Friends,

[Turns down the volume on The Cult blasting in the background]

I’ll tell you what gets me jealous.

Being head-down obsessed with something. The feeling of being indistractable (F you Grammarly, that’s a word now). I don’t mean artificially like you just installed the Freedom app or enabled “focus mode” on your phone. I mean, you don’t even care to click on any Substack unless its title included your social security number. You got a lead foot with zero drag coefficient.

I’m jealous of this because I know what that feels like, but also because the grass is always greener. As unromantic reality is when you are in that mode, the obligations to yourself and others lapse to varying degrees. You’re waiting for a drink at the bar and your reflection in the Tom Dixon pendant peers back at you “Is that a double chin?” Or it can arrive with more drama. A calendar invite for a “Mid Life Crisis”.

We mostly find ourselves balancing between devotion and discovery. Exploit vs explore. I suspect it’s better to average these poles over time rather than try to sit in the middle at all times. Switching between the modes seems like a happier and more effective way to embrace the current setting, especially if you remember that the mode is temporary.

I left the day-to-day grind 2 years ago. Instead of spending savings on a home reno or car with suicide doors, I’m consuming a leisurely period of discovery. Like a reno, this is a consumption/investment hybrid. I’m dabbling in several projects with faith in my instincts that a worthy object of devotion will present itself. Not because things just happen, but because you do things, that lead to private information and that combined with other information hints at a jungle path you are both eager to and adapted for cutting and sweating through. It’s a highly active process. It’s not sitting back and reading (although I do want to do that too NBA2k23 and writing seem to be as still as I can sit).

This week an old friend who got laid off reached out to talk. He was giving himself a few months of explore mode but was a bit wary of its potential to be overly heady or abstract. Points for knowing oneself. I can relate. I threw the following suggestions as a sort of anchor to utility that I find helpful and he appreciated them so much he said it would be useful to others. I actually think of them as solutions to a generic rut, but to some, being thrown into discovery mode can feel like a rut.

Exercise every day. Even if it’s just a 45-minute walk.

Meet 2 new people in person every month. Coffee, hike, whatever. I got this idea from my wife who has a casual pro-bono coaching practice and this is the single biggest action item that unlocks overwhelming responses from the people who actually follow through.

This is a personal and recent one I’ve been telling people — listen to the Founders podcast. It’s a free EpiPen shot in your ass.

For the reflexive ankle-biter, I recognize there’s a midwit objection to this show — “oh it’s all survivorship bias”. This is an obvious observation and completely besides the point. The show is not a recipe. It’s an inspiration for obsessives and people in discovery mode who appreciate obsession mode. The show is repetitive. That’s one of its strongest features. My own writing is intentionally repetitive. There are only a small number of ideas that matter (this is a recursive point since one of those ideas is power law).

Communication is like rotating a shape to fit in a puzzle — angle the words in just the right way to complete the picture. Except everyone has a different puzzle and needs to see the pieces from their own special angle (this is also why objecting to things that have been done before is silly unless we for some reason are optimizing for novelty not understanding). The Founders’ stories enthusiastically harp on the few qualities that are necessary but insufficient conditions for success. The rest of any extreme outcome is luck anyway.

In addition to these suggestions, here’s a troubleshooting technique:

Track how you spend your time. Results are a lagging indicator of work — so if you are disappointed in your outcomes you should at least rule out the possibility that you are lying to yourself about your effort. Your poor results could be due to bad luck, bad timing, working on the wrong things, or honestly many factors. But the one factor you have clear control over is your effort. It’s just too easy to lie to ourselves about that. Fortunately, keeping track of time spent is just as easy.

Whatever mode you are in, embrace it. It won’t last forever and that’s why you can enjoy it without guilt.

Today’s letter is brought to you by the team at Ezra:

Ezra is on a mission to detect cancer early for everyone in the world.

In this week’s Moontower edition, the team at Ezra invites you to understand your risk of cancer for free using the Ezra Cancer Risk Calculator. In just 5 minutes and two dozen questions, you can learn what types of cancer you’re potentially at risk for.

Uses the latest research

The Ezra Cancer Risk Calculator is based on the Harvard Cancer Risk Index developed by the Harvard Center for Cancer Prevention

Considers your lifestyle

The Ezra calculator accounts for multiple lifestyle factors such as age, family history, etc..

Fully confidential

Your information is fully confidential and won’t be shared with anyone.

You can complete the 5-minute quiz by clicking here.

Exclusive deal for Moontower readers:

Should you decide to skip the quiz and sign up for an Ezra Full Body MRI scan, use the code MOONTOWER150 at checkout for $150 off your scan.

