Friends,

First, thanks to everyone who reached out about my dad. This is not a bid for you to do so, I just want to acknowledge that it was deeply appreciated. I expressed that to those who reached out already but I’m mentioning it here to share something that may or may not be obvious — sympathy and empathy are not old-fashioned.

I had multiple friends call me. Some of those calls lasted 2 hours [grindset collective gasp]. I would never have predicted I would want that. But they were nice. So nice I’m still thinking about it. And with some concern — like not predicting that I would appreciate a phone call means I’m a sociopath.

I’ve been doing a lot of processing. It’s not sadness. In fact, I feel uneasy accepting profusely solemn condolences because I’m not sad. I mourned over a year ago after returning from one of my visits. It was heartbreaking. Late-stage Parkinson’s is cruel.

It hasn’t been sadness lately but reflection and to be totally bare — relief. Mercy came for him. And for me. Another failed prediction — how therapeutic it would be to give my father’s eulogy. It was easy to write. Probably because I’ve been writing it in my head for at least a year.

But it was the hardest thing I ever said. It took me 3 minutes to get the first word out of my mouth. I think. How reliable could I have been as a timekeeper in that moment?

I addressed the children of our family. They only remember their gido as frail and sick. I told them who he really was. I then addressed my dad. To tell him things I never did. To tell him the things I’ve been writing to myself as I plead with the mirror “please make sense”.

It resists. It won’t.

But it turns out, it doesn’t matter.

The memorial was a gift — one that eluded me until we came together to celebrate him. To see him without the near-sightedness that distorts love. We celebrate lions but he was just quiet and dutiful and a protector and pursued simplicity. He was just so simple. It's a way of being that is entirely invisible to modernity. And yet I’m convinced so many people, even some you reading this, are the same way but asked to be otherwise.

This is my way of saying “I see you”.

Money Angle

I never go back and watch interviews that I’ve done, but I did this one with my son, Zak.

And I’m really proud of it because I got to teach…using his spreadsheet!

The objective — teach an option’s concept to Matt as if he’s a kid and demonstrate why it matters for average investors in general AND why it matters to professionals.

Challenge accepted.

By seeing options as Legos, we see that everything can be built out of a few pieces. It explains the BOXX ETF and covered calls. It explains why understanding this one concept you can collapse the zoo of option thingies (straddles, strangles, condors, christmas trees, flies, boxes, jelly rolls) into structures you can re-derive from basic material.

This video starts at square #1 — the definition of calls and puts. Truly suitable for the beginner. Leave your ego at the door…I’ve already accepted that I’m not smarter than a 5th 6th grader.

FYI

I saw some AI tool called manus.im on my feed so I clicked on it.

[Anyone else feel like they’re speed-dating robots these days?]

I gave it one simple prompt:

“How is a covered call similar to a short put?”

I swear I heard it laugh at me before responding with this deck:

Money Angle for Masochists

Speaking of covered calls, I’m excited to unveil a study

and I have been working on since late 2024. We presented it on an X livestream on Thursday:The video is 90 minutes and loaded not just with results but education.

We break down:

Why covered calls are more than just “income” strategies 📉

How volatility and path dependency impact performance 📊

The nuances of delta hedging and risk normalization ⚖️

How indicators like IV, VRP, and skew perform vs a naive strategy ✅

The tradeoffs between indicator accuracy and sample size 🚀

Whether you’re new to options or managing advanced strategies, this deep dive will sharpen your understanding of volatility P&L, trading mechanics, and how even simple strategies have complex outcomes.

🎯 Key Takeaways

Covered calls = long delta, short vol

Separate volatility P&L from directional P&L to assess strategy mechanics

Option backtests involve many design choices—beware of hidden assumptions

Writing calls on single names vs indexes brings ironic tradeoffs

Volatility pricing is often efficient, especially in liquid names

Most 1-month option P&L comes from realized vol, not just theta decay

Written recap

✍🏽Mark did a wrote up a recap including our tables: Dialing in on TSLA covered calls

From My Actual Life

The repast following my dad’s service was overflowing with joyful stories and pictures. So many stories. I already know it’s a lunch I’ll never forget. Like most people, I relish a chance to hear family lore.

My uncle delivered. I learned that my paternal great-grandfather was emigrated from Greece to Cairo. He figured out you could press cotton seeds, which were considered worthless, to make an oil from which he introduced the first scented soap in Egypt.

His brother founded the Bank of Alexandria.

My grandmother grew up with a silver spoon in a mansion overlooking the Nile, her father and uncle being men of great wealth. She had many suitors but married my grandfather who was a police officer from a humble family. His father was a preacher. My grandfather would rise to hold an extremely high rank in the police (which has military prestige if you know how Egypt works) and a law professor in retirement.

(I mentioned Wednesday that my father, despite going to the police academy, rejected his father’s path.)

Now, I’m sitting here wondering…why is there no wealth in my family?

Turns out when Nasser came to power on a nationalist/socialist platform he confiscated the businesses of foreigners residing in Egypt including my Greek forefathers.

