Friends,

When I worked at Parallax I used to carpool with 3 good friends I worked with. On our rides back and forth, we frequently talked about trading situations that came up on the desk, “Yesterday a broker showed me this, I responded with that, how would you have handled it?”

It was the equivalent of game film for trading. I used to joke that if we recorded the calls on Periscope (remember Periscope?) it would be must-see tv for the fintwit crowd.

Given privacy and compliance, it was a non-starter idea. More broadly I thought that what I call“over-the-shoulder” educational material would be popular. The same way you watch Twitch to see how someone plays a game. Watching their mind work in real-time. Or watching somebody learn to play a song on the guitar by ear especially if they haven’t heard the song before. You pick up a bunch of stuff from what’s typically left out of a scripted tutorial. The mistake they make and how they correct it. Or how they started in the first place with the equivalent of a blank sheet.

I want to hear their reasoning out loud. I want it to be raw.

A few years ago, I watched this guy solve an insane sudoku as he narrated his thinking. It's one of the most delightful YouTube videos I've ever watched.

On the heels of the Moontower Discord Voice chat I hosted a week ago, I thought heck let me try my hand at an over-the-shoulder video. I planned to talk about how to think about synthetic futures in the options market. I opened up my Interactive Brokers account option chains and a spreadsheet and just started riffing.

Since I did no prep, I figured instead of just recording a video I’d just livestream on X/Twitter. From one thought to the next, I end up covering almost an hour of info.

The feedback to what I saw as merely an experiment was tremendous. It got nearly 13k views and lots of love. I guess I’ll be doing more of this kind of thing.

I uploaded it to YT. I hope you find it useful.

An unscripted tour of key option concepts as I look at live data including:

Synthetic futures

Implied interest rates

Reversal/Conversions

Box rates

Tracking structures in IB

P/L attribution of a strangle

Tickers used: TSLA IBIT SPX

Money Angle

Trump launched a memecoin on Friday night. One wallet (presumably his) owns 80% of it. At the time I’m writing this, he’s $24B richer.

You read that correctly. “B” like 🐝

Anyway, there’s a vesting period and no obvious way how he can monetize this without crushing the price. Maybe he can force a bank or another country to accept it as loan collateral. Or maybe he can demand the Treasury to buy it to diversify strategic reserves like its gold.

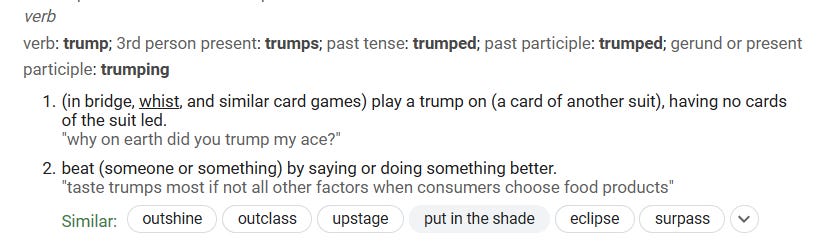

I’m kidding. I don’t think he can do such things. But also, if there’s a will there’s a way and I suppose a man named “Trump” ridin’ the mother of all heaters is some kind of cosmic onomatopoeia.

Anyway, this brings me to 2 tweets I saw pretty close together on the timeline.

In the early 2000s, I was in a fantasy football league that didn’t have a waiver system. Free agency 24/7 all week. The rules rewarded crackheads who followed football every second, ready to jump online to secure Denver’s backup RB when the starter’s knee exploded live TV. In other words, derelicts like myself who didn’t have a family in their 20s.

Today, I would never be in such a league. Not my speed anymore.

In fact, one of the reasons I left full-time trading was because it’s out of phase with how I want to live. I was never a news junkie. Having a job that required you to be on top of the news became an energy-suck. Playing a video game Trading for Living has a particular cadence.

Cadence. Rhythm. These are important dimensions in matching yourself to what you do.

Trading is different than a lot of desk careers. It’s a bell-to-bell job. Not a lot of homework. No deadlines.

But the best trade of the day can happen at 10:04 in the morning and if you were in the bathroom, you might as well have stayed home. Need to run an errand midday or meet someone for lunch? That can wait. For 30 years. You might make millions but you’re chained to a desk like a 9-year-old who has to raise her hand to go to the bathroom.

