

I was hanging out with my homie Josh this week as our boys shot hoops. Josh gave me a couple great recs. The Danny McBride episode of Smartless and the show Vice Principals which is slaying my wife and I. McBride and Walter Goggins are live-action cartoons, I have no idea how they stay in character. [McBride steals multiple scenes in This Is The End (seriously NSFW). The rest of the cast say he’s the guy that makes them laugh. They struggle to hold it together in their shots with him].

But the 3rd rec is proper Money Angle material. Bill Gurley’s eye-opening and amusing talk:

Money Angle For Masochists

A big new option post:

👿The MAD Straddle (Moontower)

This post explores the relationship between an option straddle and volatility.

You will learn:

The relationship between MAD (mean absolute deviation) and standard deviation

how to approximate a straddle value without a model

see how the straddle is the MAD

gain an intuition for how skew and fat-tailed distributions distort the relationship between straddle prices and volatility

see practical situations where ATM straddles and therefore volatility misrepresent risk

It’s broken into 4 parts with sub-posts:

Measures of Volatility

Interpreting the Straddle

Distortions

Practical Discussion

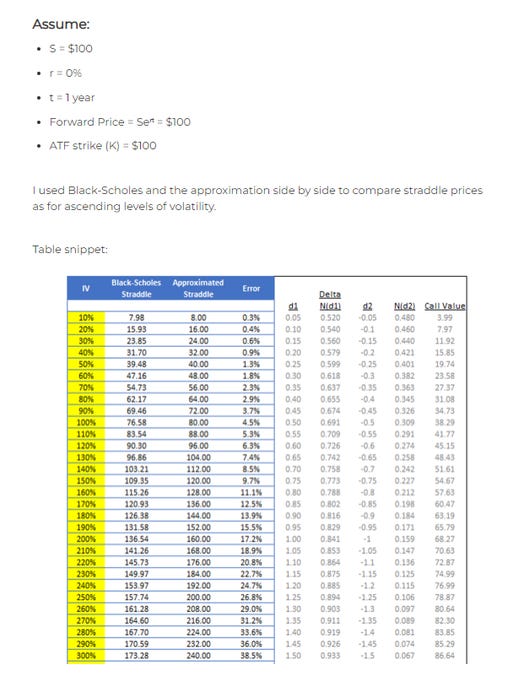

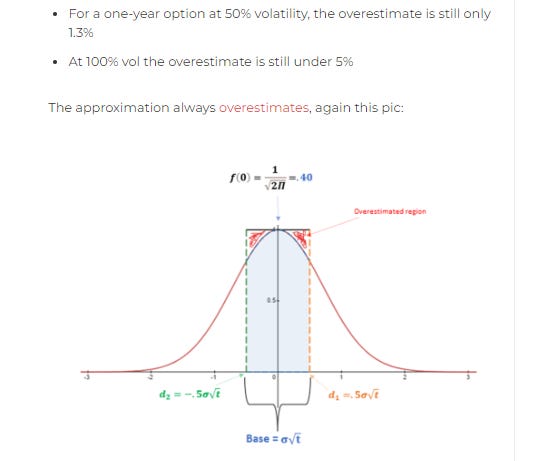

If you’re reading this section you have probably seen the ATF straddle approximation: .8 x S x σ√t

Here’s the Visual Derivation which is pretty neat because we use basic geometry instead of calculus to get to a tidy approximation that you can compute mentally.

