Friends,

When this letter started 6 years ago, it was mostly curation — I just shared things I found interesting. Although I write and editorialize much more than I did at the start, the curation will always be a major part of these communications.

In that spirit, Wednesday’s post breakeven, was a pointer to what will prove itself to be a top-tier substack for practical investing knowledge, especially for options.

Today I’m pointing you to another strong recommendation. First, I confess that I subscribe to over 100 letters. I read a small fraction of what I subscribe to. I take a look at the topic and quickly triage whether I care to ever get to it or not. I’m perfectly happy to be on someone’s mailing list even if 1 out of 5 of their posts grabs my attention. That Lord Acton quote “Judge talent at its best (and character by its worst)” holds up well. Every act of creation, whether it’s insight or art, has the potential to stay with you forever. One banger can make up for lots of duds. Slugging ratio is more important than batting average when it comes to substance.

[It’s often the case that something I consider a dud isn’t even a dud, I just wasn’t “ready” for it. If I’m not in the right mindset no high-minded thought piece is gonna matter. I’m too busy being a woodpecker to indulge material that doesn’t fit in my beak’s path.]

That said, there are a few substacks that I almost always read even if the subject isn’t immediately compelling. The writing itself is enough of a reward.

The writer I discovered in 2024 in that category is experimental psychologist Adam Mastroianni. I’ll let his about page speak for itself. I recommended him once before:

“These posts address how our minds work and critically, how they don’t.

The last two are a series about the disaster known as peer review and Adam’s thoughts on how to reform it or create a parallel path.

These posts are all well-argued but also snortingly hilarious.

I’ll add 2 more today.

Two stupid facts that rule the world — this one is especially important to me because I’ve thought about writing the same message. As I like to remind people, the presence of 8 billion humans in this world is one of the facts that we don’t seem to internalize the ramifications of. This post says what I want to say only with way more skill and humor. The essay is an immediate entrant in Moontower’s Favorite Posts By Others.

Money Angle

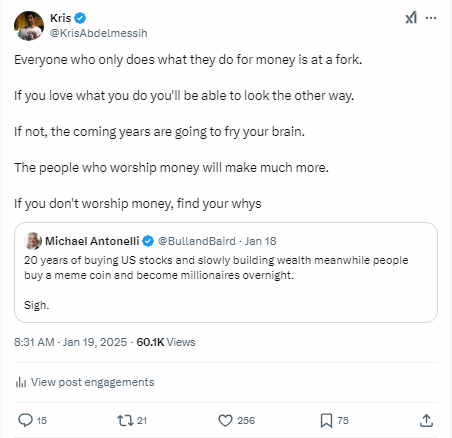

In last week’s Money Angle I touched ever so briefly on the $TRUMP meme coin. The thinking behind that section continued to stew in my head after I published it. This quote tweet slipped out:

That’s about a 95th percentile virality for my tweets (my social media skills are a slow burn not a neutron star).

I want to talk about this a bit more.

The optics of POTUS shilling openly for personal financial gain is jarring because it conflicts with long-standing norms associated with that office. It’s not that anyone thinks presidents are above corruption, but this is brazen in a way that either offends or emboldens. His defenders may say that politicians are always corrupt and on the margin it’s more virtuous to be open about it. I have my own opinions but the upshot of what I’m about to tell you is that you shouldn’t care what my opinion is anyway. One’s opinion of such things is moot from the forthcoming perspective.

Before we get there, I’ll let others articulate the criticism of what appears to be happening. Here’s Scott Galloway in his recent piece America For Sale (a short, amusing albeit dark ride):

I respect the Trump grift more than the plain vanilla trading on material nonpublic information. It’s more creative, and if you’re going to abuse the public trust, you should do it for billions vs. millions.

The most disappointing thing about our elected officials is not that they’re whores, but what cheap whores they are. For his $250m investment in Trump, the wealthiest man in the world was able to increase his purse by $140b (56,000% ROI). The increase in wealth had nothing to do with the performance of his businesses, but the market’s belief that we are now in a kleptocracy and the distinction between winners and losers is no longer about innovation but proximity to power. The polar vortex of corruption is here, as greater incentives, fewer guardrails, and the sense that character is no longer valued in America have cast a chill across capitalism.

Money has not washed over just our government, but also what has traditionally been a powerful check on corruption, the media. ABC’s Bob Iger sold out and settled rather than fight a lawsuit Trump brought over George Stephanopoulos’s on-air remark that Trump had been “found liable for rape,” a suit that looked very winnable for ABC. Jesus, Bob, really? FYI, the judge in the case also used the R word.