Visit ezra.com to learn more.

A personal note about Moontower’s sponsor Ezra

Last October, during the StockSlam Sessions in NYC I met the founder of Ezra, Emi Gal. We meet for a couple hours every week on Zoom thanks to a trading-related project we are collaborating on and in the process have become real-life friends (the internet FTW yet again — no internet, no Twitter, no writing online, no StockSlam critical mass, no meeting other members of your flock scattered around the world).

Emi offered to let Ezra scan Yinh and I for free. I was hesitant. I’m a hypochondriac and know if you start poking around you’re always bound to find something (knowing Bayes Theorem should be a hypochondriac’s best friend, but combatting neuroticism with logic is about as effective as denying the existence of love because it eludes “proof”. But I digress)

Emi was extremely understanding and in fact, related strongly to my feeling. But his framing swayed me. The scan is peace of mind either way. It scores every finding on a spectrum of concern from a non-event to go to the ER asap. It notes anomalies to keep track of and you can opt out of certain bits of info like you can on a genetic test. You might not want to know about things you can’t do anything about.

But why does it finding something give you peace of mind? Because you found it early. That’s the point. Early detection is the best weapon we have against cancer (1 in 8 Ezra clients discover potential cancer). As someone that’s turning 45 this summer and less-than-enthused at my first colonoscopy, this is a top-of-mind topic.

I had been approached by various companies about sponsoring this letter. Last year I had Mutiny Fund as a sponsor. They are friends of mine and I’m invested in their fund so I was stoked to have them. With Ezra, I actually asked Emi if they would sponsor Moontower.

I’m neurotic. I’ve written a bit about my personal health-hacking history. I don’t have great health genes (and this is a deeper convo but my awareness of my mortality played a non-insignificant role in my decision to leave a career that I wasn’t enjoying anymore). My sanity requires I don’t just chase down every weird feeling I get in my body, especially since getting older just means you get more weird feelings by default.

Ezra offers a low-effort, high-value peace-of-mind intervention that I want you to be aware of.

Money Angle

This is from a new post: Geometric vs Arithmetic Mean In The Wild (6 min read)

In this post, we review our lessons from last week’s Well What Did You ‘Expect’?

“Expectation” as a weighted arithmetic mean

When to use geometric mean (hint: in investing contexts)

The relationship between the 2 means

Now we move on to witnessing how the math theory fits actual SP500 history.

This Is Not Just Theoretical

I grabbed SP500 total returns by year going from 1926-2023. Here’s what you find:

Simple arithmetic mean of the list: 12.01%

Standard deviation of returns: 19.8%

These are actual sample stats.

What did an investor experience?

If you start with $100 and let it compound over those 97 years, you end up with $1,151,937.

What’s the CAGR?

CAGR = ($1,151,937 / $100)^(1/97) – 1

CAGR = 10.12%

These are the actual historical results. An average annual return of 12.01% translated to an investor’s lived experience of compounding their wealth at 10.12% per year.

Comparing the sample to theory

If you knew in advance that the stock market would increase 12.01% per year and you used the CAGR formula with our sample arithmetic mean return and standard deviation, what compound annual growth rate would you predict?

CAGR = Arithmetic Mean – .5 * σ²

CAGR = 12.01% – .5 * 19.8%²

CAGR = 10.06%

An average arithmetic return of 12.01% at 19.8% vol predicted a CAGR of 10.06% vs an actual result of 10.12%

Not too shabby.

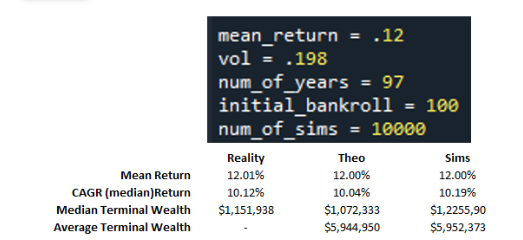

I used the same parameters to run a simulation where every year you draw a return from a normal distribution with mean 12% and standard deviation of 19.8% and compounded for 97 years.

