Friends,

Yesterday I gave a 60 minute response to a moontower user who asked:

"I was immediately correct on the directional component of the trade, I'm not too sure if I was correct on the volatility component. How do I determine/assess this?"

I love the question because it internalizes something we say here ad nauseum:

Options are always about vol!

The key is that volatility p/l is decomposed into:

realized vol p/l (gamma vs theta)

implied vol p/l (vega)

By separating volatility p/l from directional p/l we do the same thing as investors who look at their performance relative to a benchmark. If you are winning consistently on option direction but losing on vol p/l you would want to know that. It means using options is actually costing you money and you want to upgrade your vol lens.

“Decomposing vol p/l” is sounds about as fun as a root canal. If you know nothing about the topic it raises the “complexity sells” red flag. If you know a bit more, it sound like trapdoor to even more horrible phrases like “Taylor expansion”.

I want to close the gap between how many people use options and how many of them actually understand at least conceptually what vol p/l means. It’s as important to options as designating beta and alpha is for investors.

So the 60-minute answer came in the form of a video. Forget symbols, let’s breathe our ways thru this nice and slow.

The video steps thru simulations to deconstruct p/l assuming you hedge your long or short gamma daily. These steps are as simple as understanding that if you own 5,000 shares of stock and it goes up $2 you make $10k.

In the process you will learn, by osmosis, lots of hard-to-come concepts like how a floating skew model works or why everyone samples their own realized vol and how that impacts their own personal p/l.

For paid subs, you can have a copy of the sheet below. Tinkering with this is probably the best way to internalize how option p/l actually works!

[All of this logic gets extended to portfolios if you are at a vol shop, but understanding how it works on a single delta-hedged strike is a great entry point. And remember, you can simulate a straddle as a single call or put as explained in the video. 1 straddle is equivalent to 2 outright calls or puts.]

If you prefer reading over tinkering with a sheet or watching videos, this material been heavily covered in these posts:

I will make appreciating and understanding vol p/l as commonplace as knowing what a benchmark is dammit.

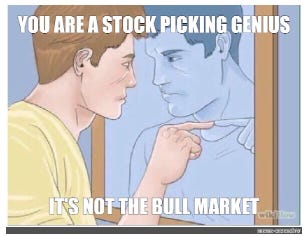

Let’s make not fooling ourselves great again.