Friends,

Today’s a long Money Angle so we’ll skip right to it after a chuckle.

Money Angle

I tried to buy some Treasury Inflation-Protected securities (TIPs bonds) last week. I failed. But I learned a lot about how they work.

I’ll paraphrase and quote from State Street’s outstanding primer for basic background info then explain the mechanics with an example.

Overview

TIPs bonds were introduced in 1997

5, 10, 30 year terms

Like ordinary treasuries they are backed by the “full faith and credit” of the US government

The principal and income are indexed to inflation

At maturity, the holder receives the greater of the inflation-indexed principal or the original principal. In other words, there is an embedded put option struck at the inflation index price level at the time of issue

Coupon

The annual coupon rate is fixed at issue

The coupon is paid semi-annually (each payment is 1/2 the coupon rate)

Although the coupon rate is fixed, the principal amount of the bond adjusts monthly based on the CPI-U or Consumer Price Index for All Urban Consumers (not seasonally adjusted)

Relationship to inflation

The breakeven rate allows you to compare TIPs to nominal treasuries

Breakeven: The annualized rate of CPI inflation over the life of the bond that makes the total return of a TIPS equal to that of a similar-tenor Treasury. Calculated as the yield difference between Treasury bonds and TIPS of the same maturity, breakeven rates are, ultimately, a proxy for the market’s inflation expectations. The lower the rate, the lower the expectation for inflation.

Positive inflation typically benefits the performance of TIPS, while falling inflation (deflation/ disinflation) may cause lower performance. It is important to note that market inflation expectations are often already priced into TIPS. Therefore, for inflation trends to be beneficial for the relative return of TIPS, it must develop at a rate that is higher than the market’s anticipated breakeven inflation rates.

The following example illustrates how the inflation adjustment feature of TIPS works during a period of inflation and what it means for returns. If the US 10-year yield is 3.87% and the yield on a 10-year TIPS bond is 1.58%, this means that the breakeven rate is 2.29%. If inflation over the next 10 years is actually 2.5%, this would lead to stronger relative performance, all else equal, for TIPS versus nominals, as realized inflation was higher than what was estimated (as represented by the breakeven) at the time of purchase.

A change in market expectations or uncertainty about inflation can change TIPS prices before maturity, however. For example, beginning in April 2021 nominal and real yields both fell. Yet, real yields fell faster as a result of widening breakeven rates and investors’ desire to mitigate the effects of inflation on their Treasury exposure. At the time, therefore, investors felt breakeven rates (i.e., market-based inflation expectations) were understated and not reflective of the loose policy environment. As expectations increased, TIPS outperformed nominal Treasuries by more than 8% through 2021.7

Why are TIPs returns only loosely correlated to inflation?

Because interest rate themselves are correlated with inflation and…

like all bonds, TIPS are subject to interest-rate risk. And because of this, they are not a perfect hedge against inflation. For example, in March 2022, the Fed began an aggressive rate hike campaign to combat rising inflation. Through year end, the central bank raised rates by a total of 4.25%, which was the fastest rate hike cycle in decades.10 During the same period, TIPS registered a loss of 10.8%,11 primarily due to their duration risk amid the unprecedented speed of the rate hike cycle. These bond losses were widespread among many other fixed income asset classes, such as nominal Treasuries, investment grade corporate bonds, high yield bonds, etc

Taxes

TIPs income is taxed at ordinary rates

The income is state and local tax-exempt

Phantom income tax: The principal amount of the bond is indexed to inflation. In a positive inflation environment that increase in principal is taxable even though you do not receive distributions. It is possible that your annual tax liability exceeds the coupon income. At maturity, you will be repaid the appreciated principal amount but there will not be a capital gains tax as you have been paying the taxes on the phantom income during the holding period

Example

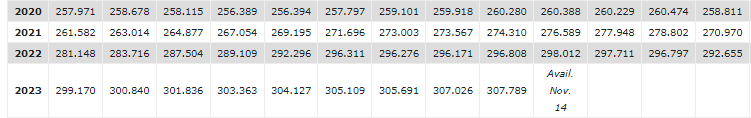

A quick bit on the CPI-U inflation index.