I ran it 10,000 times. (Github code — it works but you’ll go blind)

Theoretical expectations

CAGR = median return = mean return – .5 * σ²

CAGR = .12 – .5 * .198² = 10.04%

Median terminal wealth = 100 * (1+ CAGR)^ (N years)

Median terminal wealth = $100 * (1+ .104)^ (97) = $1,072,333

Arithmetic mean wealth = 100 * (1+ mean return)^ (N years)

Arithmetic mean wealth = $100 * (1+ .12)^ (97) = $5,944,950

The sample results from 10,000 sims

The median sample CAGR: 10.19%

The median sample terminal wealth = $1,2255,90

The mean terminal wealth: $5,952,373

Summary Table

The most salient observation:

The median terminal wealth, the result of compounding, is much less than what simple returns suggest. When you are presented with an opportunity to invest in something with an IRR or expected return of X, your actual return if you keep re-investing will be lower than if you take the simple average of the annual returns.

If the investment is highly volatile…it will be much lower.

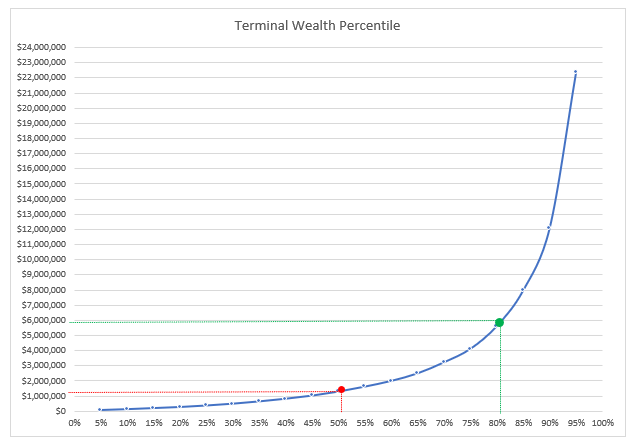

The distribution of terminal wealth

The nice thing about simulating this process 10,000x is we can see the wealth distribution not just the mean and median outcomes.

Remember the assumptions:

Drawing a random sample from a normal distribution with a mean of 12% and standard deviation of 19.8%

Assume we fully re-invest our returns for 97 years

And our results:

The median sample CAGR: 10.19%

The median sample terminal wealth = $1,2255,90

The mean terminal wealth: $5,952,373

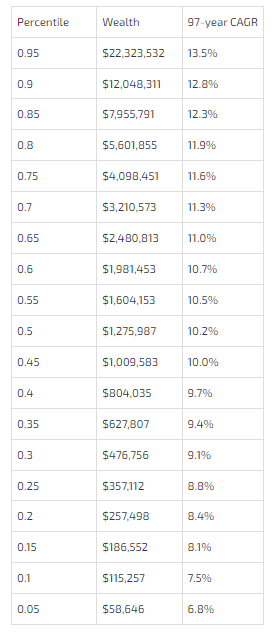

This was the percentile distribution of terminal wealth:

The mean wealth outcome is 5x the median wealth outcome due to a 2% gap between the arithmetic and geometric returns. The geometric return compounded corresponds exactly to the median terminal wealth which is why we use CAGR, a measure that includes the punishing effect of volatility.

In terms of mathematical expectation, if you lived 10,000 lives, on average your terminal wealth would be nearly $6mm but in the one life you live, the odds of that happening are less than 20%.

The chart was calculated from this table:

Note that, also 20% of the time, your $100 compounded for 97 years turns into $257,498 or a CAGR of 8.4%. A result that is 1/5 of the median and 1/20 of the mean. Ouch.

So when someone says the stock market returns 10% per year because they looked at the average return in the past, realize that after adjusting for volatility and the fact that you will be re-investing your proceeds (a multiplicative process), you should expect something closer to 8% per year.

And one last thing…you should be able to see how rates of return, when compounded for long periods of time, lead to dramatic differences in wealth. Taxes and fees are percentages of returns or invested assets. Make sure you are spending them on things you can’t get for free (like beta).

A Question I Wonder About

(This might venture into masochism for casual Money Angle readers)

If you draw a return a simple return at random from a normal (ie bell curve) distribution and compound it over time, the resultant wealth distribution will be lognormally distributed with the center of mass corresponding to the CAGR return.

We saw that theory, simulation and reality all agreed.

Or did they?

The simulation and theory were mechanically tied. I drew a random return from N [μ=12%, σ = 19.8%] and compounded it. But reality also agreed.

It may have been a coincidence. Let me explain.

Stock market returns are not normally distributed. They are well-understood to differ from normal because they have a heavy fat-left tail and negative skew.

The fat-left tail describes the tendency for returns to exhibit extreme (ie multi-standard deviation) moves more frequently than the volatility would suggest.

Negative skew means that large moves are biased toward the downside.

