commodity kamikaze

Moontower Munchies #79

Friends,

Note: I mention a trade I’m looking at in the back half of today’s issue. I’m not an advisor. I get hunches, I cross-reference them with pictures I have a hand in creating, I fire and then I go back to writing, tinkering, and ignoring what the world tells me to look at. Anything that rattles in your brain from my thoughts or existence are at your own damn peril.

On the back of Sunday’s post where I mentioned our search for math enrichment, a reader wrote:

I can really recommend mathacademy.com for your kids, I’ve been doing it as part of my trader interview prep and it’s pretty insane how fast the learning curve is. Pretty sure they start at 3rd or 4th grade level and have 9th graders do uni level math in 2 years or something similarly crazy.

I went to the website and read these:

And my first thought was screw the kids I’m doing this myself. I haven’t taken math since HS so I signed up for:

The Mathematical Foundations sequence is aimed at adult learners interested in pursuing advanced university courses, but lack the necessary foundational knowledge. Whether you're starting off again with the basics or just need to brush up on your calculus, this is the fastest and most efficient way to get up to speed.

Besides doing this to learn math (fyi it’s accredited and only $50/month) I’m also guinea-pigging it for my kids and more broadly I think I’m going to learn a lot about the science of learning as well as explore the promise of how AI can personalize learning.

Why would I think this curriculum has a clue about learning broadly?

Well, I started poking around the blog of the chief quant at mathacademy.com — a gentleman named Justin whose output makes me think his days are Venusian. Cancel your meetings and pull up the blog. Here’s 30 articles out of god-knows-how-many I saved to read later:

(Btw, I pasted the hyperlinks into ChatGPT and asked it to return them in this format including figuring out the reading time)

How to Get from High School Math to Cutting-Edge ML/AI (11 min read)

Why Is the EdTech Industry So Damn Soft? (9 min read)

Individualized Spaced Repetition in Hierarchical Knowledge Structures (8 min read)

You Are Not Lazy, You Just Lack a Habit (7 min read)

The Most Superior Form of Training (8 min read)

The Greatest Breakthrough in the Science of Education Over the Last Century (6 min read)

Which Cognitive Psychology Findings Are Solid That Can Be Used to Help Students Learn Better? (9 min read)

If You Want to Learn Algebra, You Need to Have Automaticity on Basic Arithmetic (7 min read)

The Alien-Level Skills Hack (5 min read)

Fast Correct Answers Do Matter in Mathematics (6 min read)

What’s the Best Way to Teach Math: Explicit Instruction or Less Guided Learning? (10 min read)

When Should You Do Math in Your Head vs Writing It Out on Paper? (5 min read)

The Pedagogically Optimal Way to Learn Math (8 min read)

How Bloom’s Taxonomy Gets Misinterpreted (7 min read)

What People Think Maximum Efficiency Learning Should Feel Like vs What It Actually Feels Like (6 min read)

Conversational Dialogue Is a Fascinating Distraction for Educational AI (7 min read)

The Situation with AI in Education (8 min read)

People Differ in Learning Speed, Not Learning Style (6 min read)

Talent Development vs Traditional Schooling (7 min read)

For Most Students, Competition Math Is a Waste of Time (6 min read)

Book Review: Bloom’s Developing Talent in Young People (5 min read)

Best Description of Explicit Instruction (4 min read)

Why Extrinsic Motivation Matters (5 min read)

If You Want to Learn Math, You Can’t Shy Away from Computation (4 min read)

Active Learning: If You’re Active Half the Time, That’s Still Not Enough (6 min read)

Transform Yourself into a Person Who Is Capable of Achieving Your Goals (7 min read)

The Most Effective Way to Motivate Students to Learn Math (6 min read)

Recreational Mathematics: Why Focus on Projects Over Puzzles? (5 min read)

Can You Automate a Math Teacher? (5 min read)

Getting A's in High School Math Is Not Good Enough (5 min read)

Speaking of math, turns out that if you’re a freakish undergrad, SIG’s 10-week summer internship pays $70k including a $20k signing bonus. Here’s a list of all the trading shops recruiting for next summer’s crop:

Electronic Trading Summer Internship Pay 2025 (4 min read)

Oil trade

WTI has given up all its gains for the year after falling the last few months and another 3% Tuesday after OPEC revised demand growth estimates lower through 2025. Commodities are telling a bearish story for the world economy. The BCOM index is down 5% for the year and over 12% from its May peak.

There’s a risk-off move broadly albeit uneven. Bond yields have been falling, and vols are elevated (by now you should at least have a free moontower.ai sub…there’s more to vol than VIX amiga). But instead of DCA’ing into equities which have remained quite strong relatively I’m going to add some WTI length.

I’m gonna get a little cute with this one. The deferred part of the curve has been getting hit as well as the front which fits the story — OPEC was planning to unwind the production cuts it has had in place since last year, but has kicked the can another 2 months. In other words, there will be even more supply in the future.

I checked with my favorite oil trader, Tina (who incidentally got featured in Gunjan’s WSJ piece this past week about SIG using poker to train traders), who felt that the OPEC posture was putting a damper on oil sentiment.

