Friends,

I didn’t mince words last week:

There's way too much obsession with investments as a way to get rich in the first place. It’s misallocated attention. It’s misplaced energy…Don’t obsess about investing beyond the point of diminishing returns.

Yes, you should absolutely learn about:

compounding

saving

fees

taxes

diversification

implementing or getting help to construct a portfolio with simple rules

Now stop and go home.

I was forceful about this because the exceptions to this are rare enough that caveats shouldn’t minimize the message.

I also recognize that “real talk” like this can feel like I’m putting a lid on your habitat without the courtesy of breathing holes. That’s why I added an emphasis on your human capital in preference to financial capital:

If you want to go big or go home, it's best to do so on your skills or personal edge.

This brings me to a recommendation that will inspire, educate, and entertain:

David Senra’s Founders Podcast.

It’s some of the best content I’ve discovered in a long time. The premise is simple. David reads biographies and tells you about them.

It’s hard to explain how well done this is. David’s enthusiasm, tone, synthesis, and identification of a few common themes throughout these stories are immensely satisfying. The stories are inspiring even when they deserve admonition.

The narratives remind us that the exertion of our will on the world is murky but ultimately pursuit is a mother’s hand pulling a 7-year-old through the crowded sidewalks of life’s confusion. Yes, it takes time. It takes bumping into pedestrians’ butts. You often don’t know what direction you’re headed in. But eventually, there’s daylight. You are growing. You will get taller to weave through the crowd yourself.

The podcasts are empowering without any pep talks. The subtext binding them all together is enterprise. The primacy of action. The undisputed sense that the world is malleable and you can bend it.

Getting Started with Founders

With nearly 300 episodes, there’s something for everyone. I’ve listened to these:

#207: Claude Hopkins, Scientific Advertising

#189: David Ogilvy, The Unpublished David Ogilvy

#111: David Geffen, The Operator: David Geffen Builds, Buys, and Sells The New Hollywood

#66: Henry Kaiser, Builder in the Modern American West

#21: John Carmack & John Romero, Masters of Doom: How Two Guys Created An Empire And Transformed Pop Culture

My favorite so far — inspiration straight into my veins:

#18: Yvon Chouinard, Let My People Go Surfing: The Education of a Reluctant Businessman

#245: Rick Rubin, In The Studio

…and these episodes were worth heavy note-taking:

David Senra On Invest Like The Best (Moontower notes)

This episode is not on Founders but instead is Patrick O’Shaughnessey interviewing host David Senra. I listened to it 3x. It was this interview that got me into listening to Founders and my favorite podcast episode this year.

There’s more.

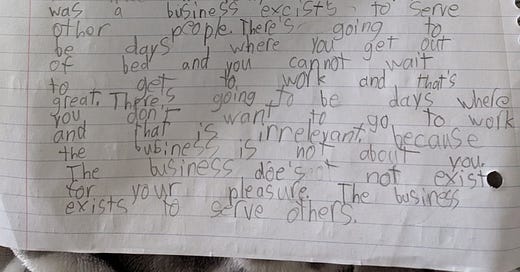

I asked my 4th grader to listen with me and take notes (he’s learning note-taking in school this year). I’ve never asked him to listen to an interview before but I wish someone might have asked me to listen to a discussion like this when I was at such an impressionable age. In my link, I include his notes too! It was fascinating to see what bits stood out to him. (Since the episode is 90 minutes, we broke it up into 3 sessions of 30 minutes over 2 weeks).

[One of the reasons the episode might have been especially fun for him is we just finished watching The Men Who Made America series on the History Channel and Senra discusses many of the “captains of industry” or “robber barons” featured on the TV series.]

My notes discuss some of the common Founders themes that stand out to both Senra and I.#93: Ed Thorp, A Man For All Markets (Moontower notes)

An oft-repeated theme on Founders is that the subjects are deeply flawed, often miserable. You are warned to not glorify them but instead extract their deep but narrow wisdom, instead of copying their lives. This episode is special because Ed Thorp is the one person, Senra uses as his own personal blueprint.And I agree. Thorp in his entirety (or at least what we can know from his public action and writing) is an admirable and impressive individual.

I immediately purchased Thorp’s book and I’m reading it to Zak at night before bed. Thorp’s life is a movie.

I’ve recommended Founders to several friends and the reaction has been universal — “where has this podcast been hiding?” If it gives you half as much joy as I’ve gotten from it it’ll be worth it.

Ok, so recapping.

Don’t spend any more time than you need to on investments.

