Friends,

Happy New Year!

My kids are still on break so I wasn’t going to resume publishing until next week but I miss you.

First some admin…

I’ll start with saying there’s a bunch of stuff in the works in Moontower-land. One thing that’s directly relevant for readers is in addition to the 2 weekly posts, I’ll be sending out subscriber-only posts. I want to discuss the thinking with that.

First, about 2% of people who open these emails already pay me despite getting nothing extra. It feels so generous and affirming. It fans 2 thoughts:

I want to give you more

More than that 2% probably want to pay me but need me to make it easier for them. There is a psychology at play where they want an excuse. I love giving $$ to work I appreciate. I’m not special in that regard. Giving feels amazing but there’s a reverse penny problem gap that makes it easy to forget.

By giving more I address both problems.

I haven’t fully fleshed out everything paid subs get but it will at least be the following:

Additional ad-hoc posts. These mostly will be more personal. Thoughts about life and investing that I’d feel more comfortable sharing with a smaller group. Ideas or tools that have narrower appeal but are high value to those who specifically care about them.

Over-the-shoulder streams where I can talk to a smaller group or walk-thru some of my technical posts in some quasi-lecture format. I like to learn from video but I don’t have much appetite for producing videos. Casually streaming a lesson just skips a bunch of faffing that I’m not currently interested in.

For non-paying subs you still get 2 posts a week and everything you’ve already become accustomed to. Anything that is broadly useful would also be free both from the archive and going forward. And I can always unpaywall something that turns out to have wide relevance.

Returning knowledge to the world that I am lucky to have been exposed to is a privilege. Getting paid for a fraction of it helps make it more sustainable by allowing me to balance the opportunity cost a bit better since I have some professional developments that will require more of my time while not being immediately remunerative.

Moving on…there’s a lot of buildup from not writing for a few weeks. I’ll choose mercy and resist the urge to dump 40 thoughts and links on you all at once.

(The bottleneck to writing a daily letter is definitely not thoughts or content but an utter inability to harness the urgency to do such a thing. Immature and a little self-loathing. I don’t recommend.)

So I saw this tweet:

God bless entrepreneurs for their optimism. I mean that seriously. But I feel compelled to respond. First, know there are valid responses in the thread (survivorship bias, “look at Japan”, etc).

Let me add a more involved take.

Regular readers know investors must be concerned with compounded returns since investing is re-investing. I start with $100 earn 10%, then reinvest $110. It’s a multiplicative (geometric) series.

The median terminal wealth of such a series is highly sensitive to volatility. If you flip a coin for 10% of your wealth your median result is losing 1% of you wealth even if the coin is fair. 1.10 x .90 or .90 x 1.10 is 50% of the distribution.

[The fact that you make 1.10 x 1.10 25% of the time and .90 x .90 25% of the time makes the sum product of all 4 possibilities 0, but the median terminal wealth is still .99]

This is know as volatility drag. I’ve written about that many times. The defined relationship between volatility and median returns is not linear because the volatility term is squared.

As volatility or annual standard deviation goes to 40% your CAGR is 1/2 your mean return.

A simple rebuttal is “The stock market has only about 15% volatility which is minimal drag”.