Many are now afraid of confronting Trump and First Lady Elonia, not because they think they might wrong them, but because they are worried about the aggravation and expense of being sued. In the end, the media and the citizenry are making a money choice when what is called for is a moral choice. (See above: Bob Iger.) For people who are not economically secure, it’s upsetting but understandable. For Bob Iger, it’s shareholder value colliding with cowardice. Last year the Disney CEO made $41m. But I’d argue he is increasingly impoverished.

Hold that in your RAM. Here’s a blurb from Byrne Hobart’s “what I’m reading” missive that came out yesterday (emphasis mine):

Ross Douthat has a lengthy interview with Marc Andreessen on how Andreessen and a large number of his peers suddenly switched to supporting Trump. Looking at the evolution of Big Tech's politics over the last five years certainly induces some whiplash, and makes me long for simple Occam's Razor-style explanations like "Vladimir Putin finally managed to steal George Sorors' mind control ray." But one thing Andreessen says provides some helpful perspective: tech was never uniformly left, and had a small active cohort and a majority of people who went along with what the majority view seemed to be. Now, the winning small cohort is on the right, and the go-along view is now support for Trump. But that explains the big swings. (Another explanation for how vocal they are is that Trump is clearly a man who enjoys effusive compliments. When dealing with someone that braggadocious, it's not enough to say that he's good, which is why many people are saying he's the best President they've ever seen.) The interview closes by noting that as soon as the Trump coalition won, the infighting started; politics is not something that happens only on a Tuesday in November.

Fi-douche-iary

Ok, let’s start from the abstract. Capitalism.

Trump’s brand of capitalism looks a lot like a Trojan Horse made out deregulated bronze but inside harbors its antithesis. Galloway:

On his first day back in office, Trump signed an executive order delaying the ban for 75 days, saying he wanted to engineer a deal that would give the U.S. half-ownership of the app. “If I don’t do the deal it’s worth nothing,” he said. “If I do the deal it’s worth a trillion dollars.”

This is not a new concept — there’s even a word for it: socialism. Socialism is when the state controls the means of production. America has proven, in spades, that the full body contact of competition creates more economic growth than the government cosplaying a business. Whether it’s the U.K. investing in DeLorean or Obama propping up Solyndra, it usually doesn’t end well.

The leaders of the most important companies in the world are falling in line because the operating system of capitalism’s vulnerability to ransomware is becoming common knowledge in a way that does away with any pretense.

More subtly but just as important is a sense that any action that can be traced back to “creating shareholder value”* will not only get a pass, but be practically mandated. The incentive is umm, I hate to use the word because of its other context, but it’s perfect here: unburdened. There is no quandary about what it means to be a fiduciary. There is only one relevant test now — are you a paperclip maximizer?

[*As of this publication in 2025, “shareholder value” is a postmodern concept. It appears the fastest way to increase your share price is to swap the corporate coffers for BTC.]

Consider Zuck.

Is his recent glow-up genuine or part of his groveling tour to get in the POTUS’s good graces? Zuck is like if Young Sheldon read that Dale Carnegie book then started slavishly going down the checklist to get what he wants. Recall the warning NFL team owner Cameron Diaz gets in Any Given Sunday: “First you get along, then you go along”.

I try to take a charitable line on individuals because our incentives and environments dominate us (even a casual reading of history reveals how thin the line between civil and savage is. If your kids are threatened, you will turn into a werewolf in broad daylight without an ounce of remorse.)

Business leaders are to shut up and dribble because once you win the war of defining capitalism strictly as paperclip maximization then any deviation from that to widen societal values is prisoner’s dilemma suicide. I quote Scott Alexander’s magnificent description of such multi-polar traps in Don’t Look Up It’s Moloch:

All these scenarios [described earlier] are in fact a race to the bottom. Once one agent learns how to become more competitive by sacrificing a common value, all its competitors must also sacrifice that value or be outcompeted and replaced by the less scrupulous. Therefore, the system is likely to end up with everyone once again equally competitive, but the sacrificed value is gone forever. From a god’s-eye-view, the competitors know they will all be worse off if they defect, but from within the system, given insufficient coordination it’s impossible to avoid…in some competition optimizing for X, the opportunity arises to throw some other value under the bus for improved X. Those who take it prosper. Those who don’t take it die out. Eventually, everyone’s relative status is about the same as before, but everyone’s absolute status is worse than before. The process continues until all other values that can be traded off have been – in other words, until human ingenuity cannot possibly figure out a way to make things any worse.

Matt Levine has this ongoing trope of “everything is securities fraud” in reference to the idea that from a market-maxi perspective, anything that hurts your stock price can be adjudicated as a crime. That logic is a profound end-around where the judicial branch subsumes the legislative.

