Options trading as a widget factory

Edge Functions: the hurdle for a trader's unit economics

Friends,

This is part 2 to last week’s When it's normal to have no idea what your returns are

Traders don't think about rates of return explicitly in the same way traditional investors or fund managers might. A trading firm is more like a holding company where each portfolio business is autonomous, while the mothership scales risk management and costs of shared resources, especially technology.

The parent company is the master allocator weighing not just opex decisions but how much capital to devote to each strategy. The capital is both the cash in the margin and some invisible cushion. From the individual trader’s point of view that cushion is an explicit or implicit risk budget — “how much can my p/l swing without inviting management to my inbox, or worse, my desk?”

Management’s thinking will be guided by ROI and hurdles. High-level stuff that overlaps with “being an investor”. The traders will have a process-oriented business lens concerning themselves with the unit economics of their specific form of artisanal bookmaking. The traders’ focus makes sense. It’s keeping their eye on the ball, understanding the role they play, why it pays, and how the information they glean from each day’s match feeds back into the gameplan.

Mechanically, unit economics, ie dollars at the trade level, is a natural focus for a trader in this structure. The master’s allocation to the trader can flex with the opportunity. That’s an advantage of the holding company or pod structure. The trader isn’t strait-jacketed into a strict AUM that leads to cash drag in dull times and wasted opportunity when it’s sizzling. But the “floating” AUM means the denominator in a return calculation is a moving target.

With this in mind, we can think about the answer to the following question from the perspective of what his counterparty, the market-maker, considers when they provide liquidity.

How important is (il)liquidity in options when making risk-defined trades such as credit/debit spreads or buying single call/put options?

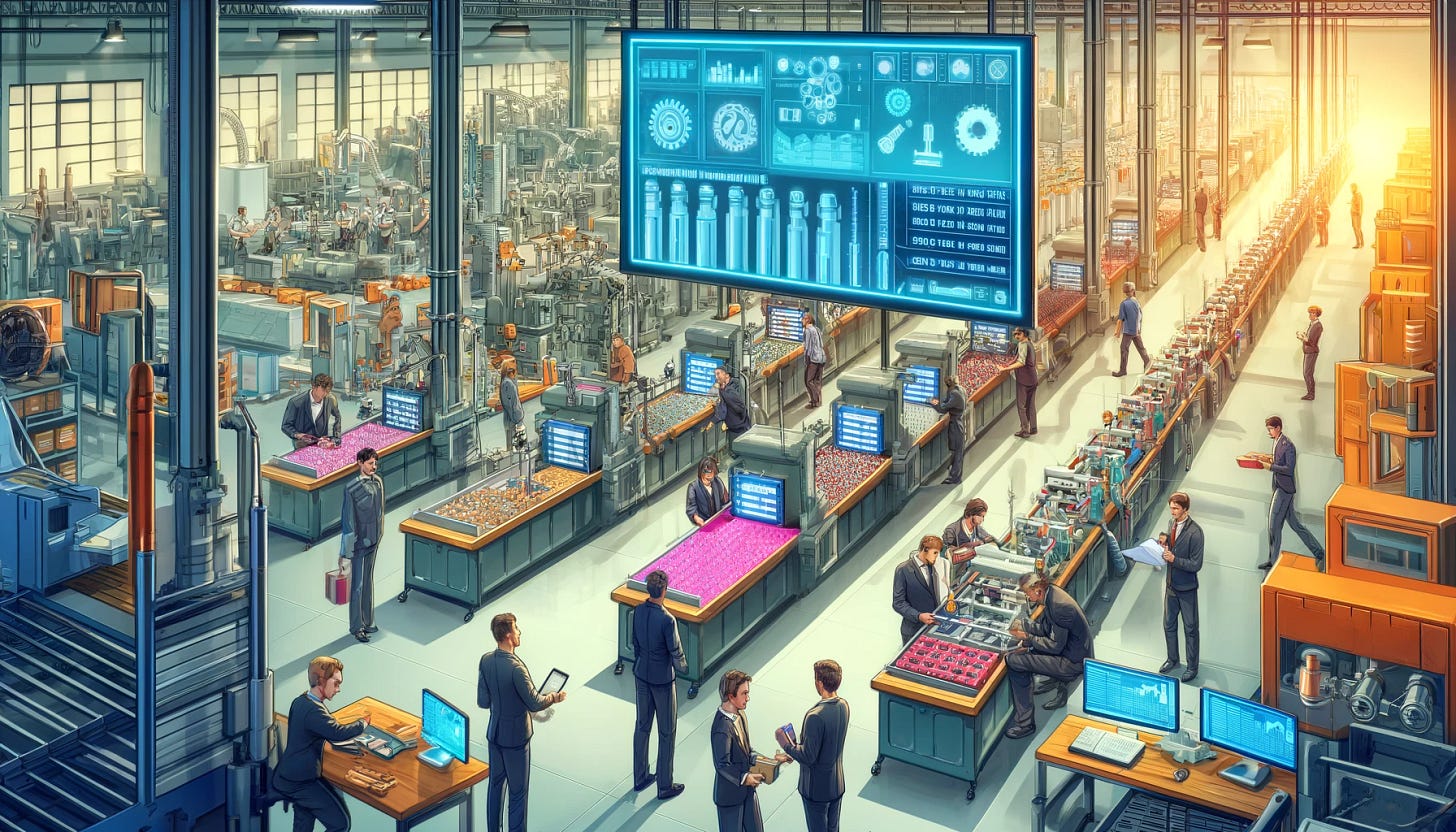

The widget factory

Scenario

You’re a professional options trader. In coming up with the year’s business plan, you estimate you can trade 100k option lots per day netting a penny of edge per contract.

Your annual expectancy is:

100,000 contract x $.01 x $100 multiplier x 250 trading days = $25mm

Call it $2mm per month. Maybe you take a few weeks off and the desk is less productive when you’re out if you want to flatter yourself.

Annual expectancy is $24mm.