Friends,

Gather round. Let’s just chop it up in no particular order.

On Monday, I fired off an impromptu email with a trade I was doing. Disclaiming of course that it’s not a recommendation. I have no licenses and I’m not qualified to give financial advice. Buyer beware and all that. I sent it to paid subs only.

Actually, let me clarify the paywall. Last year I added some paid tiers on Substack. It was like $150/yr. There was also a $500 annual OG tier. For $150, it was just a chance to support the letter and OGs had that satisfaction plus a Zoom or IRL chat if they wanted. In other words, there was no extra content for paying. It was just a tip jar. I support other writers even if the content is free so I understand the impulse. Who am I to deny givers. So put the tiers in.

I have a friend in my book club who is a marketing ninja (people throw such superlatives around but this mf’er charges really high rates for good reason). He offered to “look at what I’m doing on the internet” pro bono. He saw how many people were supporting Moontower at the regular and especially OG level and remarked it was quite unusual for those percentages considering they weren’t getting any extra content. Paraphrasing: “Kris, people want to pay you. You just don’t give them an excuse. For many people it’s hard to pay for something even if they want to because the official price is zero. It’s a psychology thing.” Reminded me a bit of the “penny problem”.

I explained to him that I actually felt guilty or a sense of reciprocity for not delivering anything extra. But I feel strongly about giving away a lot for free. Charging also felt off.

Taking a longer, realistic view — time is time, and I give this letter a lot of time. I’m not some alien for whom this comes easy for. So the eggshell that idealism always rests in has cracks in the form of opportunity cost. The compromise to satisfy both my guilt and test his thesis that more people wanted to pay was to paywall a small fraction of my writing.

Anyway, that’s the genesis of the paywall. I’m happy with the mix. I feel better about all the guilts — opportunity cost of time, giving extra to payers, and not withholding what I hope is value for people who won’t or can’t pay.

The paywall also seemed like the right venue for sharing a trade I was doing. It’s a bit safer space since I don’t think anyone pays to hate-follow.

I’ll add— if you converted to paying because you think I discuss trades all-the-time you’ll be disappointed. I suspect I might do it more especially as my personal trading infra gets better with moontower.ai but I’d rather underpromise on the writing and let this place be a source of pleasant surprise instead of having it start from a transactional place where I feel the invisible pressure of coming up with stuff for the sake of delivering something that sounds useful. If I tell you I like something it’s because I do it. And it might be dumb. But that’s why it’s never a recommendation. You can only count on me translating what the turd-throwing monkey in my brain says back to you. You decide if that’s worth paying for, either way I’m publishing plenty of free stuff and some not free.

Moving on.

I did in fact do a trade. If you follow me on Twitter, I’m transparent and I even shared screenshots. I’m more Whimpering Puppy than Roaring Kitty but my real-time thought narration is less cryptic than memes. SO, I have that going for me.

I bought the GME June 20/30 call spread unhedged. I only bought 20. My intention was to buy 100. I was comfortable risking about $25k. I got filled at $2.08 giving me almost 4-1 if the stock expires $30 or higher. Unfortunately I left a bunch of dead soldiers (unfilled orders) behind and the stock got up to $30 the same day. $4k turned into $8k and I’m just mad. As Agustin Lebron preaches in Laws of Trading — “you are never happy with the size you trade”. It’s always too much too little in hindsight.

Although I didn’t share the trade idea in the free substack, I did share lots of thoughts publicly:

Messing around a bit. Used an option calculator and ran 300% flat vol sheets vs skewed vol sheets that roughly fit the market just to see how different the distributions are (stock ref $25 in $GME)

Which was a follow-up to:

Flat vol is what old people would call flat sheets. As if you ran the same vol on every strike. My gut market on this call spread if I'm allowed to be wide would have been $7.75-$8.75 knowing it was volatile squeeze stock with 2 weeks to expiry.

[This isn’t actually a short squeeze but it’s the only mental model I can match it to]

Looking at the table, my $7.75 bid would simply get tattoo'd. Anyway, hoping tomorrow the setup invites a little gamble. If we get more of the same flow as today, I'll get the chance.

Back to the butterflies:

Fly density is just butterfly centered on the middle strike divided by the strike width. This is why vertical spreads are model free bets on the distribution. A lot of call skew or vol pushes the modal outcome to the left.

High call skew makes call spreads cheaper which implies lower probabilities of the stock going up. Which is why my original tweet is looking at how cheap the call spreads are and the market implying the stock lower.