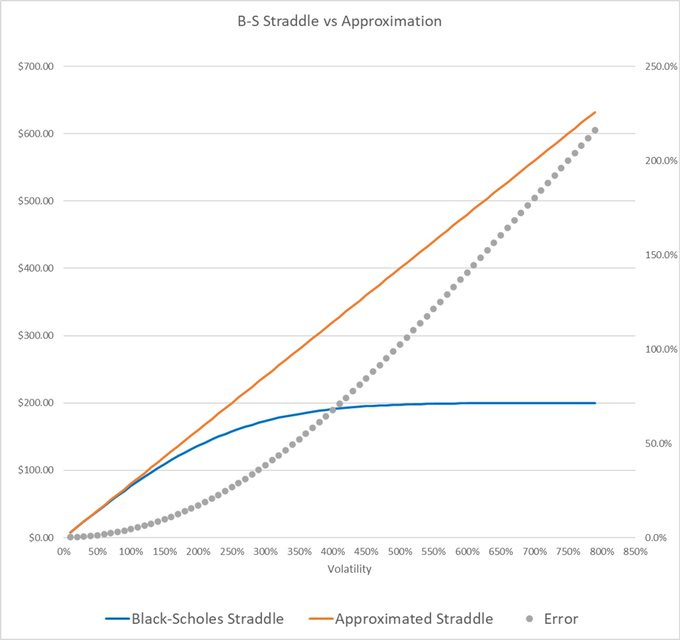

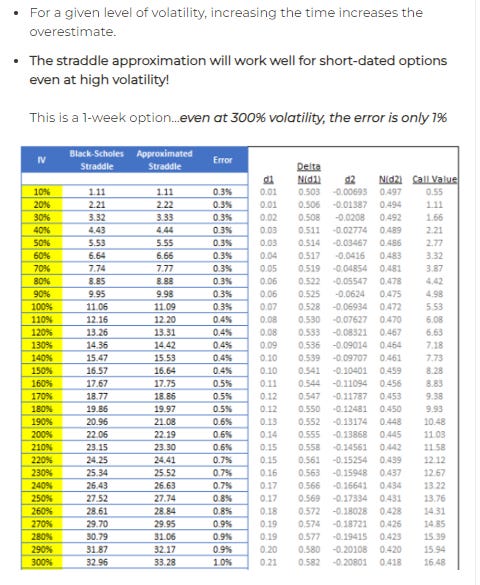

How does the approximation perform?

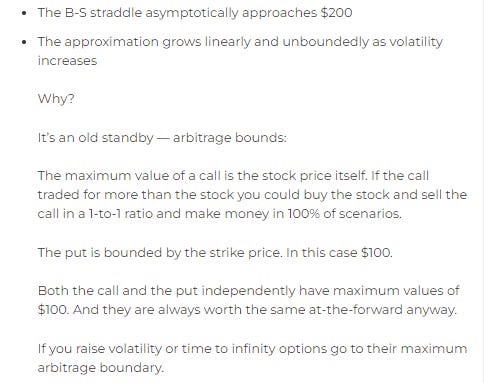

Graphically:

3 Observations

1. The approximation works well at “reasonable levels” of volatility.

2. Straddle is capped at 200% of S no matter how high volatility goes

3. Time and volatility work the same way.

Enjoy your straddles 😏

Stay groovy ☮️

Substack Meetings

I was invited to be a part of the Substack Meetings beta. You can book a time to chat. I’m more expensive than a 900 number from 1988 and have a less sexy voice.

Book a meeting with Kris Abdelmessih

Moontower On The Web

📡All Moontower Meta Blog Posts

Specific Moontower Projects

🧀MoontowerMoney

👽MoontowerQuant

🌟Affirmations and North Stars

🧠Moontower Brain-Plug In

Curations

✒️Moontower’s Favorite Posts By Others

🔖Guides To Reading I Enjoyed

🛋️Investment Blogs I Read

📚Book Ideas for Kids

Fun

🎙️Moontower Music

🍸Moontower Cocktails

Becoming a patron

The Moontower letter is and will always be free. My writing is a search “for the others”. The “others” are people like you who are unlearning the mental frames that artificially narrow our choices.

If you are here you already understand that inspiration is a tradable good. It’s not as tangible as a cup of coffee, but it packs 10x the adrenaline with an infinitely longer half-life than caffeine.

If you feel inspired, you can upgrade to becoming a patron.

"The internet is a frontier of wildcatters making ends meet in all kinds of ways"

That's good writing!