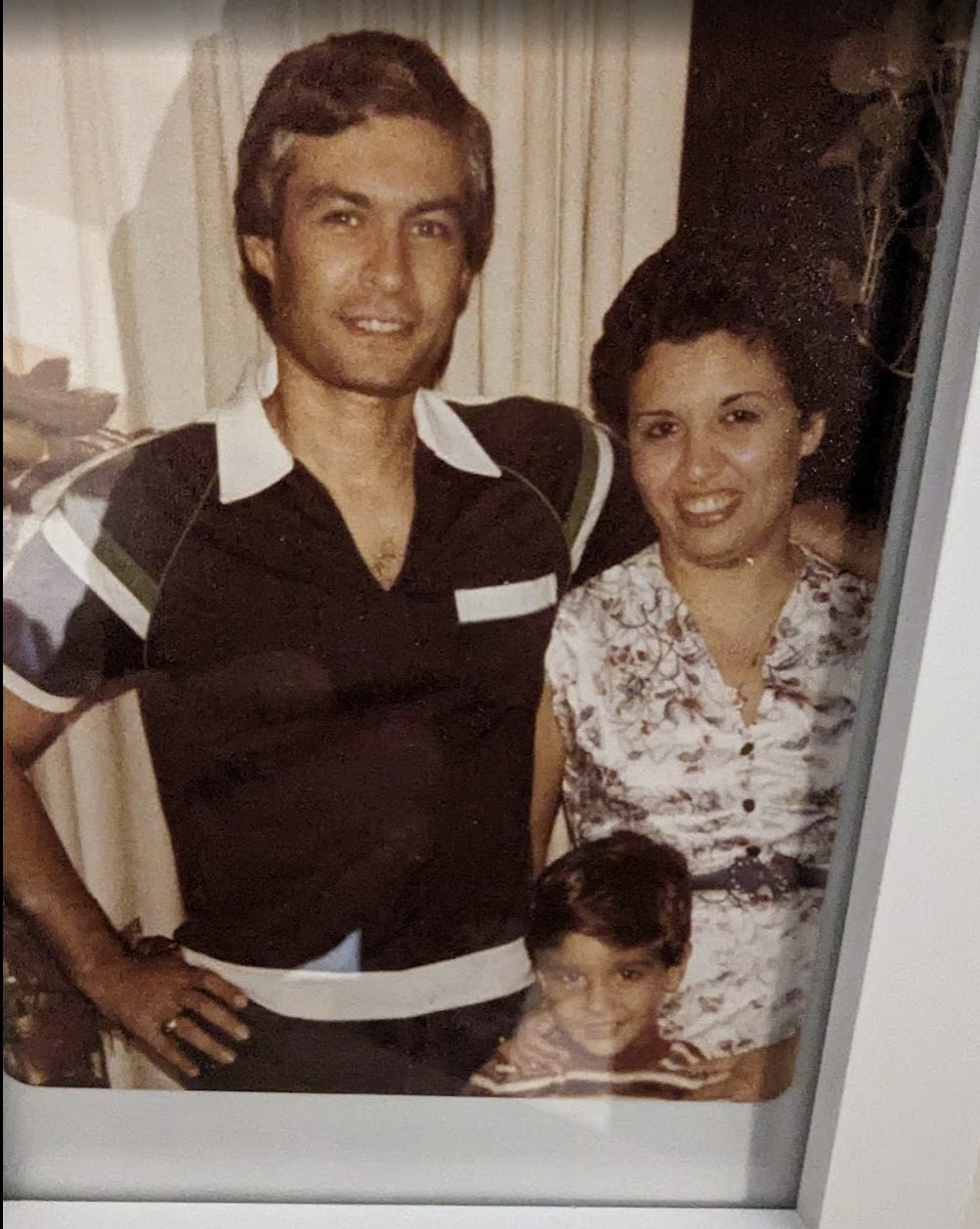

My grandmother was half Greek and a mix of Syrian/French/Lebanese. I remember her red hair and blue eyes. My dad had striking green eyes. I grew up being told I wasn’t as handsome as my dad. They weren’t wrong.

At least I didn’t start greying in my early 20’s. Then again, we all end up in the same place.

As a matter of facts, the Bank of Alexandria story is probably the faintest morsel of reality passed down through a generational game of telephone until reaching this sensational proportion. From the Wikipedia entry:

I do know that my grandmother grew up wealthy in Egypt and I know her father is from a town in Greece about an hour from Athens because my uncle who has a place in Greece tracked down his birthplace. I don’t know how these bits intersect to create the lore.

Stay groovy

☮️

Moontower Weekly Recap

Posts:

Need help analyzing a business, investment or career decision?

Book a call with me.

It's $500 for 60 minutes. Let's work through your problem together. If you're not satisfied, you get a refund.

Let me know what you want to discuss and I’ll give you a straight answer on whether I can be helpful before we chat.

I started doing these in early 2022 by accident via inbound inquiries from readers. So I hung out a shingle through the Substack Meetings beta. You can see how I’ve helped others:

Moontower On The Web

📡All Moontower Meta Blog Posts

👤About Me

Specific Moontower Projects

🧀MoontowerMoney

👽MoontowerQuant

🌟Affirmations and North Stars

🧠Moontower Brain-Plug In

Curations

✒️Moontower’s Favorite Posts By Others

🔖Guides To Reading I Enjoyed

🛋️Investment Blogs I Read

📚Book Ideas for Kids

Fun

🎙️Moontower Music

🍸Moontower Cocktails

🎲Moontower Boardgaming