Programming Note: This is the last week of school in our area and we are traveling the majority of the next 2 months (before the second annual Cousin’s Camp which is shaping up to be bigger than the first with the benefit of much more time to prepare) so I’ll be taking a bit of a summer break. My posting frequency will range from intermittent to nonexistent.

Friends,

I have a beautiful book recommendation today:

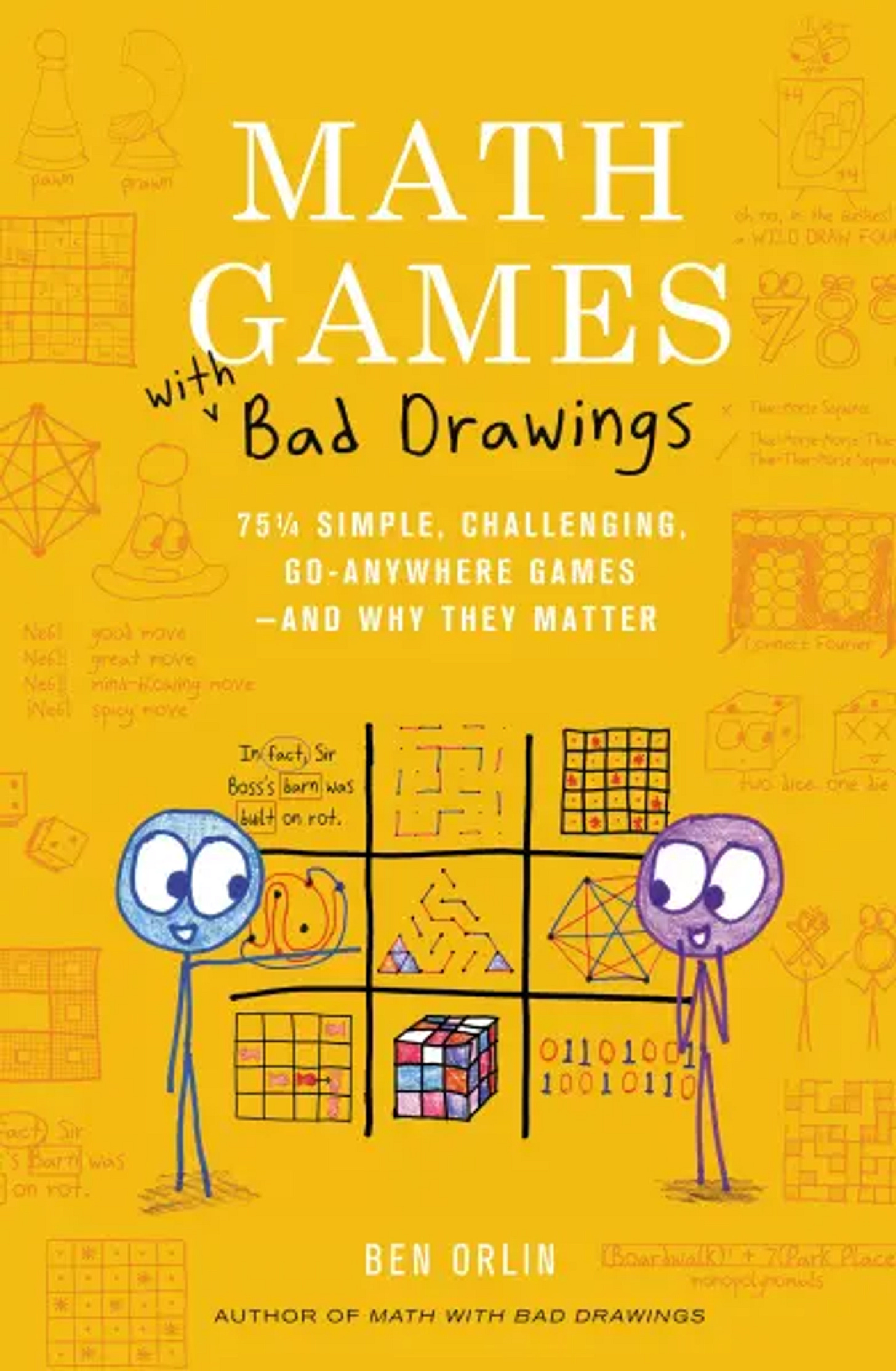

Math Games With Bad Drawings by Ben Orlin

The big, bright hardcover will grace any coffee table but even better — it’s meant to be used.

