Inflation Replicator

Friends,

Apparently yesterday was weird.

The stock market like went down or something. Bad stock market [rubbing my portfolio’s nose in red paint] you go up!

This is being attributed to “hot” inflation data which lowers the odds of a rate cut plus a weak treasury auction that saw 10-year yields pop 20 bps. Probably doesn’t help mortgage rates either.

Anyway, it’s a nice backdrop to riff on some personal asset allocation stuff.

I think in broad strokes and prefer simplicity.

Stocks

VTI, IWM, international Vanguard funds, and a handful of private managers. Very rarely invest in a single stocks.

Fixed income

This is mostly T-bills. I prefer short duration because the rates are best there and I’m uneasy about locking in nominal yields at these levels. A minority of fixed income slice is some medium duration TIPs in a tax-advantaged account. We’ll talk about inflation further below.

[The only long duration fixed income comes from some life insurance products and that is also a small position. My friend Rajiv is a quant on the insurance side (he was at a fund that bought lapsed policies — strange little corner of finance) and is my sherpa on thinking through these complicated products. I have a term policy but one of our family members got an insurance license to set all our families up whole life policies commission-free (there’s still an embedded management fee from the issuer). I have one in-depth article on insurance if you’re interested that was born out of research on IDF feeders and PPLI, topics that were of professional and personal interest. The short of it — insurance is a surgical tool not a cornerstone.]

Miscellaneous

The above part of our portfolio is weighted conservatively (about half and half). We have a small exposure to RE PE that’s we’ve had a stake in for over a decade but no longer own home. If we buy a house the funds will be drawn from out T-bill allocation so on balance our portfolio risk will increase.

Finally, about 10% of our portfolio is the weird barbell stuff that we are comfortable with going to zero. It’s comprised of SAFE notes and actively managed crypto VC stuff. 100% of this sleeve has come from reverse inquiry — either my wife or I asked if we could invest in a friend’s project or business.

I prefer the asymmetry of asking and sometimes not getting filled vs getting propositioned and knowing I’ll be filled. You will make mistakes sometimes of course, but despite a market-maker background, in real life I prefer to lift not be a resting bid or bet and not call if you like poker analogies.

Managing the portfolio

When I say “broad strokes”, I mean keeping the portfolio weights within a band that in a typical year doesn’t require rebalancing more than once. This allows some leeway to be a market timer around the edges or not look at your portfolio for long stretches.

It’s a system that accommodates the rhythm of your life. Sometimes I’m interested in markets and other times I’m just head down on other things. [My wife describes my superpowers as being patient and FOMO-immune. The funny thing is I grew into both of these traits which tells me they aren’t “fixed” sliders. In my 20s, I looked over the fence a lot. It’s a recipe for anxiety. Anxiety can be productive so I’m not recommending anything, just calling it as I see it.]

One of the things I do around the edge of the portfolio is mess with the energy weight. Some of this is old habits — most of my option trading career was being active in oil and gas. But I also see energy as fundamental to the concept of inflation and inflation is the largest tax on investment returns. I actually see the core of our portfolio not as means of getting rich — it’s just preserve purchasing power as best we can without incurring major drawdowns so we can sleep well at night. Because sleeping well = health. And so long as we are healthy, I’m confident our human abilities will provide prosperity. I’m trying to sterilize the impact of the random number generator and rely on idio — in life terms.

[Aside: If you were to plot how much of one’s net worth come from their income vs investment returns I suspect you’d get some measure of fragility — at least in the first half of their careers when you would expect human capital compounding to vastly outpace financial compounding. A 30- year-old with $500k in the bank who makes $90k a year has an unhinged Robinhood account.]

These days I have a small overweight to oil. This is something I’m in and out on with horizons of about 1 year. It’s purely on vibes. I bought XLE in late 2020 after the oil crash and when Tina told me that you couldn’t even touch the Brent call skew in the early part of the Ukraine invasion I sold the position (and in a “old degen habits die hard” moment told her to buy wheat calls if the skew was still stale — iirc that was timestamped on a whatsapp screenshot on twitter).

I bought oil again after it sold off and Biden showed his bid. I would check in with Tina and ask when there was a bunch of producer hedging in the back months and bout 18 month WTI futures (Z23 at the time). I rolled my Z23’s back to Z24 in the recent rally. Nice roll-up yield in those bad boys.

[A good buddy who runs a commodity fund once described the “does a deferred future roll to the spot or predict the spot” as the particle/wave debate in commodities which I love. I believe the empirical answer leans more towards rolling but in theory there should be limits to how poor the prediction aspect can actually get.]

The backwardated market had me opting for oil futures instead of oil stocks.

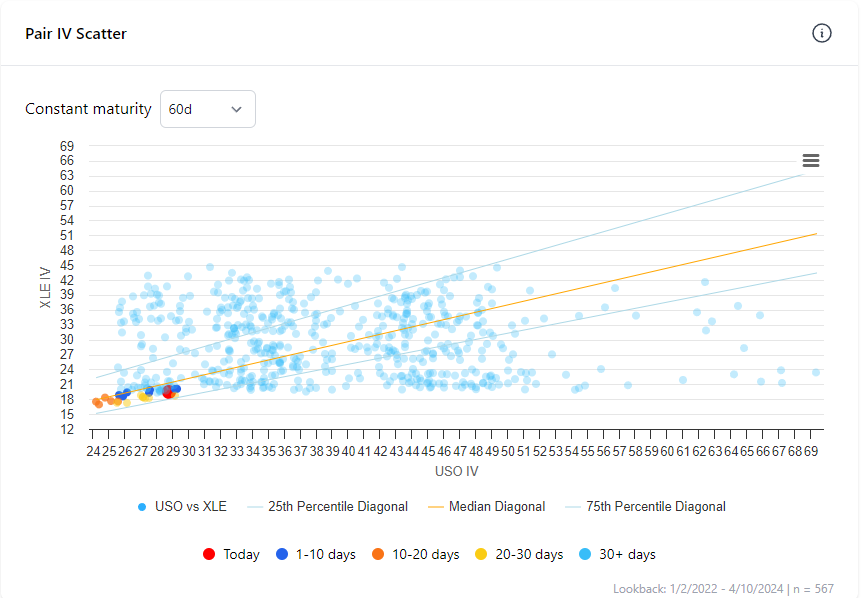

It’s worth whoring the fact that moontower.ai has neat tools for comparing 2 names. This is a scatter plot of 60 day implied volatility between USO (which holds the prompt future) vs XLE. It’s a fuzzy choice because oil stocks are more correlated to longer dated futures but USO has better option markets than say USL (12 month etf).

Quick observations:

Median vol ratio is USO is 125% of the XLE vol

Vols are at the lower end of their ranges

Extremes have seen XLE be 50% more volatile than USO, and USO be 200% more volatile than XLE

We recently added the ability to zoom in:

Back to the reason for oil. It’s an overweight because I’m just trying to provide some extra insulation against inflation in the portfolio. The choice of futures was simply tactical.

We are going to see that the relationship between oil and commodities vs inflation is quite interesting and has trading ramifications.