Friends,

This one is more investing-centric than a typical Sunday letter but before going there I want to add another gift guide to the lists I published this week.

🎁The 2024 Kottke Holiday Gift Guide

This list is extensive and will lead to link-diving into many well-curated offshoots.

One of those offshoots is an awesome guide directed toward children’s gifts (but there’s plenty even an adult would love!):

🦖The Kids Should See This (Gift Guide 2024)

Lots of nerdy ideas in there as well including a link to Purdue’s School of Engineering gift guide for kids!

On to trading stuff.

This past Wednesday I did an AMA with Kris Longmore's RobotWealth community. Kris' work and general way of being is a personal inspiration. I'm a big fan.

(His bootcamp is my #1 recommended course for retail trading because it's grounded in both the practicality of trading but also in the conceptual -- what is edge, where to find it and why it might exist)

This is all to say it was quite an honor to nerd out on his channel 🤓

📽️Watch the replay of our conversation here.

Just a sampling of topics we discussed:

Some differences between professional and retail trading

How a retail trading operation can be set up to align with your life

Good options trades and where to find them

How important is modeling time decay?

How important is backtesting for options strategies?

2 ideas that received some extra emphasis:

1) Traders are searching for contradiction not prediction

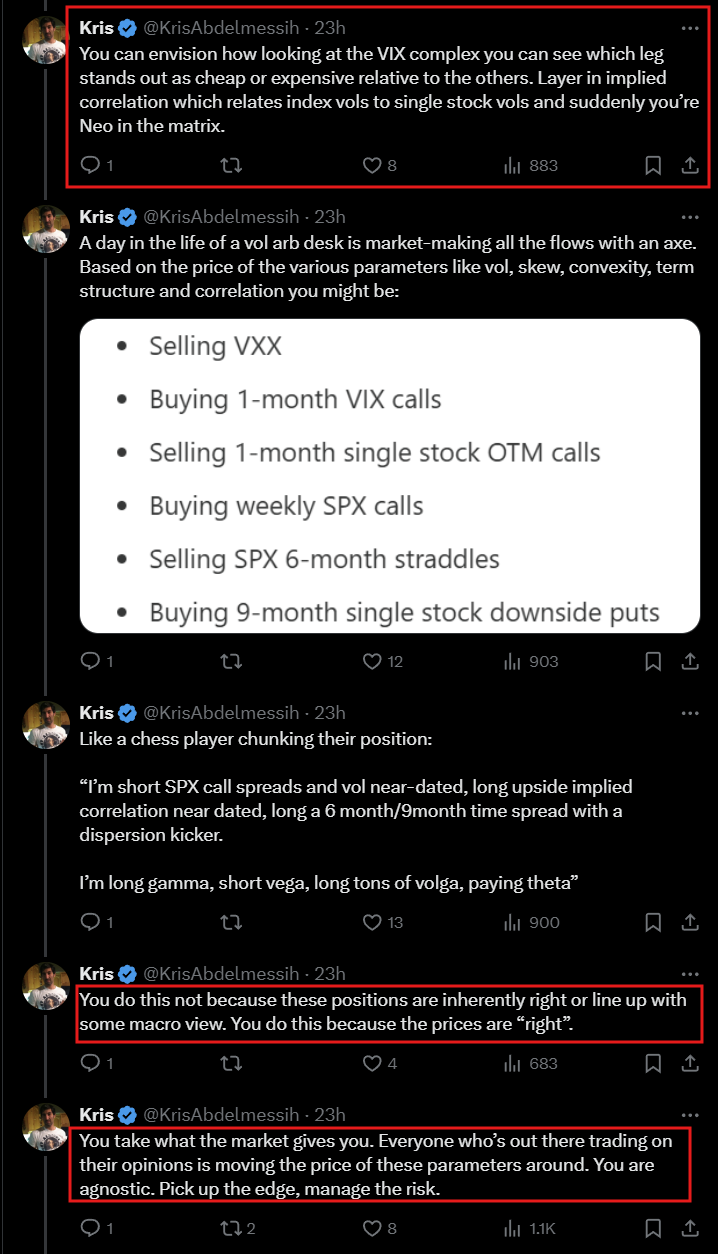

This is a callback to Measurement Not Prediction which explains why trading rests on “seeing the present clearly” as opposed to playing Nostradamus. The distinction might sound abstract or subtle. This section of a thread I wrote this week is a concrete example:

2) On timing vol

The topic of timing vol came up. And I shared something I suspect people might find surprising.

I had no edge in timing vol. In fact, I don’t think most professional vol traders have any edge in this. In other words, their edge doesn’t look anything like “vol in general is cheap here, let’s load up”. I almost always regret drawing lines in the sand about getting net long or short a bunch of vega. Did I tend to be leaning long vol when it was cheap and vice versa? Sure, but I was usually long or short for a considerable amount of time before it bottomed or peaked too, because markets love to stretch like they’re double-jointed ballerinas before reverting.

After getting humbled by a timing opinion gone awry, I always centered myself by going to back to basics. What does that mean?

The most basic decision in a trader’s arsenal, their reliable fastball so-to-speak is some version of:

“I’m buying this for X, because that is Y bid”

“I’m buying 1-month APPL straddles for X vol, because 3-month QQQ puts are Y bid”.

When you get away from decisions that take that grammatical form you are in the realm of “I’m buying this because the line went down”.

When you feel enough pain to accept that you did something wrong you will usually find this subtle switch in decision logic is the source. It stings the ego because re-focusing on the basics is admitting that you haven’t transcended the grind to become some market maven who just knows when something is about to turn.

(I think all traders subconsciously expect that their 10,000 or even 20,000 hours of practice will unlock that ability. These back-to-basic moments, if you are lucky enough to overcome your pride and negative p/l, to rediscover are humble reminders that markets are learning just like you are so the value of the 10,000 hours isn’t exerted on your ability to beat them, but instead on the practice of process so you have a chance of keeping up. There’s no “best”, only “next”.)

🌙Last Call🌙

You are welcome to use the ROBOTWEALTH promo code for 15% off moontower.ai plans. It expires tonite.

Money Angle

Several weeks ago I wrote Tax-Loss Harvesting On Levered Long/Short.

I recommend reading it to understand why it’s more valuable to have:

a gain of $200k + a loss of $100k

vs

a gain of $100k

The first grants you loads of optionality in managing current and future tax liabilities.

The rise of direct indexing, SMAs, and portfolio margining creates avenues for engineering the former in lieu of the latter.

I’ll tell you now you are going to hear more about tax-loss harvesting with a long/short extension in the coming year.

Why?

1) The knowledge and technology for managing this is becoming more widespread.

2) With US markets near all-time highs within a generational boom in stock-based comp, many people are sitting on massive gains in concentrated positions. Many are anxious to diversify but wary of the tax bill.

And a 3rd, more shadowy reason:

3) Passive index investing as an idea is begging to peak

Filed under “this is why we can’t nice things” — MSTR is going to be added to QQQ.

Another risk-loving corporate actor with an affinity for financial engineering spews negative externalities on your pension fund and passive savings by gaming a rules-based system. The only question is if Michael Lewis is gonna write a good book about this or be seduced into a bout of Stockholm Syndrome when he covers it.

Since you are going to hear so much about tax-loss harvesting a lot of it is guaranteed to be salesy. It’s an approach worth exploring but I’ll share substance* that recognizes the inherent tradeoffs and cost/benefit.

Here’s a few to get you started:

What They Don’t Tell You About Tax Alpha (8 min read)

Quorus is an upstart fintech player in the tax-loss harvesting arena. This article demonstrates how the devil is always in the details.