Here's one more this time including what a regular 30% stock distribution looks like to the picture (again using flat vols):

You are getting unusually high odds to bet the stock is not going down by June expiration.

This is the same idea I've pointed out in winter gas or H/J nat gas CSO's. When call skew is nuclear or stocks short squeeze for options market bidding for upside actually implies the stock is probably going to drop (which is consensus in a squeeze...it's just a matter of when and how fast).

The down moves are stabilizing. Think of the up move as potential energy of a stretched rubber band. No matter how far you pull it the expected snap back point is the same. In fact, the bigger the squeeze the more likely the capitulation happens because the last short says uncle and represents the last buyer. There's nobody left to buy.

This is why when when assets squeeze the put spreads get expensive. Consensus is down not up. Up is destabilizing, higher vol territory. Remember how you want to own the options AWAY from where it expires.

This is a classic demonstration. The market wants the options in the direction of the skew. It wants the "it probably won't get there but if it does things are gonna break, yee haw!" It doesn't want the options of where the stock will land. Or inverting, where the options are cheap (the cheapest body of a fly, therefore the most expensive butterfly) is where the stock is implied to land.

This account had good questions. I gave my best answers.

One account rebutted that options don’t just sit overnight with positive EV sitting in them.

Hey, I mostly agree. But this is a coin flip I believe the odds compensate for. Nobody knows where it's landing. If RK rolls or changes his position the odds change...the most egregious dislocations in the surface probably fair up and something else breaks. In the tree of possibilities, the trade can work simply by the turn card coming out (ie new information in the form of flow that shuffles the deck in a new way). I don’t need to take this into expiry. I think there’s edge in the levels.

Here’s the thing — nobody has some quant model that knows where this thing is landing. This is a pure trading situation. Of course, I can be wrong. Hell, I told my wife I’d guess I have a 50% chance of incinerating the premium which is much higher than what flat sheets or a lower vol name would suggest.

But I have several ways to win. If go to the grave with these, I do think I’m getting odds because the market had to absorb this flow by moving the spread. It can’t diversify it away. Another way to win or at least manage the position comes from trusting my judgement on how to think about the matrix. You do this long enough, you chunk an options board the way a chess player chunks familiar patterns. “Hmm, that fly looks too cheap compared to that one…ahh when I try to execute I find out it’s not really there”.

As trading goes, this is not the hard part. What’s hard is when things are grinding tick by tick. That’s a miserable nerd market that burns my eyes. I don’t have opinions on stuff where everyone can think all day and night about what something is worth. In fact I don’t have opinions often. Right back to the “options don’t just have positive EV sitting in them”.

I do think you can make better decisions in the options landscape but that not the same bar as being a pure alpha option trader. That last bar is really high. The market likes to give you false directions to that party. It’s important to know what circumstances your heuristics are more likely to apply. Trading requires the tacit knowledge of when to switch gears between “I need to act without full info but right now I can act with even less info because the amount of info anyone has is not as high as it usually is”.

One last bit.

The reason I even looked at GME closely was serendipity. A friend had an angle on GME he wanted to bounce off me. It was a pet idea. Kind of weird but also something I thought similarly about in the psychology (which I don’t think is a view most people managing money would come to). It’s not a 4D chess thing either which is something I’m generally skeptical of anyway.

But chatting yesterday, he made an off-hand comment that highlighted why options are so interesting.

He texted:

all the probabilities are skewed to make people get long lol

This is exactly, what the cheap call spreads do. Which is why we say “they imply the stock much lower”. Again look at those fly distribution pics. You only make that statement if you understand options. But here’s the rub…what is the counterforce? What’s the thing that makes people want to get short not long?

The stock price itself.

It says get short. If you have an investor’s horizon you think, why is anyone paying $9B for a couple billions worth of T-bills*? Meanwhile, the options offer odds to get long.

[*On Wednesday it came out that the at-the-money share offering raised $2B….hmm and all it took was a few days of the stock trading in the 20s to absorb it…sounds bullish to me.]

The question of fundamental value has zero relevance to the now. It’s like using a yardstick to take the temperature. Don’t mix up the dashboards you use for long-term ideas for the gauges you use to consider the short-term.