From the description:

From beloved math popularizer Ben Orlin comes a masterfully compiled collection of dozens of playable mathematical games.

This ultimate game chest draws on mathematical curios, childhood classics, and soon-to-be classics, each hand-chosen to be (1) fun, (2) thought-provoking, and (3) easy to play. With just paper, pens, and the occasional handful of coins, you and a partner can enjoy hours of fun—and hours of challenge.

Orlin’s sly humor, expansive knowledge, and so-bad-they’re-good drawings show us how simple rules summon our best thinking.

The book has five sections:

Spatial Games

Number Games

Combination Games

Games of Risk and Reward

Information Games

For each game you are given the rules, the “tasting notes” for the game, why the embedded math matters and how it relates to your life more broadly.

There are 3 games I bring special attention to because they relate easily to the topics discussed in Moontower.

A Game of Risk and Reward

This is a multi-player version of a game that helps you tune your confidence calibration. We do a version of this when we onboard applicants to PitBulls because in trading you rarely know the “right” answer. A key meta-skill is to handicap how the odds that your proposed answer is right or wrong.

If you are overconfident in trading you make your markets too tight. That means you’ll get all the market share and find yourself sad for selling $1 bills for 95 cents.

If you are too conservative (ie too wide) in your markets or ranges you’ll never trade. You’re the person bidding 15 p/e for the SP500…go away, nobody cares about your irrelevant bid.

Calibration is a learned skill. Nobody comes out of the womb a great bettor. This is a foundational belief of training programs in trading and books like Superforecasting (see notes) or Thinking In Bets. You learn by practicing. Outrangeous is a way to practice with friends whether you’re on a long road trip or standing in line at Six Flags (a good question might be “what was the avergae number of people that visitied the theme park daily in 2022).

From Orlin:

What's the goal?

Each answer is a number. You'll guess a range of values. trying to make it as narrow as possible while still including the true answer.

What are the rules?

One player — the judge for the round — announces the trivia question. The other players act as guessers, each secretly writing down a range of values.

When everyone has committed their answer to paper, the guesses are revealed. The goal is to capture the true value, while keeping your range as narrow as possible.

The judge reveals the true answer. Anyone who missed the answer- no matter how painfully close they came-receives 0 points. Instead, the judge receives 1 point per wrong guess, as a reward.

Then, among the players with the correct answer, order them from the narrowest range (i.e., most impressive guess) to the widest range (i.e. least impressive guess.)

These players receive 1 point per guesser that they beat. Note they all beat anyone who missed the answer

Play enough rounds so that each person has an equal number of turns as judge. In the end, whoever has the most points is the winner.

Games of Information

Bullseyes and Close Calls

A CLASSIC CODE-BREAKING GAME

Under the name Mastermind, this became one of the biggest board games of the 1970s, selling as many units as The Godfather sold tickets (about 50 million, if you're keeping score). But the game didn't begin with those colorful plastic pegs. For a century beforehand, it was played using pen and paper, under the earthy name Bulls and Cows. Now, as an ardent bovine feminist, I reject the idea that bulls are better than cows, so I've renamed the former as Bullseyes and the latter as Close Calls. But feel free to use whatever words you wish. This code game, under any code name, remains a stone-code classic.

[Kris: I’ve recommended Mastermind before. See Fun Ways To Teach Your Kids Encryption]

WHY IT MATTERSBecause life is a hunt for information, and humans are lazy hunters. You know this already. Either you're human yourself, or you're conversant enough in human culture to enjoy human books like this one. Either way, you've seen Homo sapiens spend hours gorging on information, then somehow emerge from the feast without an ounce of nourishment.

Take a wretched and typical specimen: me. I subscribe to 77 podcasts, follow 600 people on Twitter, and long ago maxed out the number of open in my Wikipedia phone app. Given all this information, how informed am I? The other day my young daughter picked up a pinecone. "That's a pinecone," I volunteered. "It comes from a pine tree. It's... some kind of big seed, I think?" This wasn't a tough pitch to hit. My daughter had not picked up a quasar, a Tom Stoppard play, or the hard problem of consciousness. The truth about pinecones is definitely out there. I just didn't know it. Nine words in, I had exhausted my knowledge.