Direct Indexed Tax Loss Harvesting: Is the Juice Worth the Squeeze? (10 min read)

The Elm Wealth crew, as usual and welcome in our shiny object world, offer sober takes.

Tax Alpha Insider (Substack)

Brent Sullivan is a relentless investor advocate with the expertise and gall to dive into the details of financial products. His focus is on tax efficiency. I say gall because he’s like an investigative journalist in an industry where the incentives are to shill for a bigger pie in some new product area and hope to maintain your market share rather than waste energy debunking others’ marketing research.

You can search “tax-loss” on his substack and find lots of titles to titillate.

Money Angle For Masochists

More readers than normal found this week’s Path, VIX, & Hit Rates vs Expectancy highly educational. Coincidentally, that same morning Mark Phillips dropped Sympathetic Research which had significant overlap on the expectancy vs hit rate idea. He and I have been working on a project together in the background so some telepathy waves aren’t surprising!

If you are interested in options he’s a must-follow.

It’s paywalled but I also really enjoyed his recent Gulls for Bitcoin Bulls post part of his 50 Ways To Trade An Option series. He highlights some of the same things I’ve noticed and in fact talked about on our Moontower Community Zoom this week. He presents attractive pricing on the BTC option surface for people with a certain outlook. The problem I’m having is I want to do the opposite of the trade he highlights which means my idea is consensus and expensive. It’s a bummer for me, but also that’s the nature of trading — most of the time the thing you want to do should be baked. (A nice test of self-knowledge is to ask if you can tell the difference.)

From the mailbag

A moontower.ai user asked about oil volatility and correlation in the context of WTI and Brent crude. I did the editorial equivalent of showing him a cool scar:

Let me take these in turn.

USO is relatively illiquid these days relative to the futures options. It used to be more liquid. I spent the better part of a decade relative value trading it vs the futures options including doing create/redeems (I was constantly at OCC position limits — which have a horrible one-size-fits-all application).

Long-dated USO options are very interesting instruments because they are effectively long-dated options on a rolling CL1 contract. This is very different from say a 12-month futures option that references a less volatile CL12 contract.

This difference is why you can relative value trade it, but it's a complicated model (actually I think a good interview question for a trader or quant is to come up with a model for this conceptually). It's nice that it offers you an option chain on CL1 while the futures options don't.

As far as Brent or for that matter heating oil and rbob which you didn’t ask about, the correlations to WTI change periodically when the fundamental details become bottlenecks in their respective markets. Refineries can't just easily switch their slate between product grades so you can get over/under supply idiosyncracies. There's an active "arb option" market which is options struck on the spread between WTI and Brent.

Further complicating matters is that Brent and WTI futures and futures options for a given month do not have the same expiries so when you do relative vol trades between them you end up with these residual calendar risks (brent options expiring a week earlier than WTI!)

There was a period of time where this is all I traded so to download all there is to say on this is impossible. You can make a career out of doing nothing else. If you like bloodshot eyes and your hair to be drained of youthful pigment of course.

Stay Groovy

☮️

Moontower Weekly Recap

Need help analyzing a business, investment or career decision?

Book a call with me.

It's $500 for 60 minutes. Let's work through your problem together. If you're not satisfied, you get a refund.

Let me know what you want to discuss and I’ll give you a straight answer on whether I can be helpful before we chat.

I started doing these in early 2022 by accident via inbound inquiries from readers. So I hung out a shingle through the Substack Meetings beta. You can see how I’ve helped others:

Moontower On The Web

📡All Moontower Meta Blog Posts

👤About Me

Specific Moontower Projects

🧀MoontowerMoney

👽MoontowerQuant

🌟Affirmations and North Stars

🧠Moontower Brain-Plug In

Curations

✒️Moontower’s Favorite Posts By Others

🔖Guides To Reading I Enjoyed

🛋️Investment Blogs I Read

📚Book Ideas for Kids

Fun

🎙️Moontower Music

🍸Moontower Cocktails

🎲Moontower Boardgaming