Pricing 0DTEs

Friends,

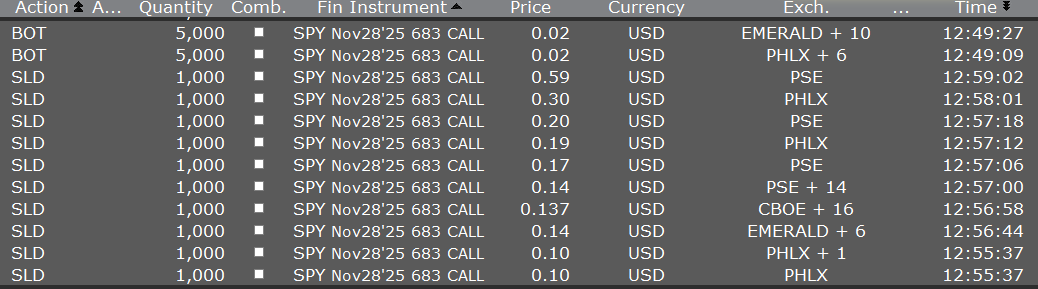

On the last day of November, Kevin bought a bunch of cheap SPY options about 10 minutes to the close and scored. Trades:

Looking at this prompted me to write this post which I’ve had on my mind for a long time: how to think about 0DTEs (or from the bulk of my historical experience — options on the last trading day).

The moontower.ai uses a “volatility lens” for discernment in the option market. But we don’t have a suite of tools for analyzing 0DTE. If we did, we would use a different approach than we do for options broadly. (I’m nothing if not opinionated about how to think about options and being opinionated is part of what you pay for.)

I’ll give you a hint. To think about 0DTEs properly, you must think about time. Any consideration about “vol” can easily be swamped by what you assume about time.

I’ve written about time in options before:

[The closest hint as to what we’re going to build on was a birdie asked how to model a 1-day option]

But these articles do not address intraday time decay. Option theta is large on the last trading day, while vega is small. 0DTE option pricing is far more sensitive to “How much time remains until expiration?” than notions of volatility.

But the question of how much time remains until expiry is not so simple. Without a concept for how much time remains, we can’t appreciate whether Kevin’s trade was a lucky outcome or strong ex-ante decision.

We’ll unpeel the problem, and in doing so, you’ll get a new view into 0DTE prices.

The most effective way to do this will be to build from a naive model of time passage to a more realistic one to see how it influences option values.

Note: This topic just got way more timely (pun most definitely intended) in light of the Nasdaq’s SEC bid to increase trading hours to 23 hours per day.