Friends,

I was at the mechanic for a car check-up and the WSJ was sitting on the coffee table with the dire wolf “unexctinction” story on the cover. I pointed it out to the receptionist, she was an older lady just chilling on a quiet morning. I explained it in a sentence. She walks over, picks up the paper, and quickly says it:

“Why do we need to bring them back?”

I have a sympathetic look on my face, but it’s an obvious retort. The look says “Do you really have to ask”?

She nods immediately, answering her own question…

“Because we can”.

She has the same understanding of human nature as I do. It’s not just curiosity. Animals have that. It’s more like a desire to climb obstacles just because. Even if the obstacles are fabricated.

I call it the “Guinness Book impulse”.

Just look at some of these records:

Most Rotations Hanging from a Power Drill in One Minute

Farthest Milk Squirting Distance

Most Watermelons Chopped on the Stomach in One Minute

Most Snails on the Face for 10 Seconds

Most Toilet Seats Broken By the Head in One Minute

and of course…Most Guinness World Records Titles

No other species does this. When a bear rides a unicycle, it’s because a human made her do it.

The Guinness Book impulse feels like a law of nature. A reliable feature of homo sapiens. Presumably, it’s been adaptive.

Acceleration is accelerating. Faster than institutions, our psyches, our understanding can grok the thing we just learned about.

Which curve is in charge?

Everyone is on a unicycle now.

Are you the human?

Or the bear?

Money Angle

I gave a talk to a quant investment club at UNC this week. I did some riffs on what said at Berkeley back in 2023.

I find these things a bit tricky because when I project my 20-year-old self onto them all I’m thinking is “I wanna high-paying job so I can be rich…what do I do old man?”

To be fair, I find all young folks who reach out to me to be incredibly mature and thoughtful. Majorly.

The inter-generational condescension olds have for the youngs is bizarre. The kids are impressive. Like the young man from UNC who reached out to me in the first place to see if I’d give the presentation. I just never would have done anything like that at his age. I was skipping class to make sure when my roommates got home I had the top score in the house in Crazy Taxi on Dreamcast. I don’t know what I was thinking. It’s so dumb when I recount it. Maybe my bar for what kids should be able to do is so low because I didn’t care about anything but how am I gonna do the least work for the most money so I can just screw off.

(I wonder if this is a class thing. Where I grew up, ambition just wasn’t in the water. I remember a kid in our town who got hurt in an accident on purpose so he could get a settlement. And then he bought a 90s Mustang and drove around with “Fear Me” vanity plates on it. Peaking in HS is bad enough, but for THAT to be the peak…ouch.)

When I graduated, options trading was a relative backwater compared to banking. It wasn’t high status. SIG wasn’t even SIG. They were called Susquehanna and nobody knew what the heck a “Susquehanna” was. I made $37,500 for my starting pay.

Today, new hires make like 10x that. That’s 10% inflation per year. I talk about the forces that drove that. But the larger point is that trading and market-making are now high-status. There are trading competitions, interview brainteaser forums, and legible stages to getting hired. The competition is claws-out. In other words, all the conditions for massive disappointment. It’s hard to have the experience I had — getting into an industry that sounds pretty cool and needed bodies because it was quietly on the cusp of roofing. It was not in vogue. Susq’s recruiter asked me to come over as I wandered the career fair. “Hey kid, you like games?”

Today, the kids show up knowing the interview questions.

They all want career advice. What do I need to do to get hired? Because the show has moved from the 1pm side stage to the Sunday night headliner I don’t have great advice for getting hired beyond “crush the IMOs”.

But that feels a bit harsh and defeatist. So I crowdsourced:

Some help from the hive please. College students will reach out asking how to get into the investment or trading industry. I don't have an answer other than on-campus recruiting.

The answers rolled in. Thread of advice for breaking into the industry.

Related topics

🌙Career Advice (moontowerquant.com)

🌙My advice to practitioners who ask how to handle stressful days — have other places in your life to get a W. Oil futures blew through a short strike on expo? Go get a new PR in the gym or prune a topiary. This short piece by David Epstein affirms the strategy: Why Hobbies Are An Advantage, Not a Distraction (2 min read)

🌙Ricki Heicklen is hosting a condensed version of her Quant Bootcamp. I’ve discussed this bootcamp many times so from now on I’ll just remind you that it’s so good it shouldn’t exist. It’s subsidized by Ricki’s joy of teaching.

🚀She is hosting another one April 25-27 in SF🚀

➡️Register at trading.camp

Moontower readers have been to prior bootcamps. It was heart-warming when she messaged me earlier this year to say:

I came here because I wanted to tell you how genuinely wholesome and kind your fanbase is. you have led to a ton of bootcamp signups and they are across the board..."

such high quality people. genuinely earnest, smart, dedicated thinkers who have also clearly learned a ton from reading your stuff

when I see that a bootcamp signup found me via moontower it’s an extremely positive signal about how much they’ll add for the cohort

This is a massive testament to YOU. I've said it before...attending Ricki's bootcamp in Nov reminded me how lazy my own thinking can be. I literally feel dumb around her and the other instructors...

Not because they're pompous, it's just the rigor around details, logic, etc. It feels similar to being at SIG. Not surprising bc of the SIG/JS lineage. Anyway that's all to say, Ricki isn't easily impressed and then y'all go and her impress her.