I pulled up the managed money and producers COT on CME Quik Strike:

The managed money length is on the low end of its 5-year range and the producers’ length is at a 5-year high.

My interpretation is that there will probably be a fair amount of resistance if it tries to rally since the producer will up the hedging. But the managed money positioning seems unlikely to have enough bullets to get much shorter (ie less long).

A recipe for being caught in the middle like Chewie in the trash compactor (RRRAARRWHHGWWR!)…while the vol is ripping higher…

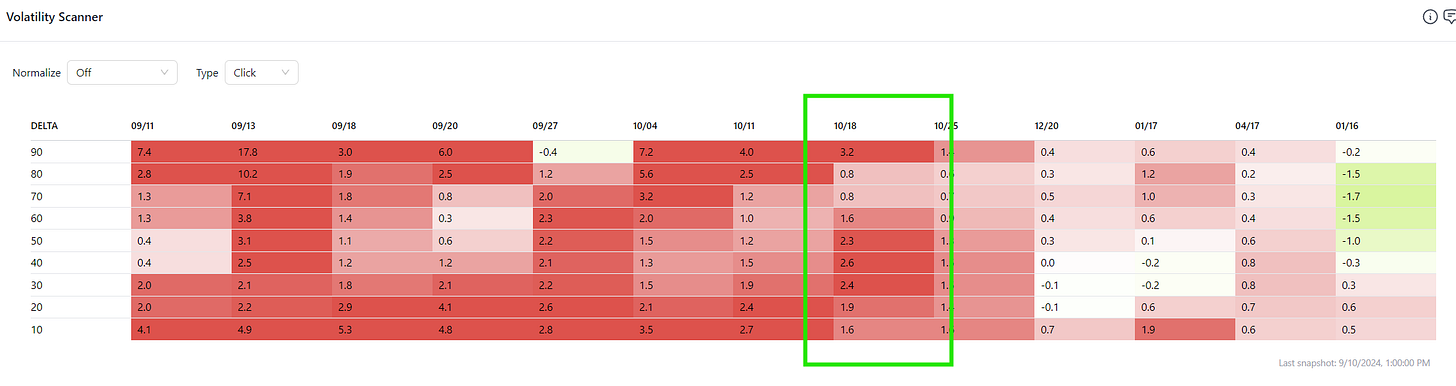

USO via moontower.ai on 9/10:

The realized vol is elevated but there’s still a healthy risk volatility premium in the options even above that.

Especially in the near-dated options (ie 1-month).