And finally, we couldn’t resist…

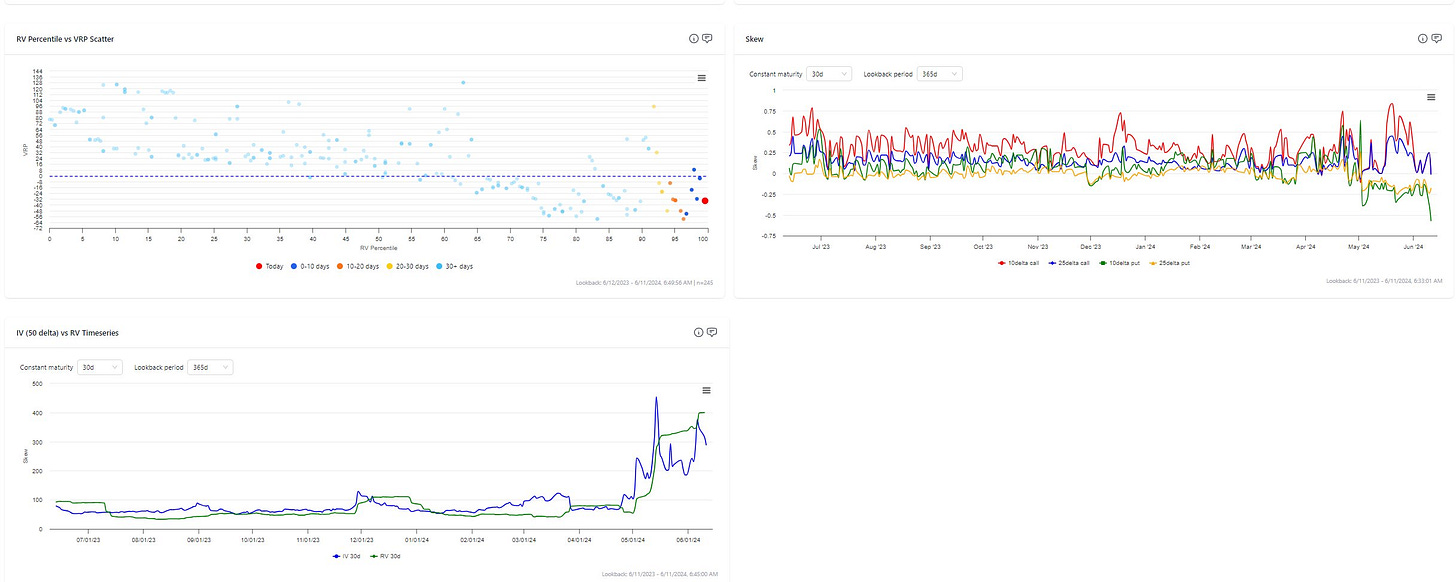

while we are about to double our ETF coverage on moontower.ai we just had to add GME.

Seriously, I’m stoked about how moontower.ai is coming along.

(If you use options, you should check it out. If you are just curious you can still sign up for free for the educational materials and MoontowerGPT)

A collateral benefit of the moontower.ai work is personally getting to spend more time in Jupyter notebooks as I sandbox ideas that are coming down the pipe. Coding is not a personal strength, I rely on Copilot A LOT. I only recently started using Git. But getting to build, learn, write, code, and bring together analytics in a way that leads to better decisions, practical actions, and teach is a super satisfying way to spend time. [By the way, nothing I code goes into production, that would be malpractice.]

These opportunities wouldn’t have come together if you didn’t give me a little hamster wheel in your brain to run on. I know if I do a good job on all fronts that elusive sweet spot of “sustainable because it’s valuable” and satisfying is possible.

So thank you.

Stay Groovy

☮️

Need help analyzing a business, investment or career decision?

Book a call with me.

It's $500 for 60 minutes. Let's work through your problem together. If you're not satisfied, you get a refund.

Let me know what you want to discuss and I’ll give you a straight answer on whether I can be helpful before we chat.

I started doing these in early 2022 by accident via inbound inquiries from readers. So I hung out a shingle through the Substack Meetings beta. You can see how I’ve helped others:

Moontower On The Web

📡All Moontower Meta Blog Posts

👤About Me

Specific Moontower Projects

🧀MoontowerMoney

👽MoontowerQuant

🌟Affirmations and North Stars

🧠Moontower Brain-Plug In

Curations

✒️Moontower’s Favorite Posts By Others

🔖Guides To Reading I Enjoyed

🛋️Investment Blogs I Read

📚Book Ideas for Kids

Fun

🎙️Moontower Music

🍸Moontower Cocktails

🎲Moontower Boardgaming