From Historical CPI-U data we can see:

The period from 1982-1984 has a defined index value of 100

The August 2023 index value was 307.026

In other words, $3.07 today equates to $1.00 in the 1982-1984 period

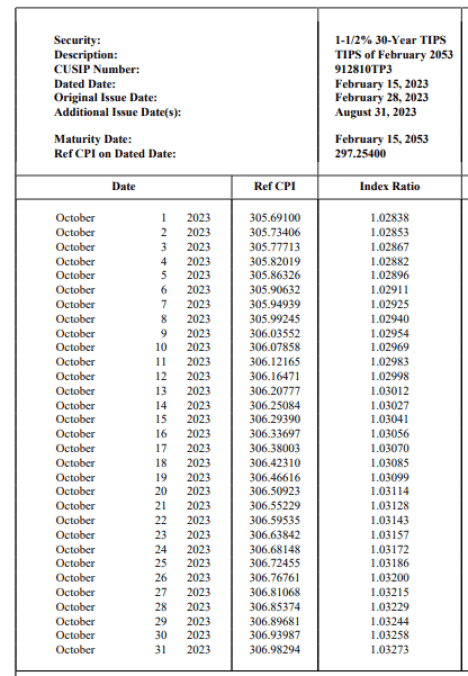

Let’s examine a 30-year TIPs bond issued on February 28, 2023

All the necessary reference data for TIPs can be found on TreasuryDirect

I downloaded the October pdf

The dated date is February 15, 2023. That’s when interest starts to accrue.

The coupon is 1.50%. That rate is fixed forever.

The holder receives .75% of the adjusted principal value every 6 months from the dated date (every August and February 15th)

Adjusting the principal

When the above 30-year TIPs was dated on February 15, 2023 the CPI-U index was at 297.254 which would have corresponded to an index ratio of 1.00.

The index ratio is the amount you multiply the $100 par value of the bond to find the adjusted principal.

On October 1, 2023, ref CPI was 305.691

305.691/297.254 = 1.02838

According to the table that’s exactly the index ratio on October 1. That means the adjusted principal of the bond on that day is $102.838

For demonstration’s sake, pretend it paid a coupon on October 1.

The coupon payment would be:

.75% x 102.838 for each $100 worth of bonds you originally bought.

As CPI-U increases the index ratio increases. The fixed-rate coupon is multiplied by this index ratio to compute your interest.

At maturity, you aren’t paid back $100 but the adjusted principal per $100 of bond you originally bought.

Quoting convention

As you can imagine, buying TIPs later in the secondary market means the security’s index ratio is much higher than 1 because of the accumulated inflation.

This 20-year TIPs was:

issued in 2009

has less than 6 years remaining until maturity

referenced a CPI-U index of 214.7 when it was dated

The bond will be quoted as a percentage of 100 par.

This is a snapshot of the bond at the close of 10/11/23 from my Interactive Brokers account:

Even though the bond is quoted as a percentage of par — we’ll use a last sale of 100.7255 — the outlay must be multiplied by the bond adjustment factor (ie the index ratio of 1.42581).

Outlay = price x index ratio

It would cost 100.7255 x 1.42581 or $1,436.15 per $1,000 of face value.

Your coupon payments will be of course indexed to an adjusted principal value:

adjusted principal =face value x index ratio

adjusted principal = $1,000 x 1.42581 = $1,425.81

If October 11, 2023, was a coupon date:

coupon payment = 1.25% x 1,425.81= $17.82

Don’t forget at maturity, your bonds return the adjusted principal not the $1,000 face value.

Additional Considerations

On-the-run vs off-the-run

Consider 2 bonds:

A 10-year bond issued today

A 30-year bond issued 20 years ago

Both bonds have 10 years remaining to maturity. The new bond is call on-the-run and the old one is known as the off-the-run.

Off-the-run bonds will trade at a discount to the on-the-run (ie the off-the-run will offer a higher yield). Why?

If you buy a new bond with an index ratio near 1.00 you cannot lose if there is deflation. The bond’s adjusted principal cannot fall below 100% of par.

If you buy an off-the-run bond whose years of prior inflation have pushed the adjusted principal up to say 1.4x of par then if you have month-over-month deflation the CPI-U index will fall bringing the ratio and adjusted principal lower. That 1.00 strike put that is embedded in the bond doesn’t protect you from a falling price level the way it protects a newly issued bond.

All the TIPs on IB’s platform seem to be off-the-run except for the recent 30-year bond. The lowest index ratio on a bond with less than 10 years til maturity is about 1.40 which means there are no on-the-run 5 or 10-year TIPs on the platform.

ETFs

You can access TIPs via ETFs. State Street is an ETF provider so they remind you that TIPs ETFs avoid phantom income:

One of the complicating issues of using individual TIPS is that investors must pay taxes each year on the inflation adjustment to the principal even though the inflation adjustment isn’t received until the bond matures. ETFs avoid issuing this “phantom income” by distributing all inflation adjustments (classified as Treasury income) as they are accrued. This turns phantom income into realized cash flows.