The point isn’t to say what’s better or worse. It’s just that trading has a pace and if you like to read peacefully, deliberate decisions slowly, and avoid paranoia you will find the environment stressful. Not to mention the boredom. A trader is like an EMT or firefighter on a slow day. Waiting but ready. Boredom is major problem for exactly the kind of people who think trading would be a great way to be in the action. You fold a lot of hands. But that takes discipline. Lapses in willpower or even a lack of sleep can seduce you into “loosening” your starting requirements to see the next card.

Those tweets above combined with FOMO and the proliferation of “if you can’t beat em, join’em” rationalization is gonna lure people towards spending their brain cycles on things that will feel deeply unfulfilling and that they are poorly matched to.

If you’re a financial thrillseeker these times are for you. If you are a builder or craftsperson, technology tools are accelerating. More power at your fingertips.

Either way…let your focus anchor you.

Why do you do anything? Maybe go a few whys deep. The alternative will be being battered by the waves. Adrift. And angry. There’s going to be a lot of games happening in front of your eyes. Some say there always have been, at least now it’s out in the open. Touche. But there are consequences to that too.

Are you better off or worse off?

It’s a deeply personal question. I am increasingly of the belief that within a decade, your own whys will be the only questions. We are leaving a world where people (at least people with the luxury to read substacks) just compile their parent’s script. Doing things because it just seems like the next thing to do.

It won’t make sense to do that in the same way it doesn’t make sense to describe a color as round or a chord as wet.

Money Angle For Masochists

I am sharing this with permission from a professional option mm who sent it to me. I deleted any identifying info. The person has been reading moontower for a long time and was graciously sharing.

Thought I'd share a few things I've learned. Most will be obvious to you, but maybe a nugget in here for one of your posts.

1) Starting with the obvious: market making is the hardest way to make an easy living. You can grind it out every single day scraping away ticks for edge, and at the end of the day your outcomes are decided by liquidity and volatility. They're the two things you can't control, and they're the two things that determine your fate. This isn't true for everyone, but it's certainly true for [redacted].

2) I firmly believe that actively trading is not sustainable for sane human beings. Managing an options portfolio is like taking care of a baby. It's a living organism that constantly needs to be tended to. If you neglect it, it will die. The amount of mindshare it takes up and context-switching is just simply unmanageable over long periods of time. The intensity it takes to perform at your best during market hours takes a beating on the human body. The guys on my team are [ages redacted] and look like they're [redacted]. Besides a few partners, I don't know a person here that doesn't have a drinking problem. This is anecdotal, but I see it from other groups too.

3) Trading vol is easy. Managing a position is hard. I'm convinced you need to be borderline OCD to manage a book. Between the pruning of positions and the fine-tuning of the model, you have to have an insane attention to detail to get an acceptable slide.

4) You're always underpaid until you're a partner or PM. I won't go into detail on this one because you did a whole blog post on it (maybe it was just a tweet idk). I'll just say that you nailed it.

[Kris: See Getting Less Screwed On Compensation and adverse selection in the option job market]

5) Like most things, luck is the difference between 0 or hero in this industry and it doesn't matter if you trade long or short. I've seen groups blow up in a matter of days. I've seen groups that should've blown up and then came back to make a fukin stupid amount of money from continuing to hold short.

From My Actual Life

5 years ago this same long January weekend was tough.

I tried to find the perspective in the stress. All turned out well, so don’t feel uncomfortable reading it.

Revisiting A Note From The ER

Stay Groovy

☮️

Moontower Weekly Recap

Need help analyzing a business, investment or career decision?

Book a call with me.

It's $500 for 60 minutes. Let's work through your problem together. If you're not satisfied, you get a refund.

Let me know what you want to discuss and I’ll give you a straight answer on whether I can be helpful before we chat.

I started doing these in early 2022 by accident via inbound inquiries from readers. So I hung out a shingle through the Substack Meetings beta. You can see how I’ve helped others:

Moontower On The Web

📡All Moontower Meta Blog Posts

👤About Me

Specific Moontower Projects

🧀MoontowerMoney

👽MoontowerQuant

🌟Affirmations and North Stars

🧠Moontower Brain-Plug In

Curations

✒️Moontower’s Favorite Posts By Others

🔖Guides To Reading I Enjoyed

🛋️Investment Blogs I Read

📚Book Ideas for Kids

Fun

🎙️Moontower Music

🍸Moontower Cocktails

🎲Moontower Boardgaming

The money angle for masochists rings especially true.

I think part of the physical toll (2) is your mind being forced to wrangle with the outcomes of luck and distributions (5)

Re: Parenting you may enjoy Yeager’s book 10 to 25.