As a rule, humans don't seek information in the right places. In a classic psychology study, subjects were shown four cards, each with a letter on one side and a number on the other. Then they learned a rule: A card with a vowel must also have an even number.

The question: Which cards do you need to flip over to see if the rule has been violated?Before reading further, think it over. What would you flip? If you prefer to copy off of other people's homework, here are the most common answers from a typical iteration of the study, conducted in 1971:

See the notes if you want to the answer and the reasoning behind it.

Caveat Emptor

AN AUCTION GAMEI'm afraid I can't teach you how to win at Caveat Emptor. But I can easily tell you the best way to lose: Just win every auction. I mean it. Play a few rounds, and you'll find that overbidding is all too common. It's a game marked by Pyrrhic victories, with winners forced to take home prizes for more than they're worth. This phenomenon-losing your shirt on a winning bid is so pervasive that auction economists have dubbed it "the winner's curse."

Lucky for you, Caveat Emptor offers a lot more information than the typical auction. Will that be enough for you to escape the curse?

[Kris: See the notes for how to play and why it matters including under which conditions you’d expect to find a “winner’s curse”.

It also reminded me of Recipe For Overpaying where I note investor Chris Schindler's intuitive explanation for why high volatility assets exhibit lower forward returns: a large dispersion of opinion leads to overpaying. He points to private markets where you cannot short a company. The most optimistic opinion of a company’s prospects will set the price.

Fyi, back in 2000 SIG issued all new hires a copy of Prof. Richard Thaler’s Winner’s Curse]

🔗My notes to Math Games With Bad Drawings

💗Give some love to author Ben Orlin — buy the book (I don’t know Ben and this is not even an affiliate link)

Money Angle

15 Ideas From Morgan Housel’s Interview with Tim Ferriss (31 min read)

Moontower

This was a great interview from last summer but the content is evergreen. These were my favorite excerpts.Portfolio Theory In The Wild: Funding YouTube Creators (11 min read)

Moontower

Business Breakdowns host Ali Hamed interviewed Spotter founder Aaron DeBevoise. Spotter is a private company that provides knowledge and capital to YouTube creators including MrBeast.I “spotted” 2 great examples of “portfolio theory in the wild”. I relate them back to where I’ve covered these ideas before and their implication.

Money Angle For Masochists

I introduced masochism posts in January as a separate section (in the past regular Money Angle posts would just veer into masochism without warning — thanks to readers for asking for a street sign).

The “masochism” title is a self-dig because the point is actually to bootstrap the logic of challenging financial concepts with broadly accessible intuition slowly and socratically. I will resume that practice after summer break. If you are interested in catching up:

Commentary or Qualitative Reasoning

Quantitative Reasoning

Examples Of Comparing Interest Rates With Different Compounding Intervals

Using Log Returns And Volatility To Normalize Strike Distances

Socratic Tutorial

Stay groovy ☮️

Substack Meetings

I was invited to be a part of the Substack Meetings beta. You can book a time to chat. I’m more expensive than a 900 number from 1988 and have a less sexy voice.

Book a meeting with Kris Abdelmessih

Moontower On The Web

📡All Moontower Meta Blog Posts

Specific Moontower Projects

🧀MoontowerMoney

👽MoontowerQuant

🌟Affirmations and North Stars

🧠Moontower Brain-Plug In

Curations

✒️Moontower’s Favorite Posts By Others

🔖Guides To Reading I Enjoyed

🛋️Investment Blogs I Read

📚Book Ideas for Kids

Fun

🎙️Moontower Music

🍸Moontower Cocktails

Becoming a patron

The Moontower letter is and will always be free. My writing is a search “for the others”. The “others” are people like you who are unlearning the mental frames that artificially narrow our choices.

If you are here you already understand that inspiration is a tradable good. It’s not as tangible as a cup of coffee, but it packs 10x the adrenaline with an infinitely longer half-life than caffeine.

If you feel inspired, you can upgrade to becoming a patron.

How can I not buy this book?! Thanks for the rec

Hi Kris, great article, the book looks amazing thank you for the recommendation.