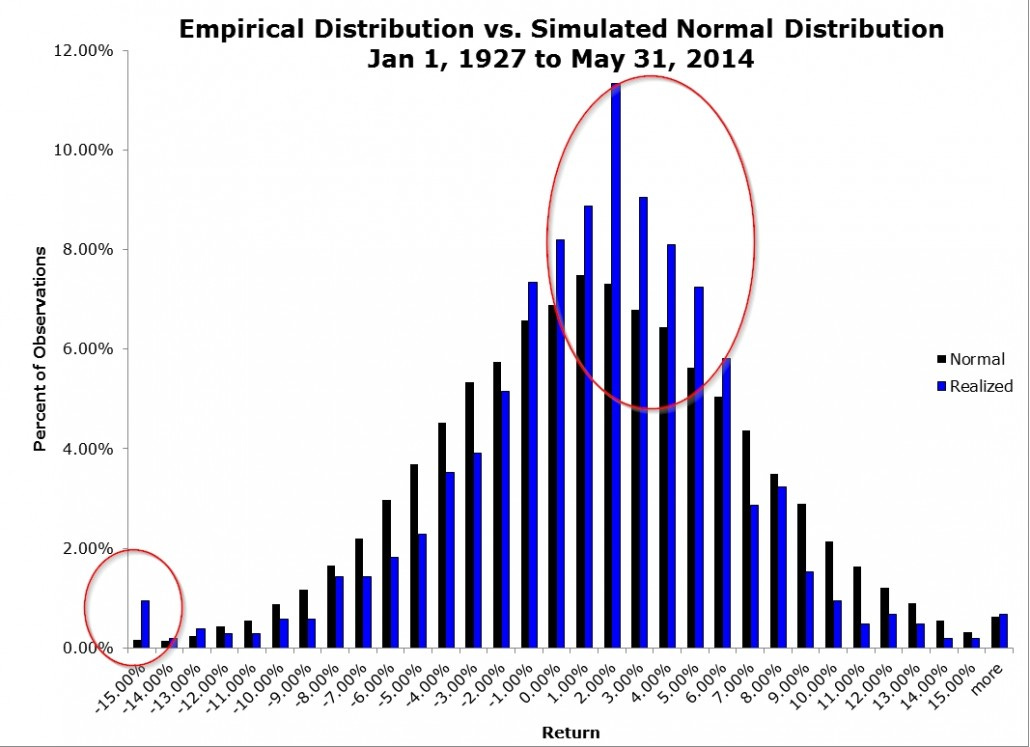

The issue is that standard deviation is only a first order risk. It fails to describe the full distribution. Worse yet, this measure of risk is suppressed by the fact that returns are bell shaped but have a fat tails and left skew.

If long-term stock market volatility is 15% per year than a 3 standard deviation event would be a loss of 45%.

That occurs .135% of the time or once every 740 years. [3 standard devs covers 99.73% of a normal distribution and we are only talking about the left tail — .27% * .5]

Once in 740 years?? 1987, 2001, 2008, and 2020 would like a word with you.

The fat left tail is self-evident.

How much does it matter? We already saw how first order risk (volatility) drags down returns mechanically but let’s just say our returns compound at 9% per year but every 20 years we have a 45% drawdown.

This would be my ever-so-succinct response to Austen’s question:

For a CAGR of…5.3%

One 45% drawdown in 20 years will nearly halve your CAGR. Large losses are have an insanely non-linear impact on the wealth creation function.

If you lose X% you need to return X/(1-X)% to get back to even.

Let’s suppose you add bonds to the mix. Here’s a summary of 20 year returns assuming 100% stocks vs 50% stocks + 50% bonds yielding 4%:

If you think there can be a 45% drawdown in stocks in 20 years (the orange shaded region), the CAGRs of the diversified portfolio and all-stock portfolio are much closer than intuition would have you believe.

I’ll leave that for you to ponder.

As far as situating this in your mind, you could think of a 4% bond return as something like a small risk-premium over inflation but you could also just assume 4% inflation and this whole analysis reduces to stocks earning 5% real returns (optimistic case) vs 3.5% (more typical case). These are well grounded assumptions (see Nick Maggiulli’s post How Much Growth Can You Expect?).

Munger (RIP) would think they are optimistic.

Look, tech founders need optimism to do their jobs. Their tweets reflect that it’s a chronic, body-wide condition. And to be fair, the rest of us need optimism too. But you’re already long optimism whether you want to be or not. Going 100% stocks is doubling down on that via a random number generator.

I’d rather diversify where I have the least edge, and double-down where I know things.

Then again, I don’t get 2400 hearts on my tweets so wtf do I know.

Stay groovy ☮️

Substack Meetings

I was invited to be a part of the Substack Meetings beta. You can book a time to chat. I’m more expensive than a 900 number from 1988 and have a less sexy voice.

Book a meeting with Kris Abdelmessih

Moontower On The Web

📡All Moontower Meta Blog Posts

Specific Moontower Projects

🧀MoontowerMoney

👽MoontowerQuant

🌟Affirmations and North Stars

🧠Moontower Brain-Plug In

Curations

✒️Moontower’s Favorite Posts By Others

🔖Guides To Reading I Enjoyed

🛋️Investment Blogs I Read

📚Book Ideas for Kids

Fun

🎙️Moontower Music

🍸Moontower Cocktails

One of my favorite posts you've written

If we have a long term expected return on the sp of about 8-10%(?) Shouldnt we increase the 19 years to counter the year of the simulated drawdown? Or am I just proving my misunderstanding 🙃

Have a nice day!