For capitalism to serve us broadly there needs to be some airgap from a corrupt OS lest the worst people will not see “fiduciary” as something to live up to but as a shield for their psychotic impulses.

“Hey, if I don’t [insert objective that sacrifices common good], I miss earnings, my cost of capital increases, and I must fire people.”

Look, if the road to hell is paved with good intentions, then consequentialist thinking is an over-optimized bulldozer. Our frontier of needs requires we resist reductionism, but nuance doesn’t sell or spread. Inverting — if it spreads, it’s propaganda.

DDoS attack on life scripts

Everything so far has been abstract. You read this and think “What am I supposed to do with this? I still gotta knock out this rent?”

I’m 100% with you. I’m just some suburban family man who feels whipsawed by our cultural tug-of-war. Too unstrategic to take a side performatively and too jaded to subscribe to the demands of ideological purity. A coward in the eyes of believers, a fool to the ambitious. Pragmatic enough, idealist enough, and wholly unsatisfying. Like the dust I came from and shall return.

So I move from the abstract to practical rationalization to get on with the business of being. I took some walks with friends to hear different perspectives searching for one I can incorporate with my own feelings to anchor myself amidst the vertigo.

[I recognize that this might sound indulgent to even want to process this stuff but for the days you get between eras of dust you are entitled to be a snowflake just as someone else is entitled to ignore your ass. If you spend your professional life embedded in the very gears of how capital moves it’s natural to wonder about the vinculum between productive norms and their denominator.]

The following is a mish-mash of reflections that took shape in the past few weeks.

The nature of “winners”

Trump and most people with power and wealth are a subset of a group that is self-selected on a very pointy fact — they are heroically relentless at whatever game they’ve chosen. Depending on what you value, this is a feature or a bug but it’s a necessary condition for them to be where they are.

Trump’s life, zoomed out, is a picture of ever-larger victories. In his mind, these victories justify anything he wants. If his game is “give the people what they want”, he’s Ali, Jordan, Gretzky and Phelps combined. A tiny slice of that surplus, whatever calculus or crayons he used to compute it, could easily be tens if not hundreds of billions of dollars and it is cosmic right to take it. I don’t think this is the right way to think but it is A way to think. Go back to Adam’s post I plugged earlier — 2 stupid facts that rule everything.

You can’t relate to Jordan or Napoleon or Trump’s mindset. If you could the world would know of the product of your relentlessness.

Zuck, Andreesen, whatever…it’s just a game. They chose theirs and put on the blinders. That’s how they got where they did (plus luck — blinders aren’t enough to take you all the way, they are necessary but insufficient.)

That there are people who will maximize paperclips as if it were their purpose on earth should not surprise anyone whose eyes are open. Your overtures to any ideals that conflict with their goals might as well be whale sonar — they don’t even hear it if it’s not useful to them. The merit of ideals from the perspective of any other optimization function is simply not a criterion for them to consider it.

This is jarring to humans who are used to operating in a set of norms that is give-and-take. Where their concerns are considered. In Trump’s case, he’s an all-time great listener because his game is giving people what they want. If they wanted cancer, he’d give them that. Like any great power, it’s double-edged. Your view of him depends on which side of the sword you’re on, but the presence of the sword is not in question. Amassing wealth is first and foremost about giving people what they want. The method and products vary but its creation always has that bit in common.

Your own game

Ok, so we’re done with a long-winded but hopefully edifying version of “don’t hate the player, hate the game”. If you want to compete with that, you’re gonna need your own sword. Your own relentlessness. And if you aren’t going to pay the price to battle in their game then you must find your own.

That’s what my original tweet is about. If the only reason you work is for money then watching everyone slash-and-burn their way to riches will corrode your faith in prosocial values. You just feel like an honest sucker.

And this is bigger than the current moment. With automation accelerating, we are bombarded with questions about the value of what we do and ultimately our self-worth. The scaffolding of the set is becoming visible as the world gets more financialized.

[This past week, Kyla and Nick both wrote good pieces on the securitization of attention]

Humanity will be unable to outrun its creations IF the logic of efficiency decides we are costs as opposed to clients. I have little faith in either a) paperclip maximizers being able to consider such a question given their relentless focus and b) even if they could, how would the coordination problem be solved?

[I think a lot about Hardcore History’s Dan Carlin's thoughtful answer about how humanity would undo itself. He thought about it on a level higher and tried to think of what class of problem it would flow from. He concludes the most diabolical kind — coordination.]

We rip open boxes like honey badgers to get to the fruit. You can’t put anything back in them. We might be able to change the slopes of the arrows of progress but not the direction. So while the curve is not yet exponential, we have to make our peace with the games others play but more importantly, we must understand our own.

