Friends,

On my way to Portugal, I was stuck on a plane with no internet and was thinking about hedging downside market exposure. You know, like you do when you’re stuck on a plane.

I know vols are in the toilet and to use a phrase from option broker Dean Curnutt — “buy umbrellas when the sun is shining”. It probably didn’t help that I also nodded along to Alexander’s post Time to Hedge?

Choosing the specific hedge is a fingertip exercise in looking at the metrics (the whole raison d'etre for moontower.ai in the first place was to reclaim the vol lens I lost when I left daily trading) and combining what they say with the personal biases I express in my portfolio.

Puts tend to be expensive. And when the vols are low, the skew can firm keeping the expensive puts much stickier than the rest of the surface especially longer-dated where the contango steepens.

There are times when you can buy puts without holding your nose but they tend to be rare (the rare easy trade was the risk-reward of owning skew on a heavy delta in late 2018 as it got very cheap. The street was choking on supply originating from the structured note market).

OTM calls on the other hand can get very cheap in grinding rally like we’ve been experiencing. Put-call parity is a timeless reminder that you can hedge downside even with OTM calls by simply selling your stock and replacing some or part of the exposure with long calls. This is a bearish or hedged posture that sacrifices small upside (the distance between the current spot price and the strike) in exchange for profiting in any large move scenario. With vols so low…by “large” I mean “historically intermediate”. Thank you market for uncautiously trying to wring out every last bit of risk premium. If the world is as great as the options market implies than being employed or running your business will harvest that reality. Not sure the logic of doubling down on exuberance in the ole’ PA but everyone’s got a different appetite.

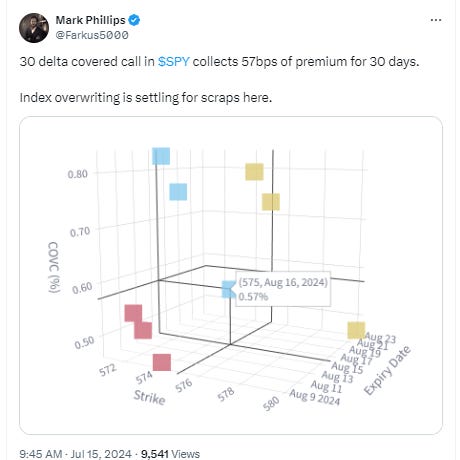

Mark’s observation below highlights just how goofy the risk-reward on calls is screening.

If you thought the actuarial fair value of those calls were 80% of the premium then you are collecting less than 15bps of "edge" per month before transaction costs. Instead you could use what the market is giving you. Sell some amount of your shares, use the interest on the proceeds to buy calls to dial in the delta you want.

(Mark has written a good post about this btw: Structured Product Toolkit)

But I digress.

Back to the airplane musing.

I was trying to back-of-the-envelope estimate how much, in percent terms, it would cost to insure my portfolio against certain moves. I had a sick, sleeping kid in my arms. No internet. No calculator with Black-Scholes programmed into it. It was going to be mock trading style mental math. If options are a bicycle for the mind, these are the trips that strengthen your betting and structuring intuition. As we step through this it will re-define what an option spreads means to you and strengthen your understanding of how options relate to each other (fyi this is part 1 of 2).

Before we get into that, I’ll remind you that options thinking is an incredible tool for thinking about arbitrage and relative value.

This post on mock trading offers a game-like, socratic description of the stream of thinking that relative value trading asks you to embody:

The collateral damage of this type of thinking is stuff like this will bother you:

Back to the mental option math I was forced to consider since I had no patience to wait for an internet connection. Whether you have no phone on you or just prepping for a job interview, stepping through the following progression will (re)wire your off-the-cuff mental pathways as you ponder prices and odds.