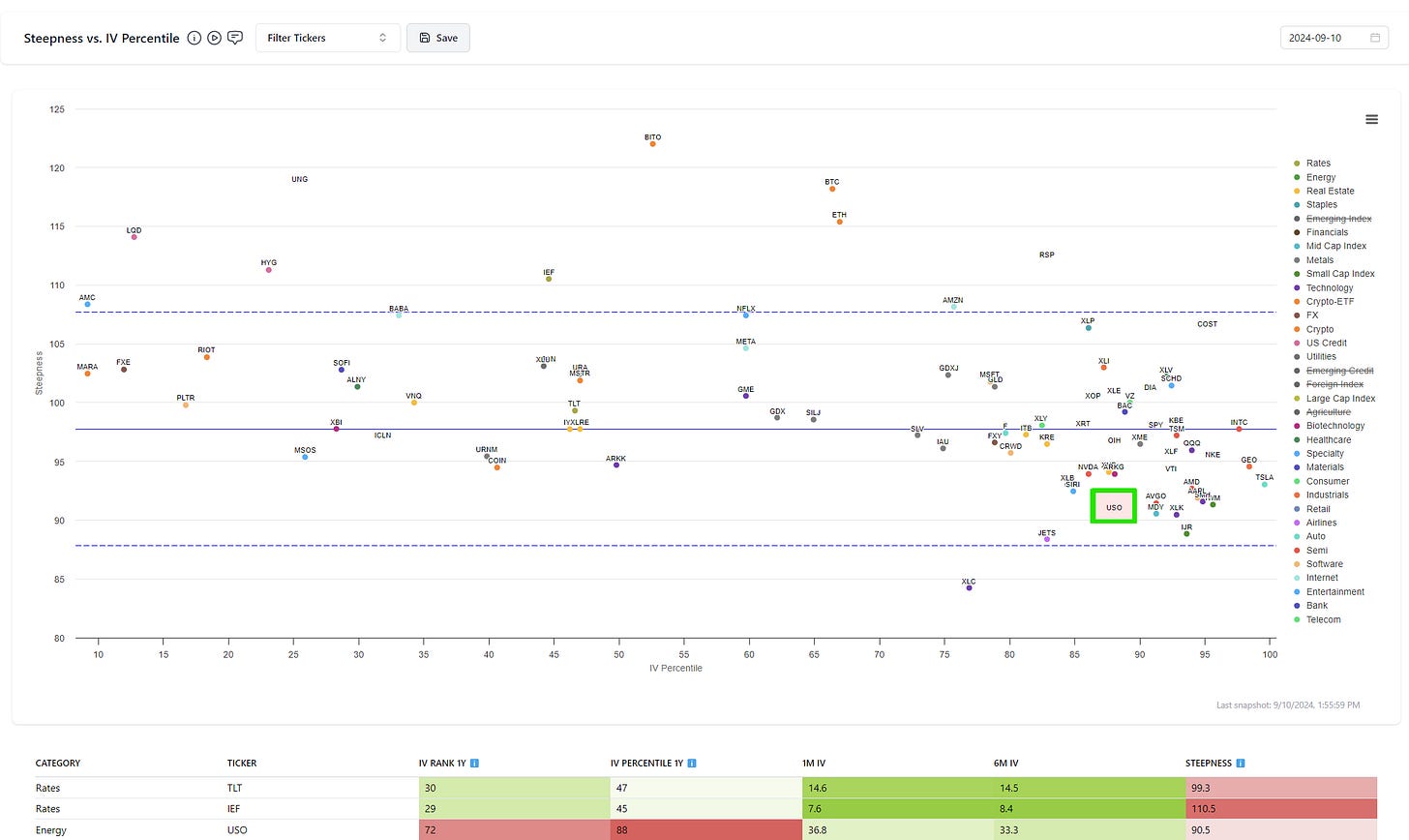

This is USO on the moontower.ai dashboard:

Vol is elevated even above the high realized, the vol curve is sharply descending (ie steepness < 100), and the put skew is jacked.

Given the narrative, COT, and vol setups my idea is some mix of:

Sell some 1-2 month oil puts naked and some long equities that have been held >1 year. My equity holdings are mostly index funds. I’d do the trade on a net long delta since I’m ok with DCA’ing into a rebalance that is effectively buying the thing for sale in exchange for things that are less “for sale”.

Sell near-dated 75 to 60 delta calls, and buy Dec25 oil futures which are still at a discount to the prompt months (a few percent of roll yield plus some vol premium especially from the downside options). As far as weighting the trade, you need about 2 futures of Dec25 (Z25 for those who partake) for every future equivalent you sell in the near-dated based on the relative beta*. And since I prefer to be a net delta buyer on balance, I can start with how many back-month futures I want to buy and then let that guide which delta call I sell.

A note on the vol charts above. Those are for USO which will trade in line with the near-dated futures options vols since that’s what the fund holds. However, USO liquidity is trash relative to the future options so I’d just trade the CME options via IB.

Unfortunately, I wasn’t able to build a delta-hedged structure as a package to trade on IB where I traded an option in a near-month vs a future in a back-month (you can do it if use the same month for the options and futures).

To execute you need to work the option order and as soon as it’s filled lift the Z25 futures leg.

🤮

I just threw up in my mouth thinking about executing like that. Going for my annual physical doesn’t make me question my life choices. Executing like a pigeon does.

Stay Groovy

☮️

*more on this in tomorrow’s paid post

Need help analyzing a business, investment or career decision?

Book a call with me.

It's $500 for 60 minutes. Let's work through your problem together. If you're not satisfied, you get a refund.

Let me know what you want to discuss and I’ll give you a straight answer on whether I can be helpful before we chat.

I started doing these in early 2022 by accident via inbound inquiries from readers. So I hung out a shingle through the Substack Meetings beta. You can see how I’ve helped others:

Moontower On The Web

📡All Moontower Meta Blog Posts

👤About Me

Specific Moontower Projects

🧀MoontowerMoney

👽MoontowerQuant

🌟Affirmations and North Stars

🧠Moontower Brain-Plug In

Curations

✒️Moontower’s Favorite Posts By Others

🔖Guides To Reading I Enjoyed

🛋️Investment Blogs I Read

📚Book Ideas for Kids

Fun

🎙️Moontower Music

🍸Moontower Cocktails

🎲Moontower Boardgaming

Ha, yes, 70k is great if you can get it. I'm actually waiting on a response from the technical. I don't think I'll move forward. Answered 11/17 and really annoyed by two probability questions I recognized but couldn't pin down a method for.

I came into math a year ago. From a humanities family, both parents when to seminary. It's weird how much upbringing can factor into talents. I grew up with 12 hour days of reading- no prompting, just wondered into my parents library and picked stuff up. I can remember exact arguments from essay's I wrote years ago, I can sit down for an exam and write all my essays using sources I read long before this class and not use a single related book in the course. But math... I haven't got that maturity. I did maybe 4 weeks of math a year. One before each semester's midterm and final. Took last year and studied abroad at St. Andrews. They're doing it right, no gen-ed classes, just math from year one. Adjustment was a punch in the gut. They had 1.5 courses worth of proofs in linear mathematics, I had covered most of the prior topics but proved nothing; jumping into the second course I had to cover all that material at once. But I walked out with a 2.1 mark, and now I've spent enough time staring at equations to form that habit and base. I'm onto learning some stuff that's actually use-full in the real world now (read: numerical implementations). Really wish I had started sooner, my parents tried kumon once. But I just didn't see any point to it when I could spend all day exploring a different beautiful written world.

Math academy......I'm not entirely convinced yet (we were part of the Kumon homeschool crew, switched to singapore. I don't love it), but I'm intrigued....