This bootcamp is special because it also marks the launch of her company Arbor. In celebration, it kicks off with a Friday night gala.

➡️See the schedule at arbor.day

Money Angle for Masochists

A couple questions I answered in the moontower discord:

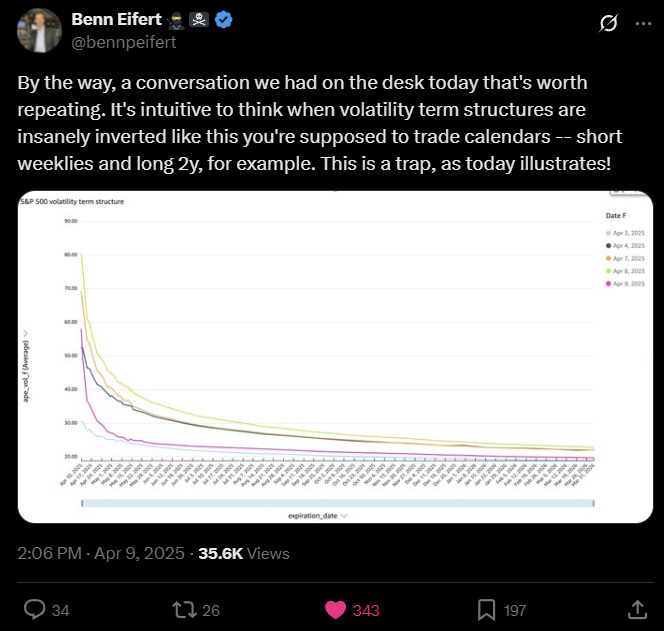

It started with Benn’s observation:

What do you think about crude with something like this? Would you be something like long vega vs long deltas rolling up the curve? idk what even would be optimal to exploit a term like that due to the gamma problem.

My response:

It all depends on context. For example, if you saw my post today, I actually thought April 11 vol was too cheap relative to expiries behind it.

The curves are useful because they allow you to compare across timeframes, but nothing about the curve itself necessarily indicates a trade. Optically, the fronts may look high—but as we’ve seen, they’ve been cheap. And part of the reason they might be cheap is that people naively think they’re too high and sell them.

So it’s less about the shape of the curve and more about reasoning through the assumptions that might be causing it to look that way.

Eventually, you'll look back and say, “Selling the fronts would have been a good trade,” because in hindsight, the market calmed down. But that’s not a timeless lesson.

I think Benn is alluding to a great truth: there is no one thing that always works. Any strategy that consistently works gets discovered by sophisticated pattern seekers, and the very act of arbitraging that edge makes it disappear. So the things that work tend to be ephemeral, not evergreen.

Instead, it helps to think of prices as an adversary. What’s baked into this price? That’s a habit you develop over time.

For example, imagine the market hears that a tariff deadline gets pushed out 90 days. My reflex is: the market will likely bump that term vol higher. But maybe it’s overreacting— because if the volatility doesn't settle down, the pressure to resolve the situation early increases, making the 90-day assumption less relevant. (Maybe selling that month as part of a calendar butterfly is better if you think the market is discounting other resolution periods too heavily).

So it becomes a habit. When you see a price that looks high or low, ask:

whether it’s justifiable (it usually is), and

whether you expect it to have overreacted or underreacted on balance.

I’m not surprised when optically high vols turn out to be cheap—people get anchored.

That’s why I try to look at everything relatively. I’m not just asking “Is this gamma going to underperform or outperform outright?”

The best time to trade an overreaction is when the overreactors are being forced—in other words, when the actions are non-economic. Knowing when that’s happening isn’t easy, but sometimes you can feel it—when markets go really wide, when there’s a ton of volume at insane prices, etc.

Question:

[redacted] options look too cheap given huge intraday swings but not sure how to trade it. The pattern has been +3% one day, -3% the next and I guess the question is whether it stays range bound or breaks out one way or the other? Does buying the straddle and trading deltas against that make the most sense?

My response:

There's no great prescriptive answer...if you buy the vol because it's too cheap and delta hedge, your hedges become your own sampling of the vol. In hindsight you'll be able to benchmark against "what if i hedged on the close daily?", "weekly?" etc.

If it trends you'll wish you hedged less often and vice versa but unless you can identify "mean reversion" vs "trend" in advance, in which case why bother trading vol lol, there's no great prescription

Stay Groovy

☮️

Moontower Weekly Recap

Need help analyzing a business, investment or career decision?

Book a call with me.

It's $500 for 60 minutes. Let's work through your problem together. If you're not satisfied, you get a refund.

Let me know what you want to discuss and I’ll give you a straight answer on whether I can be helpful before we chat.

I started doing these in early 2022 by accident via inbound inquiries from readers. So I hung out a shingle through the Substack Meetings beta. You can see how I’ve helped others:

Moontower On The Web

📡All Moontower Meta Blog Posts

👤About Me

Specific Moontower Projects

🧀MoontowerMoney

👽MoontowerQuant

🌟Affirmations and North Stars

🧠Moontower Brain-Plug In

Curations

✒️Moontower’s Favorite Posts By Others

🔖Guides To Reading I Enjoyed

🛋️Investment Blogs I Read

📚Book Ideas for Kids

Fun

🎙️Moontower Music

🍸Moontower Cocktails

🎲Moontower Boardgaming