They are numbers that go up and down and nobody can prove than know anything. From Why I Share Online And The Decision To Leave Trading:An aside that is gonna trigger some set of people: I could hand over all my professional dashboards and tools, and it wouldn’t make a difference. You won’t get the same results. Experience, discipline, and creativity are not something you can take from another. And they are foundational to a discretionary strategy. Think about this from a game-theoretic point of view. If I could codify (I tried and couldn’t) what I did, then it would be easy to prove the edge. The strategy would then be automated and be oversubscribed or its owners would never sell it to an investor. The fact that it’s discretionary and cannot be proven except by its eventual outcomes means an investor must always worry that I’m full of shit.

Do you see the paradox?If the edge is provable, it doesn’t exist for you. So the only hope of finding edge is in your judgment of a discretionary strategy. This is not a worthy use of your time because your confidence can never be high enough a priori to bet an amount that was commensurate with moving the needle. You're flirting around the edges of a low SNR problem. Unless this is fun, assassinate the FOMO right now by directing your Superman “rationality” eye beam at the paradox, and move on to the next obstacle holding you back from worthy pursuits.

Gather energy

Check out Founders.

Check out Bill Gurley’s Runnin’ Down A Dream: How To Succeed and Thrive in a Career You Love speech that inspired Founders. (YouTube)

That speech also inspired hedge fund manager Alix Pasquet’s presentation:

Learning for Analysts and Future Portfolio Managers (2 hour video)

Despite the investing-focused title of the speech, its central theme is broader:

Learning Is behavioral change!

The video is long but I found it worthwhile. The notes will let you judge for yourself.

• Moontower notes (9 min read)

• Frederik Gieschen’s notes (7 min read)

• Presentation slides (download)Strike

This old post includes links to light your fire.

• Get Unstuck and Move (10 min read)

Today’s letter is brought to you by the team at Mutiny Fund:

How can you access a multi-asset strategy concerned with protecting assets and growing long-term wealth?

The Cockroach Strategy seeks to achieve higher long-term, compound growth compared to traditional stock/bond-focused portfolios with more limited drawdowns. It is intended as a total portfolio, a ‘set it and forget it’ approach that strives to give investors peace of mind and meaningful capital appreciation.

The Cockroach strategy consists of a diversified ensemble of assets including stocks, bonds, commodity trend strategies, long volatility strategies, and gold. It is designed to perform across multiple macroeconomic environments: growth, recession, inflation and deflation.

The Cockroach strategy gives investors exposure to asset classes designed to perform in each of those environments including stocks, bonds, commodity trend strategies, long volatility strategies, and gold.

Disclaimer: Investing is risky, and you are reminded that futures, commodity trading, forex, volatility, options, derivatives, and other alternative investments are complex and carry a risk of substantial losses; and that there is no guarantee the strategy will perform as intended.

Money Angle

A question I posed last week:

I suspect, despite positive track records in return space, their total dollar p/l is very negative. Sometimes the simplest benchmark is useful — what are your net dollar profits? There are fund managers that have probably made more from fees than their investors have made in p/l.

Anyone know the money-weighted returns of ARKK or crypto investors?

My buddy Aneet has a strong clue to this in this post:

ETFs are the new stocks — mind the creation/redemption gap (4 min read)

Performance-chasing flows are a nail in their own coffin. If everyone is bulled up on an idea, the price must reflect a fat premium that sellers command to do the out-of-consensus thing. The article focuses on flows, but flows are downstream of sentiment.

You’d be wise to think about what the sentiment is before you buy any shiny investment.

I’ve discussed this before in Staring Out The Window.

Last Call

Rounding out the personal growth theme this week:

The Art of Fermenting Great Ideas (paywalled)

by Nat Eliason

Nat’s post is paywalled but it’s a banger that uses fermentation as a fitting metaphor for the process of idea generation. You can’t force it, but you create the conditions for it. Some bits with my occasional commentary.

If you want all of the ideas that pop into your brain to be clever responses to that person who was WRONG on Twitter today, then, by all means, scroll Twitter all day. If you want all your mental RAM to go towards fearing for your life over this year’s new armageddon myth, go for it. But if you want to come up with useful brain farts that move your life forward, you will have to stop feeding your mailroom dog shit. Garbage in, garbage out.

Removal is only the first step, though. You must replace it with the fresh juicy jalapeños you want your brain to be fermenting.

You’re probably assuming I’m going to say “read great books” or “read old stuff” here, but no, that’s not the answer. That helps shift your thinking in a more interesting direction. But it doesn’t necessarily help generate great ideas.

The most important food to constantly feed your brain is the problems you want it to be solving. These problems do not need to be grand like “solving world hunger.” Maybe one of your problems right now is what to get people for Christmas. You have to define clearly what those problems are and then constantly remind your brain to think about them. You need to be sending all-caps memos down to the mailroom fifty times a day saying COME UP WITH GIFT IDEAS!!! Otherwise, the mailroom is thinking about whether you’d rather fight 100 duck-sized horses or 1 horse-sized duck.