I’ll add one more thought. ETFs offer something akin to a constant maturity exposure. So for example, if you buy an ETF targeting 7-10 year durations you will have constant exposure to that level of interest rate risk/sensitivity.

If you buy individual bonds, as time passes they become shorter-dated which reduces the exposure to interest rates.

It’s not a matter of what’s better, it’s just a question of whether you want constant exposure to interest rate volatility or if you like an entry point today and content to receive the carry while the exposure to rates dwindles away.

I saw a YouTube video comparing the performance of a TIPs ETF vs just owning an individual TIPs bond and then it moaned about how the ETF did worse in the rising rate environment. Well of course it would — it’s interest rate exposure never lapses. If rates were falling, the ETF would have done better than the individual bond.

If you are going to compare an ETF to individual bonds, you should compare the ETF to a bond ladder that is rebalanced to a constant exposure to the same duration.

Final observations

Inflation reporting

Inflation reporting denotes a trailing 1-year rate. The latest CPI index vs 12 months earlier. Just like you might prefer a shorter moving average to emphasize recent data you might want to just look at the monthly inflation index. You could even annualize the recent 3-month change if you thought that was more relevant. If you do that, don’t forget to consider seasonal biases.

For the past 3 years, inflation has been compounding at a touch over 6%

In the past year, we’ve seen inflation of about 3.70%

In the past 6 months, we’ve seen inflation of about 3.94% annualized

TIPs seem cheap relative to nominal bonds (ie breakevens are “low”)

Implied breakevens:

5 Year Breakeven Inflation = 2.26%

10-year Breakeven Inflation = 2.34%

Does this imply:

Bearishness (ie inflation/economy is going to tank — this doesn’t seem to be reflected in equity valuations)?

Flow anomalies?

The breakevens are derived from off-the-run TIPs whose embedded put option is worthlessly far out-of-the-money?

Oh yea, one last thing…

I said in the beginning I tried to buy TIPs and failed. There were over $5,000,000 worth of bonds on the offer. I tried to pay the ask for $100,000 worth and got a message that the NBBO did not need to be honored for less than the displayed size. I don’t know how the heck the bond market works but that just smells.

Additional reading

Mike Ashton’s 2020 post The Big Bet of 10-year Breakevens at 0.94%

Eversight’s 5-Part Series on TIPs

Stay groovy ☮️

Substack Meetings

I was invited to be a part of the Substack Meetings beta. You can book a time to chat. I’m more expensive than a 900 number from 1988 and have a less sexy voice.

Book a meeting with Kris Abdelmessih

Moontower On The Web

📡All Moontower Meta Blog Posts

Specific Moontower Projects

🧀MoontowerMoney

👽MoontowerQuant

🌟Affirmations and North Stars

🧠Moontower Brain-Plug In

Curations

✒️Moontower’s Favorite Posts By Others

🔖Guides To Reading I Enjoyed

🛋️Investment Blogs I Read

📚Book Ideas for Kids

Fun

🎙️Moontower Music

🍸Moontower Cocktails

Becoming a patron

The Moontower letter is and will always be free. My writing is a search “for the others”. The “others” are people like you who are unlearning the mental frames that artificially narrow our choices.

If you are here you already understand that inspiration is a tradable good. It’s not as tangible as a cup of coffee, but it packs 10x the adrenaline with an infinitely longer half-life than caffeine.

If you feel inspired, you can upgrade to becoming a patron.

Without knowing the ins and outs of the NBBO, I was a former CB salesman in London and Hong Kong and there are lots of cases where you don't want to deal with 100k orders. Minimum size that you actually want to deal with is a mill, and depending on the issue potentially more than that.

You might deal with a 100k order if you're axed that way or at least have a position, but if you're axed the other way or are just market making and don't have a position then it's more pain than it's worth to do the trade.

For example if I don't have a position and as a result of filling your purchase I'm short 100k of bonds, I now either have to buy 100k of bonds which is a pain because everyone else only wants to deal in 1 mill lots so I likely have to call in a minor favour and get someone else to sell me 100k or buy a mill and end up 900k long which I don't really want to do, or I could try and get a borrow for 100k which again is a pain and I now have a position on which is absolutely pointless but is still a pain.

The main problem is that bonds simply aren't liquid in the same way that stocks are. They often don't trade much at all (it's quite common for bonds not to trade at all on any particular day) and they don't trade in small size lots because the market is very much dominated by instos.

Hopefully that explains some of the issues!

As an FYI, Blackrock just launched term tips ETFs. It’s part of their iBond suite. Let’s you get exposure to TIPs at different points on the curve. 2024 ticker is IBIA.