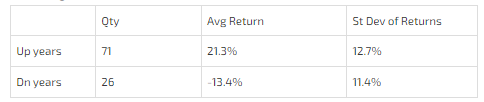

These scary qualities are counterbalanced by the fact that the stock market goes up more often than it goes down. In the 97-year history I used to compute the stats, positive years outnumbered negative years 71-26 or nearly 3-1.

The average returns, whichever average you care to look at, is the result of this tug-of-war between scary qualities and a bias toward heads. With the distribution not being a normal bell curve it feels suspicious that the relationship between CAGR and arithmetic mean returns conformed so closely to theory.

I have some intuitions about negative skew (that’s a long overdue post sitting in my drafts that I need to get to) that tell me that in the presence of lots of negative skew, volatility understates risk in a way that would artificially and optically narrow the gap between CAGR and mean return. By extension, I would expect that the measured CAGR of the last 97 years would have been lower relative to the theory’s prediction.

But we did not see that.

I have 2 ideas why the CAGR was held up as expected, despite non-normal features that should penalize CAGR relative to mean return.

Path

In Path: How Compounding Alters Return Distributions, we saw that trending markets actually reduce the volatility tax that causes CAGRs to lag arithmetic returns. It’s the “choppy” market that goes up and down by the same percent that leaves you worse off for letting your capital compound instead of rebalancing back to your original position size. The volatility tax or “variance drain” occurs when the chop happens more than trends (holding volatility constant of course). But since the stock market has gone up nearly 3x as often as it went down perhaps this trend compounding “bonus” offset the punitive negative skew effect on CAGR.

What negative skew?

Using annual point-to-point returns, I’m not seeing negative skew.

I’ve exhausted my bandwidth for this topic so I’ll leave it to the hive. Hit me up with your guesses.

Money Angle For Masochists

For those who want to take the concept of compounding to the limit (of Δt→0 that is, muahahaha), see another new post:

Understanding Log Returns (2 min read)

This post will help you understand the concept of normalizing distance in option theory. Strike prices are in absolute dollars and transforming them into percent moneyness is still not exactly the right way to compare distances. In practice, you use delta or standard deviation, but even underneath those rulers is the concept of a log return.

In this short post, I dwell on log returns because it’s often taught quickly leaving that foggy “I think I get it” feeling in a student.

Again, I’m being explicit in my use of repetition and a slightly different angle to see if it works for you.

One last thing…

Back in October Tina Lindstrom, Mike Steiner, and I hosted 3 nights of what we called the StockSlam Sessions in NYC.

We are bringing the event to the Bay Area March 8, 9, and 10th.

It’s totally free. If you like learning about games, math, trading, decison-making, and like shouting and thinking quick, you will love it!

It’s a total privilege to be a sherpa for these sessions. No egos allowed. No experience required.

Based on my experience and the feedback from NYC, the social aspect and chance to meet new friends was truly unique and uplifting.

Apply here!

Stay groovy!

Substack Meetings

I was invited to be a part of the Substack Meetings beta. You can book a time to chat. I’m more expensive than a 900 number from 1988 and have a less sexy voice.

Book a meeting with Kris Abdelmessih

Moontower On The Web

📡All Moontower Meta Blog Posts

🧀MoontowerMoney

👽MoontowerQuant

🌟Affirmations and North Stars

✒️Moontower’s Favorite Posts By Others

🔖Guides To Reading I Loved

📚Book Ideas for Kids

🎙️Moontower Music

🍸Moontower Cocktails

Becoming a patron

The Moontower letter is and will always be free. My writing is a search “for the others”. The “others” are people like you who are unlearning the mental frames that artificially narrow our choices.

If you are here you already understand that inspiration is a tradable good. It’s not as tangible as a cup of coffee, but it packs 10x the adrenaline with an infinitely longer half-life than caffeine.

If you feel inspired, you can upgrade to becoming a patron.

Hi Kris, and thank you for your interesting articles (which I just recently found).

I believe the key to why normal distribution can be used to model long-term annualized returns is the fact that compounding over time involves adding log returns.

The fact that log returns are additive over time means that the law of large numbers applies to geometric (log) instead of arithmetic returns implying the average annualized return over time converges to geometric expectation.

On the other hand, adding a large number of short-term log returns over time and calculating their yearly mean implies that central limit theorem can work its magic and make the distribution approximately normally distributed no matter what the original log return distribution was.

Back when I made the comment about survivorship bias, it wasn’t meant to be dismissive. I think the show is fantastic; I’ve probably read 4-5 biographies since I started listening - I have a newfound admiration for the genre and what it can bring a reader. The show is also quite inspirational and I think your description of its merits hit the mark.