Programming note:

Labor Day weekend is our annual family camping trip, there will be no Sunday issue.

Friends,

The Earth rotates around the Sun at a speed of 67,000mph. When I go out for my occasional run, my own speed is in the tens of thousands of miles per hour. Should I take credit for this amazing performance? I wouldn't be completely lying if I bragged about this with friends (which I do); but it would be more transparent if I mentioned that my speed record is in the frame reference of the Sun. In this frame of reference, my speed is indistinguishable from Usain Bolt's. This factoid obscures the vast difference in skill between the two of us. To really understand the difference, we need to change the frame of reference. Another way to interpret the decomposition of returns is a method to change the frame of reference in investing. Total returns - and a portfolio's total PnL - live in the Sun's frame of reference. It is easy to fool ourselves with the belief that we beat birds, airplanes and supermen at their own game. Idiosyncratic returns and PnL live in the Earth's frame of reference. If we want to compare our performance to that of our peers, or to our very own past performance, we need to move to this frame. Factor-based performance attribution makes it possible.

- Giuseppe Paleologo (via Advanced Portfolio Management)

When I think of the “heyday” of hedge funds in the early 2000s I picture a bunch of cowboys who became generationally rich riding a steed named Greenspan. “Hedge” funds? How about beta boys?

I’m writing in between sips of hatorade because I remember the contrast of working in trading vs seeing peers in asset management. They had “points” in the bonus pool. Meanwhile traders had “I know you made all this extra money but we think your pit was more lucrative then expected. We don’t pay extra for good luck”. And to be fair, I also saw the flipside where traders got paid well despite having a tough year because they made good decisions that had a lot of noise (an amount of noise the firm was willing to underwrite and not penalize you for — the whole “not resulting” thing isn’t just marketing — it’s load-bearing).

[Side note: cultures like that are hard to build and rest on constant communication and buy-in for situations where the opportunities might outsize your specific trading assignment and you need to “recruit” the mothership’s approval either implicitly or literally by storing some of the trade in an account whose p/l you don’t need to stare at every day. The old-school “back book” except you know about it because you were the one who alerted management to the situation.

The other thing such cultures rest on is “permanent capital”.]

The triumph of pod shops has been to operationalize trading firm epistemology, then maximize the fee they charge for blue meth. The job of a PM is now as hard as Walter White’s life for the same $10mm in comp you could have gotten 20 years ago.

When it comes to the retail investor, the conventional wisdom gets it pretty correct — almost everyone should be using low cost indices to construct diversified portfolios and get back to the competitive advantages in their daycrafts.

The retail world can be further divided into retail traders (the more sophisticated ones are sometimes called “prosumers”) and retail investors who “sin” by trading in haphazard ways as if NVDA earnings was the point-spread of the big game on Sunday. In both categories, there are no external demands for retail to be honest with themselves about their returns on effort in trading.

Which is basically, well, fine.

I don’t want my tone to be misconstrued — I’m not here to wag a finger at anyone. Serious traders, the ones who depend on edge to eat, get this. If you trade actively but less seriously then presumably you have some other means to knock out the rent so it’s hard to muster solemn concern for you.

But you can still upgrade your thinking massively by stepping through attribution.

On Sunday, I published a slutty post-mortem on a GLD trade that worked (and continues to work this week). I also promised to step through a trade that was not flattering because I think it’s loaded with lessons.

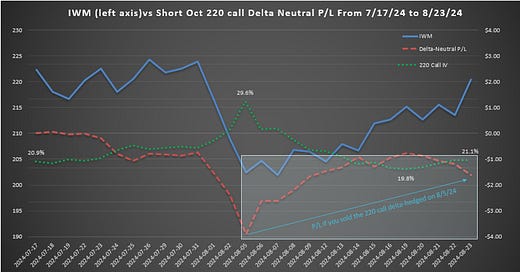

Let’s go through an option trade I did in IWM back on 7/17/24, a few days after the “small cap rotation” pushed the Russell up 10%.