You must direct your precious attention to your game as relentlessly as the psychos do to theirs. That’s the only way to decommodify yourself in a world that profits from your negligence of that duty.

There’s no quick way to explain how to do this. It’s the sum of everything I’ve ever put into the Motivation & Creativity and Affirmations & North Stars categories of my writing. But just to help with something immediately I can offer an inspiration and an exercise.

The inspiration is a short post by Matt Zeigler about the history of Sub Pop records:

We're Not The Best, But We're Pretty Good (3 min read)

It’s an encouraging reminder that if you focus on quality and survival you will get a chance at longevity. Which is the key to compounding in all the ways you need to flourish.

The exercise is something I did for myself because I can be a bit all over the place and find it settling to narrow my aperture. I tried to write a single line explaining what I do. Something narrow enough to focus, but wide enough to keep my identity from being brittle or defensive as the world changes.

I wrote:

I make words, pictures, and tools to help myself and others make decisions. If I can find others who value this and persuade them (ie build trust that I can help), the economy has a place for me.

Every object-level activity I do career-wise serves this definition. And what those specific activities are will change. Because how could they not.

Money Angle For Masochists

I will use this section as a boost for Thursday’s paywalled post:

The feedback on this one confirmed my sense that it would be one of the most important option posts I’ve written because it gives a walk-thru of a major topic that encompasses so many critical pricing ideas (there’s a downloadable spreadsheet included so you can get your hands dirty).

These are 2 additional excerpts from the paywalled section:

[Bonus observation: power law functions handle vol term structures well. Remember a power function can be converted to a line using a log-log transformation where your variable Y is vol and X is DTE so you can fit a linear regression. You can start to imagine a wider infra where you have a well-defined event calendar, extract implied events sizes everywhere, and fit base vol term structures to identify kinks, ie buy and sell signals. Suddenly it dawns on the reader what relative value vol trading looks like. Throw in layers of execution topics and you can see the basic truth — there isn’t any magic sauce it’s just fastening a thousand submarine doors before the thing can go anywhere. And every day the state of the art of little door details inches up.]

Trading vol around events is a major topic. At scale, quants will have more “proper” methods for doing this but I can tell you that a significant portion of my career earnings have come from understanding this stuff. (It was 20 years ago, about 2005, that I was starting to build this infra. All in Excel by the way.) The techniques improve. I’m not a quant as I’ve said many times. I don’t know the state-of-the-art but with some simple math and yea a lot of endurance, observing, noticing you can go quite far. Is this gonna turn you into SIG or Jane? Hell no, but these are the ant trails that take you to the questions. To a frame of mind that measures for and seeks contradiction. Notice how little broad opinions matter. Instead, you are trying to turn market prices into mini-hypothesis. Trades are tests against hypothesis. But it starts with measurement. Here are a few questions that option traders are asking every day…

From My Actual Life

Ok, this isn’t from my life but wtaf 🤯🤯🤯

Stay Groovy

☮️

Moontower Weekly Recap

Need help analyzing a business, investment or career decision?

Book a call with me.

It's $500 for 60 minutes. Let's work through your problem together. If you're not satisfied, you get a refund.

Let me know what you want to discuss and I’ll give you a straight answer on whether I can be helpful before we chat.

I started doing these in early 2022 by accident via inbound inquiries from readers. So I hung out a shingle through the Substack Meetings beta. You can see how I’ve helped others:

Moontower On The Web

📡All Moontower Meta Blog Posts

👤About Me

Specific Moontower Projects

🧀MoontowerMoney

👽MoontowerQuant

🌟Affirmations and North Stars

🧠Moontower Brain-Plug In

Curations

✒️Moontower’s Favorite Posts By Others

🔖Guides To Reading I Enjoyed

🛋️Investment Blogs I Read

📚Book Ideas for Kids

Fun

🎙️Moontower Music

🍸Moontower Cocktails

🎲Moontower Boardgaming

I'm going to push back on "You can’t relate to Jordan or Napoleon or Trump’s mindset. If you could the world would know of the product of your relentlessness." (specifically, the last sentence)

That's true if you're relentlessness is something visible to the world.

It's probably still true even if it's for something intangible, like "become the world's foremost expert in XYZ."

It doesn't hold true for something hidden, like relentlessly pursuing being a great husband/dad, sacrificing all else towards that end. You could successfully achieve your end and yet the world would not know the product of your relentlessness. I'd go even further in saying these are the only pursuits worthy of relentlessness.

(I don't think this scenario is *common* - I'd say our current cultural default is to not have a life ordered towards one thing, but rather a more compartmentalized life where decisions are generally made piecemeal, so your main point still holds. And the few who order their life towards the pursuit of one thing generally pick something not worth the pursuit.)