[This works for getting better at anything including relationships]Output time is creating the space and boredom for those inputs to ferment into something interesting. Staring at a blank page of your journal, opening a document to start writing, going for a (no headphones) walk with a notebook, working out without music, or sitting in the sauna. However you create bored, quiet space for your brain to finally get some processing room to spit ideas out; you must create that space if you want the ideas to form.

The ways we fail at this are obvious. We never give ourselves output time because we’re terrified of silence and boredom. We need a podcast while working out. We need music while working. We keep social media up in another tab. We have notifications on our phones. We let ourselves be interrupted.

If your first response to boredom is to seek out another input to sate the longing for stimulation, then your brain never has to make shit up to entertain you. The idea muscles will atrophy and never produce anything of worth. But if you can respond to boredom by leaning into it, keeping the blank page open, and seeing what pops out, the muscle gets stronger over time.

[Maybe shower thoughts are shower thoughts because there are no other times when we would have such thoughts. Corollary: A good use of money is to buy time so you can be idle and have more ideas.]We all want our problems to be solved quickly, and we want to neatly move through a checklist of tasks to retain the illusion of control over our lives, but great ideas don’t seem to work like that. Sometimes you need to be exceedingly patient with them.

You can’t always have all the time in the world, but when you have the space to noodle on something, take it. I’ll narrow down what I’m going to write about in this newsletter by Monday or Tuesday of the week before, then spend the rest of the week seeing what ideas pop up about the various topic ideas. By Monday, I’ll typically have the skeleton of a post fully flushed out in one of them. If I waited until Monday to start jotting ideas down, it would be much harder, and the post would certainly be much worse.

So give the great ideas time to pop up. Even if you know you have weeks or months to figure something out, start priming your brain with those questions now so it has time to process them.

[This is exactly what I do. I keep several ideas brewing top-of-mind at the same time]Recipe:

Find the best ingredients possible to ferment into great ideas, and aggressively prune everything you don’t want your brain to process.

Give your brain the boredom and output time it needs to figure out what to do with that information. Don’t keep opening the jar and packing more into it.

Finally, be patient with the process. The more you can reduce the amount of information you’re taking in, and the more boredom you can give your brain to work, the better your results will be.

From My Actual Life

One of the blogs I guest posted on asked for a headshot. I got tired of using this one:

So I went to my wife Yinh. “I need help. I need like a headshot for the internet crap I do”.

Like a prepper before a Cat 5 storm, her day had arrived. “I got you. Come to my office”. Yinh’s IG story game is A+. Whenever I meet a friend or colleague of hers they always feel like they know me because her stories are prolific, but they are clever and well done (you can follow her. It’s a locked account but she accepts the requests and she knows I’m sharing it here today).

Sometimes when technology shapes us we snatch a victory. In this case, her commitment to the IG story has sharpened her photography eye over the years. So when I went to her office she posed me in different settings, lighting, and a couple of costume changes. I have no eye for design or aesthetics. I know what I like but struggle to map that to creation, whether it’s photography, decor, or even Powerpoint. I have yet even more appreciation for those skills today, as she made me look as good as I can possibly look.

After an hour and hundreds of photos (with an iPhone too), we narrowed to these 3:

Tell me you wouldn’t fork over all your life savings for a Moontower Coin or invest in my blood transfusion start-up.

(I have been told I look like Ross from Friends my whole adult life. An older lady asked me for an autograph on a subway platform in Brooklyn about 15 years ago even.)

Happy Thanksgiving and stay groovy fam!

Substack Meetings

I was invited to be a part of the Substack Meetings beta. You can book a time to chat. I’m more expensive than a 900 number from 1988 and have a less sexy voice.

Book a meeting with Kris Abdelmessih

Moontower On The Web

📡All Moontower Meta Blog Posts

👽Moontower Volatility Wiki

🧀Moontower Money Wiki

✒️Moontower’s Favorite Posts By Others

🔖Guides To Books I Loved

🎙️Moontower Music

🍸Moontower Cocktails

Becoming a patron

The Moontower letter is and will always be free. My writing is a search “for the others”. The “others” are people like you who are unlearning the mental frames that artificially narrow our choices.

If you are here you already understand that inspiration is a tradable good. It’s not as tangible as a cup of coffee, but it packs 10x the adrenaline with an infinitely longer half-life than caffeine.

If you feel inspired, you can upgrade to becoming a patron.

Love this newsletter! Great insights and a great portal to other worthwhile explorations.

I've also been enamored with David's podcast. So well done, and my favorites have been about Edwin Land and Estée Lauder.

What I've enjoyed most is how David cross-references his other podcasts like a deep-linked blog post, and with such enthusiasm. It makes you want to listen to everything else he gets excited about.